Aloha! Below is this month’s edition of the Da Real Estate Braddahs:

For more insights into investing on the mainland and my personal investing check out my monthly update here in the Greensheet.

- What is the Next Step in Asset Protection After LLCs

- Top Things Ignorant Investors Do

- Top Markets to Invest in 2020

- Stop Listening to Real Estate Gurus

- Mental Mistakes of Investors w Marco Santarelli

- How the Rich Use Land Conservation Easements for Tax Deductions

- What Interest Rate to Expect from Investing in Private Money Lending

- Don’t Invest in Short Term Rentals Until You Understand This

- Best Marketing Platform for Short Term Rentals

- How to Position Your Short-Term Rental

- How Much Money You Should Have to Do Private Money Lending

- How Politics and Rent Control Affect Where You Should Invest

- Big Changes to Your Retirement Account in 2020

- How the Secure Act Screwed over millions?

- Do I Need Asset Protection on my Retirement Accounts?

- Is it Safe to Transfer Money to Overseas Trusts?

- It took stocks only six days to fall into correction, the fastest drop in history – CNBC – “The S&P 500′s swift drop marked the quickest 10% decline from an all-time high in the index’s history. The speed of the decline over the past week even beats the Black Monday plunge in October 1987“

- Why the Coronavirus inverted the Yield Curve – Pensford – My initial thought was that the market is overreacting to the coronavirus news. “Classic flight-to-safety-knee-jerk-overreaction, rates will rebound if we can get a grip on containment.But the traders I spoke with were legitimately concerned about the long-lasting effect. Sure, the 35bps drop in the last few weeks was re-positioning to avoid getting steamrolled in the event the news got much worse.

But longer term, the virus has the potential to pull the global economy into a recession.”

- Specialty Grocer Earth Fare to Close All Stores and Liquidate Inventory, Files for Chapter 11 Bankruptcy – REBusiness – “Most of Earth Fare’s locations are near a Whole Foods, Trader Joe’s, Sprouts and/or a Fresh Market,” says Beitz, whose firm operates an online platform called Planned Grocery. The app maps the real estate locations of all grocery stores in the planning, development and operating phases.

- Industrial Outlook for 2020-2021 Remains Strong – CPE – “Dallas is in growth mode due to many factors, such as strong population growth, a friendly business environment, low operating cost compared to other gateway markets and limited regional competitors,” local industrial broker Nathan Orbin, Cushman & Wakefield executive managing director. Net Lease

- Investors Still Value Dollar Stores – CPE – “Dollar General has announced 1,000 new stores in 2020, while Dollar Tree continues to focus on renovating hundreds of Family Dollar stores and growing in strategic markets.Currently, the average cap rate for dollar stores with 10 or more years of lease term remaining, that have been on the market 90 days or less is 6.16 percent. Logically, many of these current offerings are newly built stores, as they offer the majority of longer lease terms.”

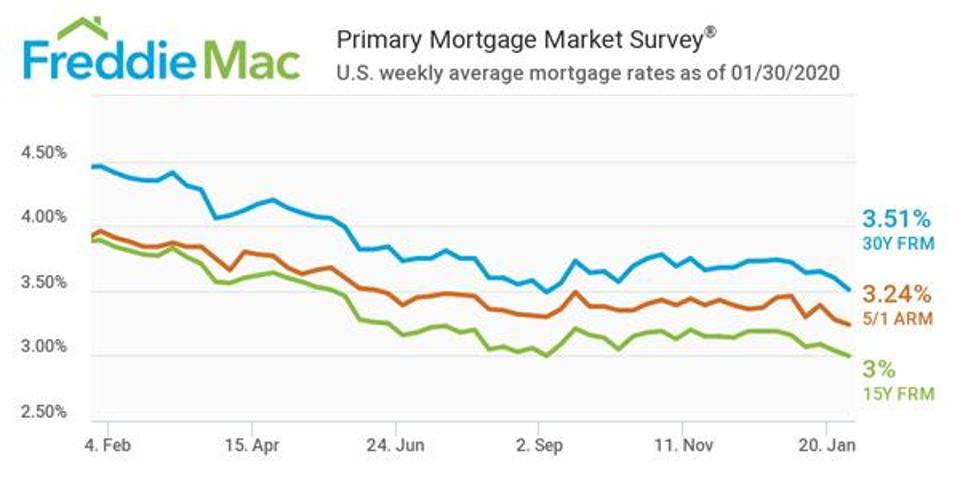

- Mortgage Rates Near 3-Year Low – Forbes – decrease was largely due to investor uncertainty surrounding the coronavirus, as well as trade-related and geopolitical concerns.

