Aloha! Below is this month’s edition of the Da Real Estate Braddahs:

It was a restful holiday season yet busy time as we transitioned ownership into the last few deal we closed in Q4 of 2019. Da Braddahs is now a podcast and we had 300 downloads in the first month! Catch us on YouTube or Live meetings.

For more insights into investing on the mainland and my personal investing check out my monthly update here in the Greensheet.

- Transitioning to Syndications & LP Tips Webinar

- Infinite Banking with Whole Life Insurance for 2020

- New investor portal with 3 free modules and past deal webinars

- 2020 Goals Launch

- Florida’s 1st LGBTQ Senior Housing Project Breaks Ground – MHN 19.10.25 – [Simply pointing out a trend in ALF]

- NAS Acquires 27,465 SF Flex Building in Springdale, Arkansas Leased to BNSF Logistics – REBusiness 19.12.02

- Redstone Arsenal growing to 50,000 workers by 2025 – Huntsville Real-Time News 19.12.04 -“Huntsville’s Redstone Arsenal will grow from 44,000 employees now to “over 50,000 by 2025,” its senior commander said today, and it plans $2 billion in infrastructure investments in the next five years to keep growing.” Plus new $175M Plant

- Top markets for MF Rent Growth – MHN 19.11.29 –

- Freddie Mac: Here’s what to expect from the housing market in 2020 and beyond – Housing Wire 19.11.27 -The GSE also expects home price growth to slow over the next few years, with annual growth rates of 3.2%, 2.9% and 2.1% in 2019, 2020 and 2021, respectively.

- An end to Fannie, Freddie conservatorship by 2022? – Housing Wire 19.11.14 – “If all goes well, 2021, 2022 we will see very large public offerings from these companies. Fannie and Freddie could be looking at exiting government control by 2022 or 2023, according to Calabria.”

- On a year-over-year basis, the September starts of buildings with five or more units were 5.8 percent below September 2018. – MHN 19.11.18 –

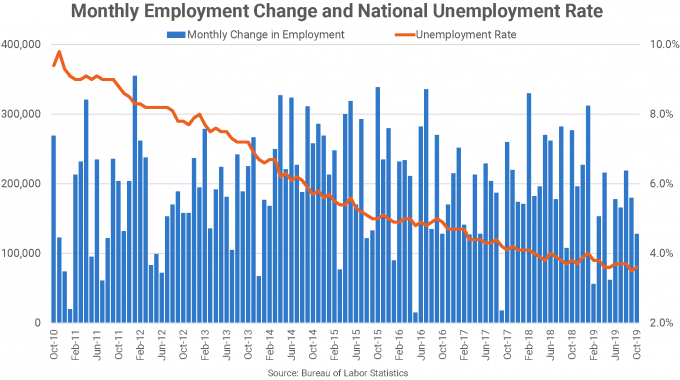

- U.S. Job Gains Surprisingly Solid in October – Realpage 19.11.06

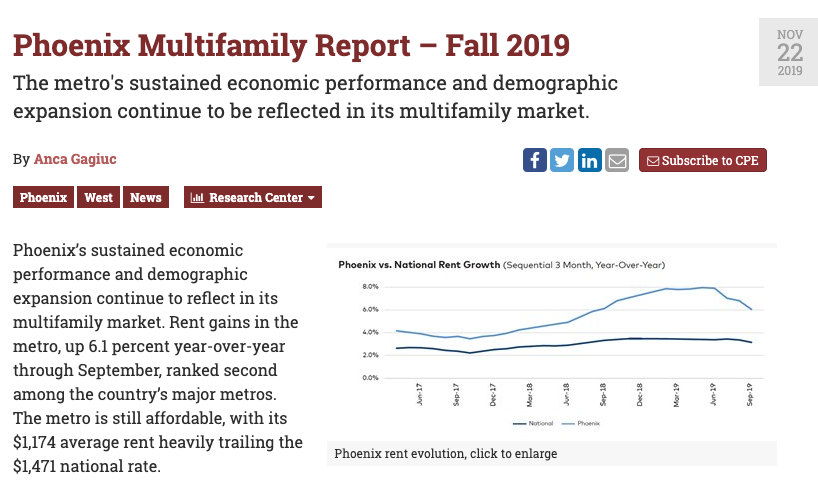

- Phoenix Multifamily Report – Fall 2019

The metro’s sustained economic performance and demographic expansion continue to be reflected in its multifamily market. – CPE 19.11.22 – [Its a hot market but it also fell a lot in the recession]

- 19.12.28 Matrix Multifamily National Report-November 2019

- Airbnb is banning all “open-invite parties and events” – Newsweek 19.12.06 – “Hosts who attempt to circumvent this ban and allow guests to throw large parties will be subject to consequences”

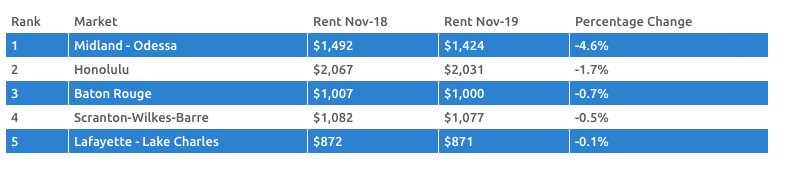

- 5 Markets With the Greatest Rent Loss – MHN 19.12.12

- Average New Apartment Size Shrinks in East and West Coast Cities – National RE Investor 19.12.19 -In buildings developed since 2010, apartments average roughly 940 sq. ft. in size, according to RealPage. That’s down from an average size of roughly 1,000 sq. ft. in buildings created before 2010. “Prior to 2010, properties were more likely to feature a more prominent mix of two- and three-bedroom floorplans as opposed to studios and one-bedrooms”

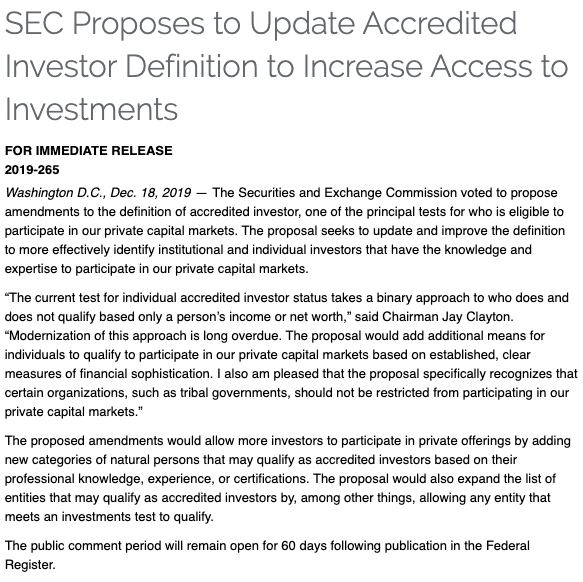

- Other trends: Boomers downsizing, pop up stores, rumors on accredited status

Transcript:

0:00

This is Episode 23 of the real estate writers

0:19

doing this for almost two years now so monthly, which started off as a virtual webinar, then spin, people thought we didn’t exist. So then, last three, I think we’ve been doing live here at Keller Williams office, but it’s probably going to evolve next month and we may choose choose another venue and a different or a different route to go, but we’ll be there for sure. But as new faces I see so if you don’t know I’m My name is Dean. As I mentioned earlier, I was a CPA, an accountant, by education for last 18 years. I got into real estate investing and sales and I really found that to be more of my passion. So, as usual talk about wasu Real Estate statistics, starting with December 2019. So December information came out already. And if just remember, it’s December 19 compared to December of the prior year. So this is a very interesting month. So for single family, you see sales went up for 4% at 820,000. And we also had median condo prices also who was 7% and 425. Five. Another pretty strong sign for the sellers was that close sales went up 19% for single family with 22 nine close sales in December. And for condos, we had a slight decrease of almost 3% at 2020 close sales. Meeting the days on market, we saw a real 40% reduction Or it closed it got from 30 days I went to 18 days. These are market for single family. So basically from the point that the property was listed to the point that it went into escrow, it was it was only 18 days. That’s really short. for single, I’m sorry for condos we were at 30 days on market for and this for 20% reduction order five, these Lauria so what does that mean? Like if you’re just summarize that whole thing of who they are? So I was thinking how could I do it in after we talk about all those numbers? What, what is the way to summarize it? So I said, Okay, well, who is the winner then for December 19? Was it the buyers or the sellers? So in my eyes, I think it was definitely the sellers because both sales prices for single family and the Congos went up and that Big one to me was closed sales jumped up a lot for single family and is a market went from 30 days to 18 days. So that’s a that’s a real big reduction. So that transitions me to what I wanted getting a little cultural now for the Hawaii people. I know few folks are aware but he the stat was one third of the population are either full or, or have Chinese blood in them. What in the state of boy. So point being that is a strong there’s a strong presence of Chinese. So January 25, is actually Chinese New Year this year. Last year was on February 5, the reason why it’s different because it’s on the lunar calendar. So it’s run by the when the full moons of the years. So just that information this this year is the year of the rat and even though if you’re using rad is actually a bad luck. Good luck here, because the Chinese when your year comes around, then you’re reborn again. And when you’re reborn when you’re young, that’s when you can get taken over by demons. So in the next few years, few weeks in the month of January, there be a lot of poetry events going on wahoo including Chinese lion dance, which is a way the Chinese believe chases away evil. It doesn’t I’m sorry, it brings good luck. It doesn’t it’s not doesn’t chase you it brings good luck. So what you do is you feed the line, VC or Chinese money, and that will get them to stay around longer and that will bring you more so just in case people aren’t wondering what said loud noise, the drones and the fireworks and he’s

4:52

lying.

4:56

But my son is actually part of a club so this is like our busy time. much do they race Oh I’m so actually for so they have a lot of for weddings or first birthdays I think it’s our standard rates are 175 for for one big line and then if you want multiple lines are the prices Yes. So know here we have it we have BB lions. It’s a it’s a fun, it’s not a profit. But yeah if you have more information of where the performances are going to be or anything like that or just reach out to me just wanted to throw in a little cultural tidbit in there. Um, here’s another one for the waffle people for Are you di wires or flippers on Island I wanted to do a connection. So I have a an acquaintance that has 1400 square feet of color laminate flooring that he bought for 500 $5 was $6 a square foot from Bougainville but he it was installed and they didn’t care for it but he had it removed and it’s just sitting there and he put something else in so he’s up there offering it for $3 a square foot if anybody is interested let me know I can get you the details pictures and the make model oh yeah yeah yeah i can i can give you more information you can see the person but that’s just reaching out they’re part of this whole thing is networking. Right. So this is the local voice a networking.