- Cleveland Multifamily Report – Winter 2020 – Boosted by the ongoing revival of the city core, the metro’s rental market wrapped up 2019 on a positive note. – CPE – “Most of the new development targets downtown Cleveland; the area ranks as the largest jobs hub in Ohio and is expected to see a population”

- Sherwin-Williams to Develop World Headquarters, R&D Center in Metro Cleveland for $600M – RE Business – The transition to the new facilities won’t occur until 2023 at the earliest, the company says. Sherwin-Williams previously launched a nationwide search for its new headquarters location before deciding to stay in Ohio, where it has been based since it was founded in 1866.

- MBA Forecasts U.S. Economy to Slow in 2020 as Job Market Weakens – RE Business – His forecast calls for U.S. GDP growth of 1.2 percent in 2020, down from 2.2 percent in 2019, and for job growth to dip from a monthly average of 175,000 last year to 150,000 this year. The unemployment rate, which currently stands at 3.6 percent and is near a 50-year low, is expected to reach 3.9 percent by year’s end.

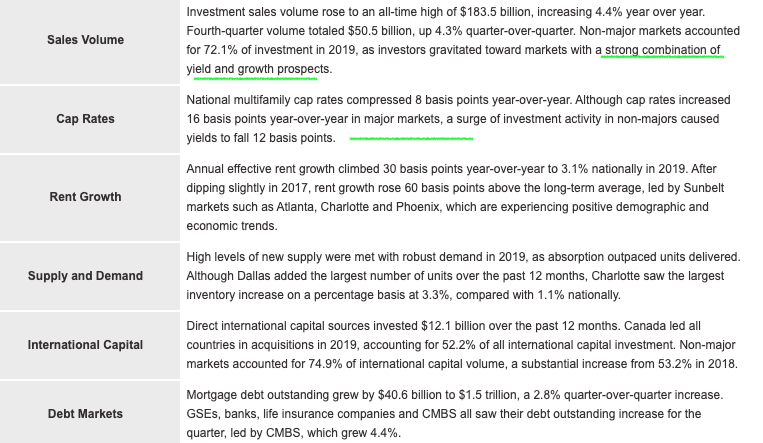

- Newmark Knight Frank MFH Capital Market Report 4Q19 –

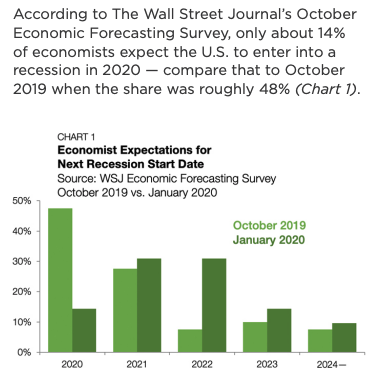

- Arbor – Q4 2019 Small Multifamily Investment Trends Report

- Trump’s 2021 budget proposal – Cut $5.6 billion from Department of Education funding—that’s a 7.8% decrease with changes to the ways we take out and pay back loans for higher education expenses. Positives:Eliminating subsidized Stafford Loans, which don’t accrue interest while you’re enrolled, Eliminating the Supplemental Educational Opportunity Grant, which typically goes to independent students or those whose families make less than $30,000 per year, Cutting $630 million of funding to the Federal Work Study Program, Reducing income-driven loan repayment programs to one option. Instead of paying 10% of your income, you’d pay 12.5%. Payment plans would last 15 years instead of 20, with the remainder forgiven, but graduate students would have to make payments for 30 years under income-driven repayment, Eliminating the Public Service Loan Forgiveness program. Positives: Reinstating federal Pell Grant eligibility for short-term education programs and for some currently incarcerated students who are being released within five years, Increasing career and technical education funding by $900 million, Putting caps on graduate and parent loans with annual and lifetime limits. Parent PLUS loans for undergrads would be limited to $26,500. Graduate students would be capped at $50,000 annually and $100,000 total.