6:37

Forget a personal

6:40

So one thing that as realtors care a lot about our association fees for townhouses and condos and a lot of feedback I get from both investors and homeowners are Oh, yeah, no, no, I don’t want to live in a townhouse or condo. Yeah, Pina was was association fees, right. And it’s like Throwing away money. So I kind of wanted to say that, you know, you know, when he told me that you’re not getting any value that that’s not necessarily true, right? Because a lot of times it could be, you’ll be paying these fees and you’ll be getting like in structural structural insurance right? To replace the insurance for the structure. If you have your own single family home, you’re gonna have to pay insurance on that on your own right. So that you also have amenities right, some of them townhouses or condos or pools, barbecues, business centers, security, all of that is coming out of it. He’s also a big one I think that a lot of people overlook is that you’re paying these fees and they’re the association is is banking your money theoretically, for these feature deferred repairs and costs. So things like elevators, repairs and maintenance or replacement roof, painting the structure or resurfacing the parking lot area, all those costs a lot of money. I mean, they’ve single family home owners to paint two storey house, you know, probably you’re talking like five grand at least. Then type of roofing you could be in the 1015 $20,000 for for a new roof depending on if you have to move there and put another shrink or shingles on. So, point is you do get some value. But there is also a contra point where you’re not getting $1 for dollar benefit for your association fees, right because it costs money to run the association. So, association is paying

8:46

property management company to

8:50

take there they’re going to be running a lot of it too. So they take a portion so it’s not $1 for dollar wise. But I guess point being is that you do get some value for the association. So, something to be considered when you’re when you’re buying new looking for a new home or investment, right? Because for me if I’m looking for an investment, that association for you could be higher lows, something just like real property taxes in different states. I’m more concerned with the bottom line.

9:23

Me You gotta look at this record numbers like 15 sets. Yeah, they’re like take the top line.

9:30

Your income is 2000

9:34

minus $500, which is usually right $1 to two for like square foot. Right?

9:42

So you take that so you know

9:48

I hear it all the time and I bite my tongue. That’s why I have these kind of games like say what’s really is a chip how investors predict to it. Thank you for like, oh my Are you ready for 2000 dollars, but they don’t talk about h waves. And of course, you after the 1500 dollars is the truth when you do your rent to value ratio analysis divided by the purchase price but that’s why that the rent to value ratio you can be shooting for that 1% or whatever and it may or may not come up right to your point and that’s why that’ll hit someone who’s just looking at that rent evaluation and not running the deeper numbers because things like the HOA fees or even the property taxes per state, it’s it’s so different. Even even after the numbers work out on the choices that like cookie and saying when you got like a little co government stuff and it’s never some shit. It’s somebody who’s been told to do it or whatever, or people who they’ll force you to get get angry and then they say, oh, why is my wherever fees going up. I’m gonna get on the board and it’s always an established And they always they always undervalue their cap x when the expense happened so in my opinion and then as an investor you don’t get to have say a lot of things so they could say oh no t cannot property. Alright CCR and health house we either are limitations for that

11:25

to save for tomorrow

11:27

and I think cleaner so if you guys don’t know who I am I run a podcast simple passive cash flow calm it’s a lot of free information like the rest of the show I analyzes on their offering it’s nothing for sale after this thing this is all just a reason for Gina and hang out

11:49

every once in a while

11:53

so

11:57

so I went I’m sorry about astronaut four times a year, john burns came around with the big data house. And the question is, Where’s everybody? It’s all the southern states. So I was kind of sitting in and I thought about this. I took this picture right here. Other headlines, I’m going to go through a lot of headlines here really quickly. That’s just how I do things. Not all the information was the joke. That’s why I’m commentary. If you guys have any questions, we’ll talk about it. So there’s always a discussion. whole point is to take all this. The world is so much information out there and a lot of faith. But what is it that’s going to guide us towards the right fence as investor but this is from Google keywords which you can do is figure out what people are searching for. So I look at this once a year and just just for like hobby, I keep We’ll look for a recession or recession. Obviously, everybody was talking about it. But then, recently, I don’t know what that was was the late last year.

13:15

I don’t know me.

13:21

Yeah, I mean, you know, a lot of technical experts will always be like, eight, eight, this is the 10th 12. Right. And you can never go off of numbers, typically eight to 12 years is your average market cycle. But I think as of a few months ago, every day you wake up is the longest bull market. Oh, yeah. I mean,

13:42

the markets at record high ceiling right after

13:45

the after the Iranian rhenium threat kind of simmer down is that what’s your opinion? So I always urge people like to look at other markets these days like 2000 and when we met 2000 15 ish me, we were looking at like turnkey rentals and stuff like that. Where we were buying in Kansas City. I was buying it and walking. I was doing Birmingham, Atlanta, Indianapolis because that’s where you can find events, evaluations available. cash flow. So don’t invest in anything it doesn’t cash flow. So, but problem is like places like Memphis, Kansas City, Indianapolis, Little Rock, a little bit of a tertiary market, but these perennial markets you hear about all the time. Well guess what, it’s five years later. That doesn’t really cash flow these days. So you got to kind of go to look at places or tertiary markets they call further out out. So for example, in Pensacola, Huntsville, this is kind of this less list of top five markets for multifamily. I’m asking Oh, that’s not a tertiary just seeing what’s up yeah top. But I don’t like Las Vegas, Las Vegas, Las Vegas, California my goals.

15:13

I don’t chase on sophisticated.

15:16

Here’s a commercial property, it’s for assisted living up and coming. But, you know, the old people, you know, they can have their own beliefs or whatever if I take i plus there and like certain races or where they came from, whether it’s right or wrong, that’s what they do. But this is like the first l GTQ. I’m in seniors lousy. Interesting. Yeah.

15:47

So I invested in like,

15:50

it’s built in pods. And the vision was like, Oh, this cod is going to have like Mexican

16:04

people decide but I mean this is how old people want to

16:10

good bunch of them with them.

16:15

I’ll look at different like articles like this like, again, these are a couple of tertiary markets that I look at Arkansas on so even piece of the feasor you got to look where the job growth is going

16:31

on in the northern states

16:34

where everyone’s coming to it’s all the southern states all the states but these are real jobs. One One mistake I see a lot of people like Amazon fulfillment center Yeah, what is that going to be like? 50 jobs like this nothing at all. My one of my first mistakes was or not first mistake, my learning experience one of investment frickin similarly back from before I met years I went online and a look for you know, googling mostly cash cash receipts and I found them Illinois was good for this for this this news report like you said is this so anyway I restarted actually ended up picking up a property there’s a short sale and it’s currently still doing doing well for me. However, I think a lot of stats the LinkedIn pulling in recently and we’ve seen as they, you know, like the U haul trucks. That’s not as a everyone’s kind of immigrating out of Chicago out of Illinois because

17:42

the laws of the taxes

17:44

are kind of high. I think that the the noise and Chicago their their governments are not doing so well. So they’re pumping up taxes and then actually, Chicago and Illinois are not very tenant friendly state. So that purchase I still have it and it’s doing well. But in retrospect, you know, I’ll do this macro analysis, then maybe I would have thought twice, but like I said, it’s doing well. And then as you do at this macro level, you still gotta take it with a grain of salt, right? Because there may be some kind of competitive advantage you might have in a certain area that steps may not sure strongly for a

18:28

competitive advantage. So

18:29

it’s hard when you’re living in Hawaii, you’re taking pawn shots over the Pacific Ocean and don’t know anybody. This is the best you have to work with. And I would just say that we started is this network of other people coming in

19:19

I think that’s a good

19:21

I think that’s a good strategy. I mean,

19:30

I think well if you can, if you can be of a competitive advantage over others and you enjoy what you’re doing, and you see that as we might pay off, I think that it is a good strategy eating but as real

19:46

people are always violent, right.

19:57

And that’s what the conversation

20:07

Hey

20:12

military I was

20:13

all over Chicago Yeah,

20:32

so that’s good.

20:41

I don’t personally use it specifically that way but yeah, I think that’s that’s

20:46

better than nothing.

20:48

Right and that’s what investing is for gambling. But it’s not like Las Vegas for your odds are against not investing is gamble, but most times, you’re going to

21:19

Question personally I don’t want

21:23

because military is a stimulus of money helicoptered into one area in point. Yeah, well, I the investment thesis I’m going to go after the collar workers. That’s what I call and it might be might differ anyway as long as you stick to it. That’s what I think is everybody is getting

21:52

tired

21:55

continuous income they wanted to keep it

22:06

That’s when when it’s here to work

22:10

with Dean mentioned that you

22:15

see what that is but like you always like that cheapskates

22:20

do it yourself first, I would, I would probably

22:25

call the record where the Van Lines if you guys have heard of Van Lines, those are like if you’re a white collar worker, you get located across the country, everything gets put into container for you like a tree and that has different data. Right. Okay. And to your point, so you and you were talking about the so for your, your avatar or your my investment thesis is I want to go after middle class working workforce. Okay, so that so like you said, by your deeming Pause like, not in that clap. Okay, so you would use it. So it wouldn’t be because that’s sure your tenant emigration where the tenants are immigrating.

23:13

Like I’m not looking where he’s talking to me

23:15

differently. He’s talking syndication,

23:18

apartments and single family population growth, job growth. Those are what I see as the to drive. Military student housings are like such an inch of people to go after a bad strategy.