- The U.S. is experiencing its longest economic expansion on record, besting the period from 1991 to 2001. (CNBC

- The decade-long U.S. economic expansion has generated 20 million jobs. (New York Times

- 3.4% year-over-year wage growth is the strongest in more than a decade. (MarketWatch

- January 2020 had record job growth in the private sector: 291,000 new jobs, the largest monthly gain since March 2015. (Yahoo Finance

- The U.S. hit the lowest unemployment rate in 50 years in 2019. (Whitehouse.gov

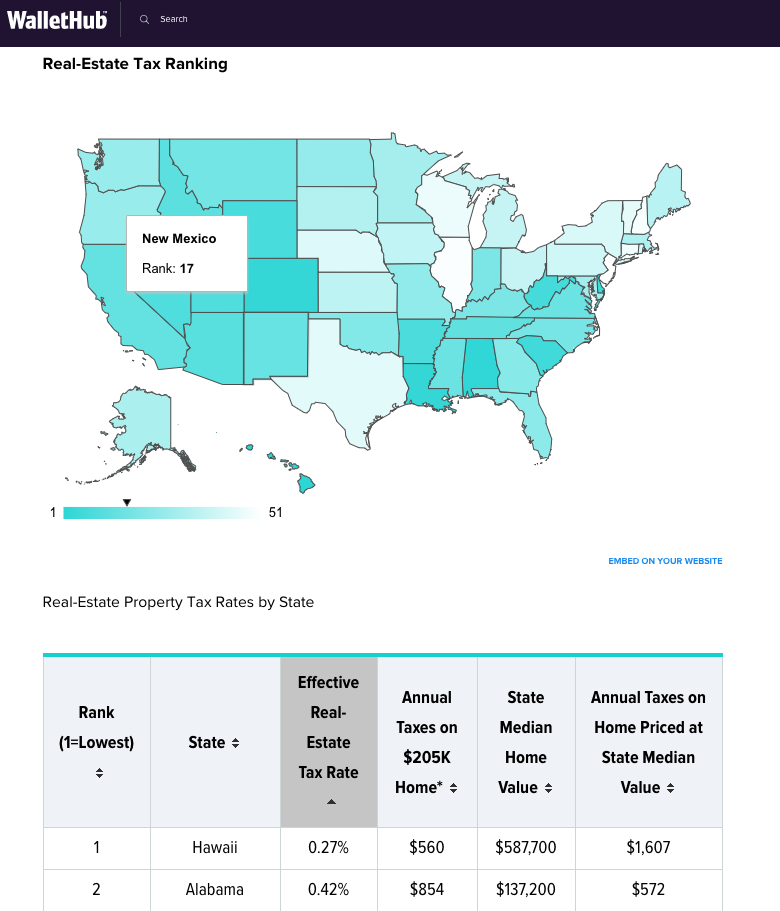

- 2020’s Property Taxes by State – WalletHub –

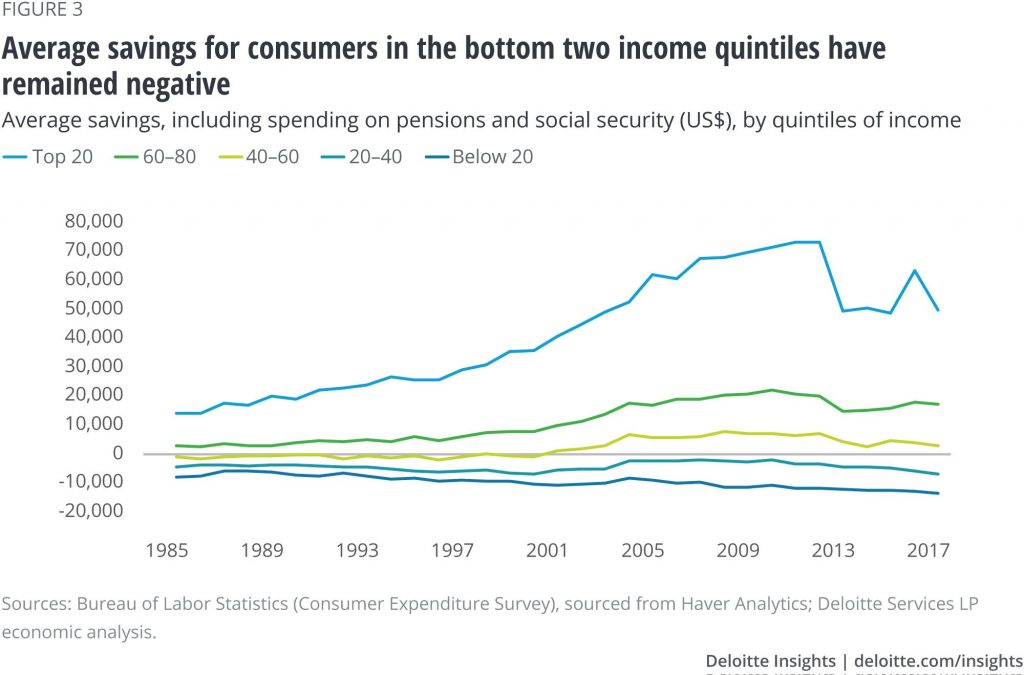

- Personal savings: A look at how Americans are saving – Deloitte – While the personal savings rate has been trending upward, average savings—calculated using the Consumer Expenditure Survey—has been on a broad declining trend since 2010–2012 for consumers across income levels and for key working-age groups.

Transcription:

0:20

everyone, welcome to Episode 25 of the real estate brothers. This is your March edition. We haven’t we haven’t gone in person live for a few months so we’re at homes hopefully you did tuning in via the zoom attachment that we sent or you’re tuning into Facebook. I think we’re on my personal Facebook Live post if you guys have trouble with the zoom today, I got some a lot of good content for you as usual. Hopefully, you folks enjoy so just start off. We are actually a day early from getting the February Ohio statistics so I said to have some other content. First starting off with I guess the big elephant in the room

1:06

at flour at home, right and exactly trying to stay

1:11

healthy. No more manly handshakes with the chest bump. It’s all about the corona of fist pumps nowadays, right? What is that? I don’t know if you noticed, but they go around in do the fist pump with the outside of your hands versus the big handshake. Oh, I seen that a lot more recently because it’s more sanitary and you’re not passing around the germs right? Because that’s all covered 19 theoretically goes around is through your hand and then you picture your mouth.

1:41

It’s like one of those office jokes.

1:44

I mean, it’s it’s prevalent now because you can pass it your aerosol to you know, people sneezing and stuff, but a lot of it’s, you know, hand to mouth and to Noah. So that’s really say, you know, just be careful. So, I To me, this is the biggest thing is, like I said, the elephant in the room, and so Many, so much news popping up. And so it’s constantly changing every day. I find it really interesting, personally, and how it’s affecting, you know, the stock market, and just even everyday life, right, I think Tuesday, Fed chair reduced the Fed rate by 50 basis points rate as a proactive measure to give everyone assurance