23:52

So, do you guys know Fannie Mae, Freddie Mac, they are government they use the private organizations but Recently at the recession, the government bought them out. And they’ve been pseudo government agencies financing pretty much all our debt, primary residences. Whether you go to Chase Bank, Bank of Hawaii, wherever it all gets, it’s all backed by Fannie Mae Freddie Mac, essentially a subprime borrowers. So there’s this there’s always these talks about winners, Fannie Mae, Freddie Mac went to go back to big private entities. Now there’s some talks about going in like you’re 2021 2022

24:33

feels weird saying

24:36

that far away, but I’m not concerned about it at all. I think people are like, Oh my god, like they won’t be able to get along because it will be a Fannie Freddie back. I wouldn’t worry one bit. I mean, after subprime it got so tight the lending requirements in another mysterious time well, how they’re cut they’re loosening, you know? Yeah, slowly by slowly it’s very cyclical, right. Everything is cyclical. The bar like all the top of the markets going to go crashing down but like it’s still really hard for people who have bad credit to get a home. It’s hard it’s hard for even people who have good jobs to get home. So I think that’s a good thing.

25:17

So

25:19

here’s some new builds of multifamily apartments something I cannot because it’s workforce. It’s not like high end stuff. That’s like Middle America. That’s why I cannot statistics and is an apartment. So what they’re saying here in this, this one is that there are always new properties be built, but they’re class eight properties, the luxury properties built and it’s been pretty much in this consistent fat so it’s not like there’s always consistent and I would say it’s replacing the old stuff at a pretty famous everything here on Welcome to Red Rock.

26:01

That’s where the margins are for the develop

26:04

us job gain surprised me solid in October. So the Orange Is The unemployment rate. It’s very rare that you have a job.

26:22

Everybody’s working for the most part.

26:28

The Phoenix is another market that I’ve been kind of looking at late but it’s traditionally a very hot cyclical market where it goes up and down, down.

26:44

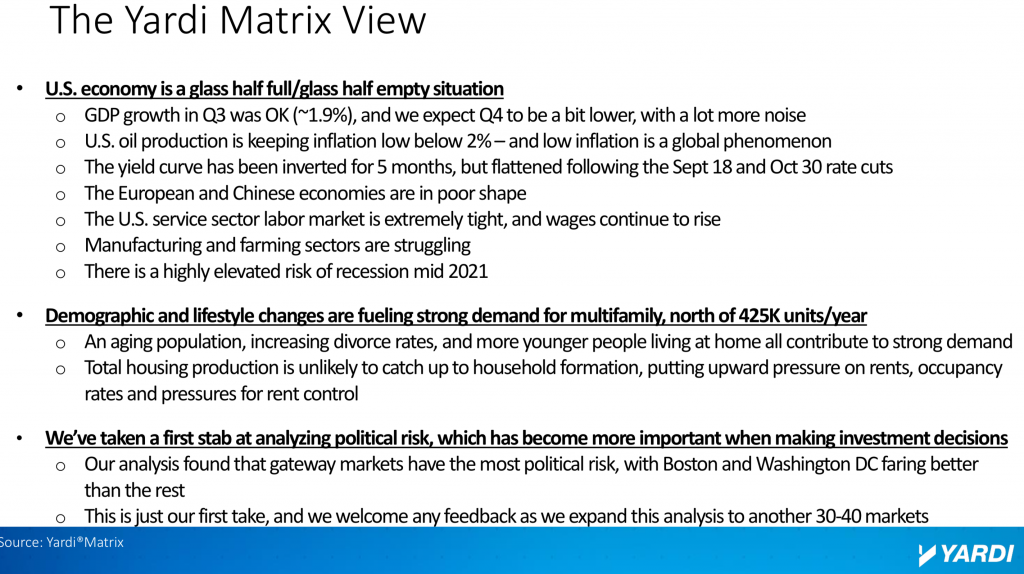

Maybe we can go over that. So yardie matrix is a commercial real estate source so I I cannot they say a lot. Here’s some other

26:57

takeaways for the year and

27:01

So then GDP growth and q3 was okay 1.9% and everything I read whether from Gardner everybody else everybody’s time between 2.5 is like the forecast for the next three quarters, which is growth. That’s anywhere from two to 3% usually