that the government’s gonna be taking active role. But I don’t know if you were watching the end, but it actually had a negative effect on the stock market, short term. So that day, I think it freaked out the market because they’re like, wow, you’re, you’re going 50 basis points, not not 25. So it kind of shocked the market. So I thought that was kind of interesting, or it had a, I think, a reverse effect on what everyone thought and then not to get political. But Joe Biden did really well right on Tuesday. I think he did one the pause and then the market did well after that because that was a good time. For I think the healthcare side because I think what they’re saying is Bernie’s not his plan is is not really good for for the healthcare industry. So all these kind of interesting things. I don’t know if you heard lean, but I’ve heard rumors that Kim Jong so today he he wrote a letter of condolence to South Korea. But somebody was telling me that and again, this is this total buzz and probably fake news, but he was telling me that North Korea if there’s anyone they found out that had the virus, they just shoot him on the spot. Is there nothing to laugh about? But I just was tripping out because I guess North Korea’s claiming that they have no cases of the virus. I’m kind of interesting. I find that really interesting.

3:45

Like all the statistics, right, they said it’s 2% mortality rate, but like, but they just weren’t testing people. Right. For a while. They’d had a shortage of tests. Yeah. And now they’re starting to actually test people’s All right, obviously, like in the beginning and be like, yeah, Dean, you have, obviously we know you have quantifiers let’s get you tested. Right whereas now they’re gonna start to test everybody since actually have the test kits,

4:13

right. So like in China, supposedly they’ve been testing since January. And I think today they’re saying they may be at a peak. So that’s that’s a good thing. So I think the actually the China markets did well, like you said, as of three, three days ago, I have that note right there on YouTube that New York City ER doctor was saying they still couldn’t test because like you said, mentioned Maine, I think the CDC had produced a bunch of test kits and then they retracted them and said, No, no, we gotta adjust those. So it’s only a recent that we’ve been starting testing. I think even in Hawaii, like you said, there’s dying in my mind. I’m sure it’s it’s here. It’s just, we have no way to prove that last 5% to confirm right away. I mean, these things are happening and you see all those social media posts you go to Costco no toilet paper no water. I went last week and for some reason there was no detergent. The detergent was wiped out as I was kind of thought that was interesting. Or bleach, right?