27:25

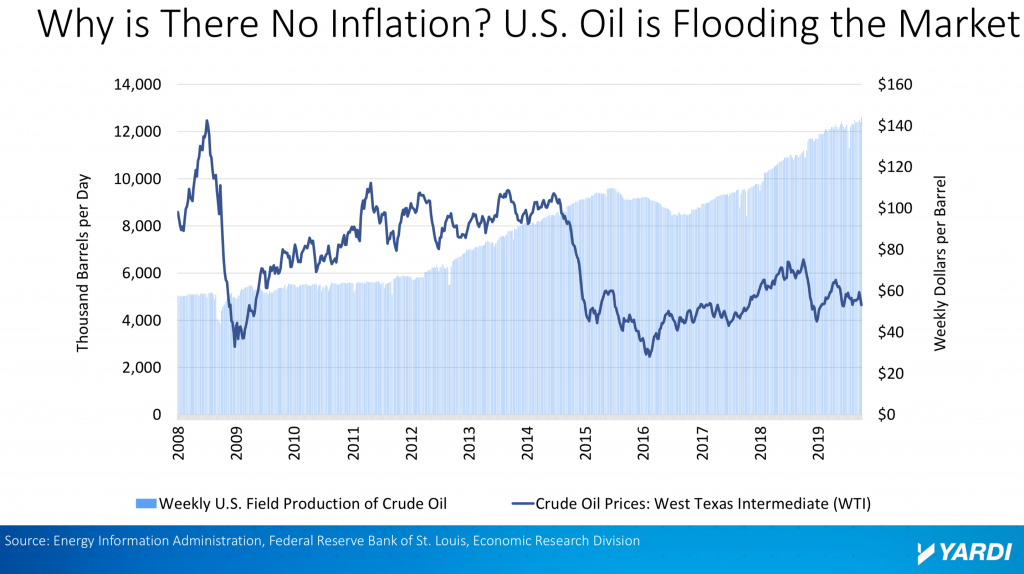

saying us oil production is keeping inflation

27:30

correct me if I’m wrong here so America is making a lot more domestic production oil. I’m not gonna say the F word here, but that’s what’s causing it. I think I heard on CNN today that it’s because of that, that they’re not the biggest I don’t know man in you know, a pitch that could just be fake news, right? That’s against the F word. said get us some fracking. Yeah, factory. But it may just be like, environments against that type of Because even after the missile returning is expecting prices to change, because my understanding is that the whole we have our own production, but we use it but we also export it tonight. So it’s like one big. Yeah. So is it late December? play around with it. And the nice thing about oil gas investments is that you get these things called ITC drilling costs. But the government wants you to invest in gas because we can get is that the play we’re up for? Yeah, so they put you on the GP and depreciation. So doctors love this kind of stuff because you get a lot of passive losses from pic deals, but a lot of times you can like, take it to also active. So, unless it’s all gas, especially exception, seats government says incentivise You for you to invest. Like all this real estate stuff. It’s all these stuff like tax loopholes. It’s like directions pay less taxes because they want you to put money

29:12

on people they want to incentivize people to do that. So

29:16

I just followed what they tell you to do not pay any tax, barely any. What else is important here? Oh, so we’re talking about that graph of like how this always so they’re quoting here that at population sports rated for younger people that contribute destructive, raw and total housing production is unlikely to catch up with possible even though new stuff is coming online. There’s a fourth housing shortage and I think that’s true and affordable housing curatorship

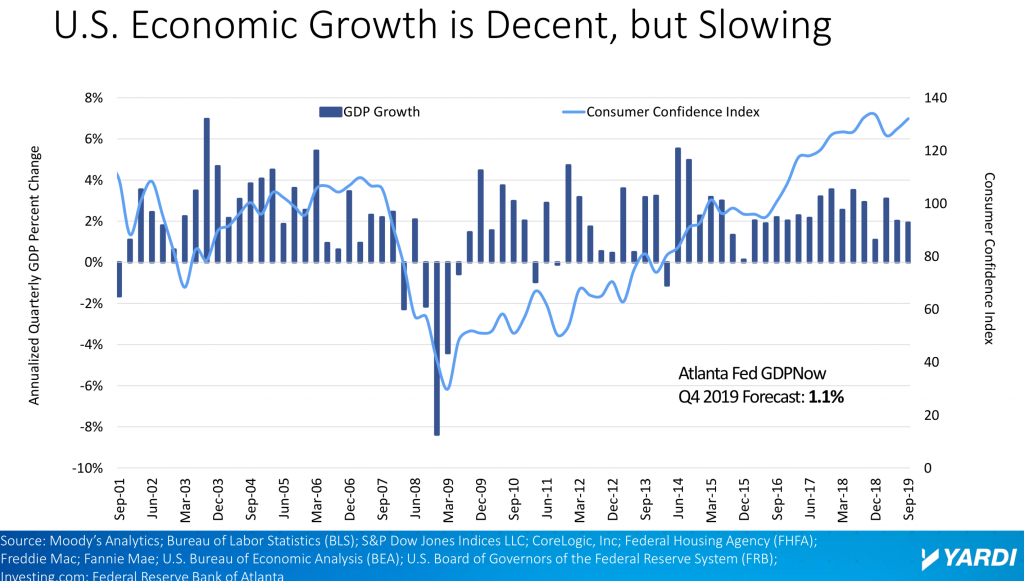

30:01

GDP growth and Consumer Confidence Index all kinds hide terms of confidence. call that a vanity metric. I don’t know if that means that. How’s that a dry confidence. GDP growth is important here and it’s positive.

30:25

Here, they’re saying that in q4, they’re forecasting positive. What’s the recession to two consecutive?

30:34

two consecutive quarters not ending is TC.

30:37

Yeah. Megan. Yeah.

30:43

So we talked about the oil. Here it is in graphical form. It’s happening. This transition happened around 2015 that when the F word started to become a big thing So number one, I was working for the railroad hole was a big thing from 2000.

31:06

Did I graduate

31:09

7000.

31:12

And in 2010 was when oil or coal was really big. Everybody was saying everything about on a regular basis. Penis burning coal forever. That was they said it was cleaner for me because it didn’t go into mines. It was just like excavated. So you don’t know where the black lung? Yeah, you don’t have to worry about that. But then that went away a couple years later.

31:47

Anybody do short term rentals and

31:53

Don’t do it. Don’t turn around and face Oh,

31:56

I don’t do it.

31:59

There’s another part They came up easily to their invite parties. The party houses I’ve done this a couple times they haven’t dance or something it was it wasn’t probably party house

32:15

gets it

32:17

that because they did that, too that’s that’s a trigger this day.

32:23

Oh someone’s always got a

32:37

sale sales

32:39

for sale.

32:44

Housing and

32:54

condo statistic or is it taking long Oh, that’s I mean, that’s captured. That’s definitely captured and that I believe you’re probably seen anecdotally will say that I think that’s probably a as the word was there was a guy like, one month or two months ago that sat back there. He was like, Yeah, he does. He sees a lot of people.

33:18

Yeah. And you were talking about I think,

33:21

the other part of the winners out of either we had a discussion about how there are a lot of people on the windward side, they’re doing short term rentals in after the Lord testimony. And additionally, we were seeing a little bit of a bump on that side in terms of for sale and then coincidentally or not there the multiplexes are so many open houses. Yeah, I almost said I was gonna pull up too because

33:54

I’m like, should I go in here and check out

33:58

I don’t even know which by the

34:00

So that we know what you have to do is you have to figure out how to build a monster house and just do long term until

34:08

you can totally jump. Yeah.

34:11

So here’s another great article five markets with the greatest fat loss number to Honolulu, out of a whole nation. I lost 1.7%

34:30

time. Does it make sense to buy properties here? Well, I mean, why did the rents go down? I mean, I know there’s good conversation. Normally Hawaii

34:44

from November to

34:56

but this is Prince. So notice notice a lot of my data is Everyone is turning their back to long term rental do more inventory or supply what is like you know, like the other Airbnb is Is it 5% or 1%? Oh I don’t feel like they didn’t drop.

35:29

This is also a very self selecting estate investors now i don’t know i mean could be could be a blip 1.7

35:44

I don’t know.

35:47

Play it is what it is right

35:50

I should ask my my landlord for a little bit.

35:56

Don’t buy houses to live

36:01

long article about it

36:04

because I’d rather buy to that

36:07

real estate, Grant Cardone

36:11

Dean will help you buy houses here.

36:19

Can you say anybody interested in syndications private placements? stuff? So this might be interesting to you. You mentioned this last time. Yeah, so this actually came out in the series we’re so like, there’s a difference between accredited investors and non credit, credit investors, their net worth is higher. And you have to have a noun or, or, or an income of $250,000 You’re

36:51

pretty increased Well,

36:53

200 if you’re single 350

36:54

America. So it’s always been an issue for non accredited investors. To get into these deals because they’re not accredited. So now the SEC is looking at making changing the laws where they’re like, well, you can test into getting accredited status. So I think what they’re kind of working on is like there’s a series seven or 65 brokers exam that you can test to it, or you have to test before they not haven’t figured it out all that kind of what when I read between the lines and other stories together, that’s what they’re trying to do. But I don’t I don’t know what the whole issue about being a credit. I don’t know why it’s so important that 97% of private placements are for non accredited investors. That doesn’t number Yeah, I mean, you can go to the SEC website on Egor database for the data. It’s also the deals are final six exception deals are sophisticated. You just need to be sophisticated with a pre existing relationship. So is that reducing the threshold or the requirements for a sophisticated VC? There’s no there’s nothing nobody has already just defining it better it just defining accredited

38:11

has nothing to say sorry yeah.

38:16

So you think it’s gonna open up a lot of money per se mean they call crowdfunding changing? And now there’s there’s more people available to crowdfund. I think if you’re sophisticated, and you’re not accredited yet you’ll find a way to get into deals. And this could be another way to do it.

38:39

So on my website, simple passive cash flow, calm, I write articles, this is all I do these days. first article is transitioning to syndications and other living partner tips webinar. And there and the other one was infinite banking with whole life insurance or 2020. You feel I created Media portal

39:03

for new investors

39:03

and the 2020 goals lunch so the stuff we’re doing live here I have I read this book recently. anybody read this one? He says the F word a lot. So maybe she’ll marry Yeah, so the present that David Goggins is his name he’s to be like he’s he’s he got abused as a kid. It’s like first chapters like jarring. Yes, like you got a few is here like what his bed every night is like kind of one of those circumstances. And he was just like a loser for a while and then he started to run these ultra marathons. He went to buds three times. So just like mental toughness, he’s like the guy

39:57

if you’re interested in making a change,

40:01

checking out a few podcasts

40:05

I think you have to find somebody who resonate with you might be too much like a spectrum yeah you gotta find someone like he’s a little too hard for

40:19

you gotta find someone hears it

40:24

that’s it right so all this stuff we edit these webinars down their YouTube channel but you guys can find that calm but any questions anything or topics you and topics yes

40:48

so there’s five or six be Apollo 60 deals for the most part right? See See deals file succeed deals like cat they can mass market it out Public. So the Klan, you can do that the government’s like, right you can mass market it and put it on the radio, put it on a podcast, put it on like social media, but we’re not going to allow you to take non accredited investors. And when you do take your investors that are accredited, we need to do a third party certification. To answer your question, you can be non accredited, but you have to be as has to not be a fallacy. And like I said, like 90 to 97% the vast majority or six of the deals that aren’t mass market. No syndication, you can syndicate something small, you can syndicate anything

41:47

at all take a giant queen. Yeah.