5:11

I mean, yeah, yeah,

5:13

I went yesterday and there was a lot of Clorox but yeah, those those those wipes, those Clorox wipes were

5:19

gone. I think it’s like one of the symptoms is like diarrhea, right? That’s why all the toilet paper is all gone.

5:28

I think everyone’s going into hurricane preparedness mode. Because that’s what we are most familiar with. Yeah. So like even for me, I was the king. And this is bad buzzing for vienna sausage. Long set of sale. I went to Milan town. I went to Mililani goes to my house and also went to I was out in Hawaii for a client meeting and all three were wiped out. So kind of interesting. Also is affecting here locally, right. Like you said we don’t have any confirmed cases but this coming Monday. festival this weekend, they earlier on, they canceled the fireworks and just yesterday or the day before they canceled the actual parade. So when things like this happen to me, we need to take a step back, right and look at things in terms of our investments for one, either real estate stock or whatever, and just look at in life in general in terms of putting things into perspective. Right. So on the next slide, you’ll see we’re talking off sorry, the timeline also it’s funny interesting about how this is how it started setting up and there’s everything is constantly changing, right? And we get new information every day or you find it in in Europe and then first in Asia, then the non Europe in our in the states and how the rates but I just wanted to put that as perspective is yesterday, California enacts the state of emergency right? So right? They do that because now they can get federal funding.

6:58

Do you know how to play the game? Hate and hate, right?

7:01

So just a reminder for people with a for next slide I just like yeah, keep calm take a step back and we talked about to for investors, they always they say, you know, don’t do what everyone else is doing right so in my mind, I mean, don’t go buy five packs of toilet paper and all that water but that’s one thing but even on the investment side right maybe now is the time to take action because a lot of people are getting scared and let’s wait and see. With that said, I try to have that mindset and try to do what others are doing. So what I did is in January, I took a look at and this is just one piece of my portfolio as I looked at my 401k or what’s sitting in my current 401k if you look, take a look at it. So it was a diversified portfolio. Yeah, you know have like 30% in large cap, not 30% 20 35% in mid cap and small cap Bay. 30% and then money market have 5%. So, around January 27 is was when I actually made that call I said I’m gonna cash out so and again this is just a piece of my portfolio but was sitting in my old employers 401k I cashed out and I made that call to take take a risk and try to do what I’m thinking others are not doing. So having that mindset try again to keep calm, take a step back and do not do what others are doing. But trying to think for myself with that said, also wanted to bring up association fees. I think the last two episodes we talked a bunch about association fees and what they stand for the trend of them to always go up because you know, the cost to the business has been going up. So I’m happy to say I actually found an association that the fees monthly fees actually dropped by 13% For 2020 and this is my my investment actually in in in Las Vegas. So it’s a small I think it’s a two bedroom. One bath walk up in North West Las Vegas. So we went from 240 $9 a month to 216. So it’s 13% job. So there’s a there’s a hope for, for association fees. They don’t always have to go up, I guess is my point

9:27

there sell it though. It’s probably gonna go back up. That’s the thing, like the people that run those ways are usually they’re not professionals, right. It’s just a bunch of people who have kind of been voluntold into those positions.