41:51

But it’s regulated by sec. sec regulates stocks. There’s just different code regulations for these types of Investment facilities.

42:20

I mean, etiquette wise, I think especially honest, it’s a taboo thing. But when I go to the mainland to my things I, people, I go to paid stuff, right. So people are like, higher network. They’re also accredited. Most of them are like, have this business card and they’ll give it to each other and have their network liquidity.

42:41

That’s true.

42:42

Like it’s crazy. Like it’s crazy,

42:44

right? Like here in Hawaii, it’s different that can answer your question. We can talk offline

42:50

to me is you don’t want to,

42:53

that’s a good point.

42:57

Like I have an accredited investor Kind of a little hush hush quieter there it’s a pre selected group of people and it’s to me it’s it’s cool in there to kind of talk about personal finances but I mean let’s face it in here you guys

43:14

either questions rentals good

43:32

mobile home parks

43:35

so you’re talking about just investing as a passive or investing.

43:52

So from an operator standpoint, I think operating them as hard apartments, but from an LP perspective, I mean just destroying money here in there right? To me how I’ve done it is, I don’t know nearly as much as I know about apartments and parks. But I find the other investors that I trust that don’t have a dogfight that invested in other people’s deals that are is there the tax benefit the bonus depreciation for Yeah, it’s all the same. So it’s not just underlying that there’s there’s improvements attached. I haven’t seen an employee seen it like in real life with the K one yet. What I just did, I thought, because I’ve also heard about mobile. Yeah, but it

44:39

was like, which one is harder to invest?

44:43

like to do due diligence and

44:53

yeah.

44:56

It’s just like how we talk about like, everybody was investing Kansas City before in Indianapolis now you can’t do that right? everybody’s busy apartments before you can do it you gotta walk to the less you gotta get off the beaten path, parks or that. And that type of investment investment is going to different do with correction in a changing economy too, right? Because theoretically that’s like you’re hedging against the downturn because theoretically, it’ll be stronger and stronger terms of your tenant occupancy rates and stuff for that type of investment. In one thing I talked to other more sophisticated, higher net worth. They diversify with different asset classes, because you don’t know like, like apartments and mobile and rental properties like 80% of my portfolio partially because I know what the best rate and how many stocks got along, but you never know if like the government’s going to build some government subsidized class be housing Don’t know private entity is going to build UTC class which doesn’t make sense and that’s why I invest in C class but you never know right the government I think that’s how like Asia does it right like they build like older stock or like, like budget or the word is associated socialistic kinda, yeah. But that’s the nice thing on mobile home parks they’re never going to build number one, they don’t make any money for the municipality and number two, they’re isolettes political. The mirror permits one or the government permits when everyone gets all upset. I did my backyard. Yeah.

46:43

I mean, I think you gotta like learn it one by one. Like, like to me like self storage. I’ve never invest in self storage yet. I recognize it could be good but I’m just going to learn one thing at a time

46:57

and and let my strategies that might not work.

47:01

grow my network and hopefully they know or something more about self storage.

47:10

So when you say that

47:14

I have

47:24

I mean, I guess the way I do it is like I look for operators and syndicators. And then I figure out, do they have my network and then they go, Oh, Dean, did you? Did you work with these guys before us? I mean, I call this investing like boxy. My first deal as a lp I lost like 40 grand. Yes. Because the person I asked, just happened to be like a self directed IRA company. And looking back on it wasn’t made by them. Yeah. Yeah, some guy, some guy and then looking back and I was like, What the heck was I doing? I did.

48:01

They were illegitimate like referral source.

48:07

Yep, build relationships. That’s why we do these things.

48:13

Build up relationships with the right people.

48:19

And the ones that are in line with what your goals and your strategies are.

48:24

Any any other

48:33

numbers don’t lie, make a lot more money doing real estate deals.

48:39

You can control the asset.

48:42

It’s tangible. Yeah, it’s tangible. It’s real but just straight up numbers I probably can make three times as much time including any of the textbook, which is ultimately why I think 401k is in and mutual funds are what robbing everybody in America, their retirement. Other good benefits of real estate leveraging a good debt on it leveraging it I think is really good and a tax benefit as another lot more fluid in terms of tax benefits versus Yeah, yeah. Some people I talked to you like they want to have half feels they have stopped so that’s cool you know?

49:23

Yeah. Or and a half but it’s but why don’t you

49:26

go all in with real estate I mean, obviously know how to do it have deal flow, you have a slow slowly and slowly transitioning things over. But identity I mean, I like a diversification so yeah, and I call me old school or whatever it is, I guess growing up as a CPA, an accountant.

49:50

It was always starts. So.

49:54

So, for me, it’s always hard to get out of that, but I totally see the benefits now. moving things over, and even things that I had stock portfolio in before like you mentioned self directed IRA. I couldn’t fully get out of stocks or into the sea, but what I did was three real estate investing you check out our e i aloha.com.

Transcribed by https://otter.ai