9:41

Depends like to your point. Yeah, on the board. It’s a lot of it’s all the owners and some of our some of them are owner occupants, or there’s our investors, but a lot of times they are on the board, like you said, or it can be it’s just anyone who lives there owns that can sit on the board, but hopefully the association management is right run by like a property management company, like, locally, we have a lot of its oil or socio. So to your point, though, on the board, you run the full gamut a lot of times its owners who are angry that the fees have been going up historically and they want to make a change, right? So they say I’m gonna get on the board and, and a lot of times they see they find out Oh, yeah, it’s it’s tough to keep these costs down. But anyway, I wanted to talk next about I call this the G one inspection corner. So the G one is a term on the purchase contract on the residential purchase contract in a way and that allows the buyer the opportunity to do a professional inspection and use that to negotiate either repairs or credits. So I just wanted to educate the our listeners about what a GFCI is, which stands for ground fault circuit interrupter. So typically, these are installed nowadays to code itself. I think if you’re six feet away from a water source, then you need to have this interrupter there. And basically what it does is it’ll cut off the power, if you’re touching it and you know, you’re grounded to the water source. So basically reducing injury and potentially death. The reason why I want to bring this up is you often see in the proficient inspections that they test these gfcis to ensure that they’re working, not only understanding what these are, is, is important, but my next tip is to make sure that although you understand what these are, and you know what they look like in that picture, that basically we want to keep, keep it to the professionals. All right. So a situation that that happened to me in a recent transaction was that we had the J one inspection performed, you know, and my buyer paid a inspector to take a look. So one thing they do is they plug that into the dollar in Check. Here we go. Thank you. So leave it to the Pro. So they test the GFCI to make sure that they’re working. And so our inspection report stated that we had four out of five interrupters in the kitchen weren’t working you we use the inspection report, I sent it over to the sellers agent and let them know that, you know, we our request was to get these repaired and fixed because that’s a safety issue. So what happened was my, the sellers agent went in and he bought or he owned one of these GFCI outlet testers, what you see on screen in red, and he went in and he started plugging in into the outlets, and they lit up and he even sent me a video and he said, Look, look, I plugging in it. It works. It works. He’s like, yeah, these work. We’re not gonna replace it. So, um, and via text, and so I told him, yeah, you know, I didn’t say leave it up to the polls or anything, but I just let them know is it No, it’s not that There’s no electricity running through the outlets is that the the gone fault interrupters not working properly. So he then went back and said, Okay, let me get back to you and then the guy happy to say that they ended up doing that repairs prior to close. But my point is, yeah, you know, we should definitely leave it up to the pros because, you know, we, we may know what we’re doing if we buy this $10 tool, we can say Oh, yeah, you know, it’s working but I leave it to them to do and you know, you stay in your wheelhouse because that’s potential risk and not to say I mean, the the sellers agent was was trying to do what he felt was best for his client which, which is great. But with that said, I think know what’s in your wheelhouse and stick to, to what, what you do best and, I mean, of course, we’re always trying to look out for our client and try to think of doing what’s what’s best, but yeah, sticking to stay in your lane, I guess, is my point. Yeah, so

14:01

that reminds me when I was like a city engineer and everybody thinks that they are traffic engineer because they got a car, right?

14:10

Why are the lights going off where

14:13

you should put it like this making lane right here right now? Oh yeah.

14:21

So if you guys want to learn more about passive cash flow on the mainland, check out my podcasts about passive cash flow on iTunes and Dean and I run a local investing group at Rei aloha comm join our meetup and Facebook group. You guys need access that let Dean or myself know, but I’m going to kind of quickly go through some of the headlines that I’ve collected over the past month. Kind of going back to what you’re saying earlier, Dean, you know, maybe you want to Zig when everybody’s aching, right? Like I’m going. I’m going to Disneyland in a couple of weeks when the corona virus is happening. I’m really excited because hopefully everybody is afraid and I can actually write the Star Wars. Right. So, but you know, what is always said in the situation right? What is your financial plan? I always say, Oh, you have to you gotta you got a player for the long run. Right. Right, your money in. Right,

15:20

right we have a well balanced portfolio. So that’s that’s what we, the whole plan is to write up these peaks and valleys. Right?

15:28

Yeah, I mean, I have a different thought process. I don’t have any stocks or mutual funds. My money is all in cash flowing real estate, where work for somebody in workforce housing, pays rent, and it pays for the expense. So that’s just me. But I think we’re all here because we’re drinking the kool aid of real estate. So I kind of take it to an extreme a little bit, but yeah, so I think like, what about like a week ago or two weeks ago that the Dow dropped 1000 points And it dropped like 1000 points is huge. Like I remember when 400 to 500 points was a big drop per day. Yeah. And so drop the thousand points, which was the quickest six day fail in history. Yeah, quickly

16:18

since the was this oil from the subprime or is it in history since

16:24

the speed of the Klein off beat the Black Monday plunge in October

16:27

1987 Wow or even 87 specter? Yeah.

16:34

So Black Monday and then putting things in perspective here. Here’s kind of a graphical representation what happened for SARS, which is very similar to Corona virus. And it was a sort of a knee jerk reaction where it kind of came come crashing down and then actually started to be a sort of rebound right back up. And that’s what I’m looking at how things are heightened I’m not one bit concerned about this Corona virus it could be wrong right this is how this is where they they put in those zombie apocalypse movies right as the laminate dead man’s last words but

17:15

I think this is a show inherit the earth or the world there is

17:20

I think this is the beginning of a little nice breather excuse to take a rest and then we pour about right through for the last few years

17:31

so that’s what I was responding to your comment I think on the social media Yeah, I think it’s it’s an excuse for a correction like and like it’s not it’s not a huge one, but this is it’s actually I mean, it’s bigger than SARS already right. They said that already. So that’s

17:48

confirmed or even like swine flu, right? Like if you listen if you hear back if you kind of put yourself in that perspective, like it came around the summertime and then just dissipated like nothing. Yeah. So in other news this is more on the East Coast specialty grocery store Earth fair went bankrupt because of a lot of the competition from Whole Foods Trader Joe’s etc. Commercial Property executive says the industrial outlook for 2020 to 2021 remains strong nj investor still value dollar stores and if you guys haven’t heard about dollar stores we don’t really have too many of them on in Hawaii. They’re a little bit different on the mainland is like dice or dev dice so yeah, not not like dice. Oh, yes, ISO is a fun novelty shop. Where? Yeah, on the mainland. If you don’t have very much money like you make 10 grand to 40 grand a year you typically shop in family dollar stores. And there’s also like a new store that I thought was a frozen yogurt store called five and below. Okay, I went when I was at Alabama I went inside because I wanted to but it was like a $5 and below store. Oh, these things are super popular on the man. Yeah, but they do well in the recession and they’re taking they’re really kicking butt now

19:21

to take it off

19:26

mortgage rates are at a three year low and this is even after the last the actrix of the last week or so. We were closing out 100 I don’t even know how many units hundred 50 something units or hundred 70 units. Congratulation locked in yesterday at 3.5%.

19:47

Wow. Yeah, commercial.

19:49

Yeah, commercial. So a little higher than residential.

19:52

That’s pretty awesome. This is B ago. No.

19:58

So it’s just a really minder, I were at three year lows. And I think the knee jerk reaction everybody’s going to want to do is like, go out and refinance fi refi. Right. But you know, that’s exactly what the lenders want you to do because they want to collect origination fees. And you got to figure out if it makes sense for you. Yeah. The exercise I’m sure Dean can get as ti 83 Plus or tip three, and figure out what the crossover point is.

20:23

Right? Yeah, cuz they, to your point, too, is you don’t want to extend for another 30. So, like, an option is Yeah, like you said, Go for a 15 or some lenders will actually offer you like a same term. Right. And so that that’s, like you said, I mean, there’s options and not to mention that this option of just trying to pay it down quicker. Right.

20:46

Yeah. I don’t know if I quite believe in that. But hey, what’s your whatever your goal is, right? I mean, right. Let’s figure out what your goal is. And if it’s financial freedom, that’s one thing but if it’s just paying off debt, that’s another and sometimes those two are not aligned. Yeah. So report from Cleveland, heading there in a couple of weeks. Hopefully it’s not snowing. But you know, this is just an example of you got to really look into the sub market. I think a lot of investors that are looking to the mainland, you know, they’re looking at like population growth is one of them from a state basis. But Cleveland is one of those places where the population is actually flatline or going down. Okay, but if you look at the inner city part, it’s the downtown development that’s really pushing things, whereas the outside suburbs, in all the places you would buy those turnkey rentals that Yeah, you know, 20 minutes outside the city center that’s not in high demand these days. Some market thing and and this is where I think investors I see it all the time, right? They come to our events, and then they’re like, what market should we get? And they’re like, you know, they got like in their computer, all these spreadsheets of this data they got that’s really old. And they’re trying to pick up market but then they need to, they need to drive down and on like, which block or they’re gonna buy what somewhere? Are they gonna buy? Like, right and what we mean so market it’s kind of like, you know, on the east side of Kakaako or the southwest side of Kakaako right?

22:15

I mean, my understanding too is they can in some of these areas it’s one street over can make a major difference, you know, to me,

22:23

right, right. I mean, give me an example and milania I mean, Milan doesn’t really have like sub markets per se like it should right. It should have leukocyte or kebab. I don’t know

22:33

like yeah, or Milani mocker I think there’s a little bit from the standpoint of you know, they the different model home types so then like if you go up kilakila on the on the other side and it’s that one hugs the hugs the ravine or it’s those are outskirts outskirts of the Milani maka, so those are like, you know, a lot of those houses I’d be different from stuff on the other side of the street in terms of and, and they have the datasheet view, but no neighbors on one side. So I mean, that might be an example. But to me, my understanding is on the mainland, it could be more extreme. Not from like, you know, a super high end to not so high but you can get from middle class to like, like little bit ghetto across the street or the one block over especially

23:28

like Kansas City, right where you can pass like, there’s like the, I think the metro and like a few blocks away, it’s like super good shot. Yeah, pretty much and even like, I’m

23:39

Chicago too, I think it’s kind of similar to that too. So, to your point, too, is they got you got to look at what news you’re getting and what stats are getting. Because if it’s coming from return provider or not, or whatnot, you know, they might be biased or something or like the information might be old, so just make sure you’re getting

23:59

on not fake news right?

24:02

Right right everybody’s here trying to make a buck. Figure out when you align with somebody the right way. Oh, next headline Cheryl Williams to develop world headquarters right where they were at in in Cleveland again. Oh, okay. Oh, for Hawaii investors are not just Hawaii people in generally love these Las Vegas news right it’s so we were talking a lot about se you’re all interested Yeah. I’m looking

24:33

where it is. Is it the strip? Okay.

24:36

Yeah, so this one they’re gonna put in like a brand new 450 room luxury hotel. Okay, called dream. I don’t know if that’s really gonna be called but it’s gonna be right across the Mandalay Bay. And the bali hai Golf Club. So what is it the south side of the strip? I think you’re right. Yeah. So it’d be one of the first hotels seen from the iconic, iconic Welcome to Las Vegas sign.

25:00

Still think this is north of

25:04

what’s that? That Hawaii locals? It’s a locals hotel down there. I

25:13

don’t not pounds.

25:14

South point South point.

25:16

I’ve never even tried there.

25:18

Yeah, a lot of locals like to go there. But I think this is north of that. That area. But anyway, I just bring this up because this is just an example of class a new stock coming online. And I think two or three months we talked about what was it the carnival Carnival kind of lame hotel is getting old. Right. And it’s changes hands. And oh, yeah, it is. And we also talked about the Bellagio also traded hands. Yeah. I mean, it was nice. Yeah, still a nice hotel, but it’s not the top shelf one anymore. You know. So that’s just what these what the institutionalized guys do and that’s what other investors like to do. Write things straight down, you trade it and do the value add. Yeah. This Ari business reports that the NBA forecasts US economy to slow in 2020. And I put this in here because I try and get both sides, you know, both bull and bearish news

26:17

in here. Okay,

26:19

so this one, if you’re watching on the webinar, you see the numbers on the screen. But if you’re tuning in on our podcasts, we also do this in podcast form has the GDP growth, and that is showing like a little dip and this year and the beginning of next year, but then right back up to 2.2 GDP growth. So this is pretty consistent on what I’m seeing in other more higher level publications, not your fox news or CNBC or, you know, Wall Street times and that kind of stuff, that a lot of people are calling for a little pause in 2020 to 2021 and then we get right back and growing in 2020 On for people looking to buy a home, I would you probably interested in the 10 year Treasury. And then a little, little bit education like yesterday, Dean mentioned or a couple days ago they dropped the feds fund rate 50% or 50%? of 1%. Yeah, that doesn’t mean 50 basis points.

27:24

Yeah. Yeah. There’s she said, half of a percent.

27:27

Yeah. So people are like, oh, that then my interest rates gonna go down? Not necessarily. So they they are sort of correlated. But you what you really want to be paying attention to is that 10 year Treasury that has a lot better correlation to what your interest rate is going to be paid. And this last drop, it actually did impact it. There wasn’t a positive correlation there. Yeah. I think

27:51

a lot of it too, is because you know, what, what the market has built into their forecast, right. So I think this one was this job wasn’t forecasted in. So Wasn’t bid goes into the the rates are ready.

28:03

Yeah, yeah, another publication Newark night Frank multifamily commercial or Capital Market Report from fourth quarter 2019. They come up with these larger parts, a lot of times it’s mumble jumble. And this time it was a lot of mumbo jumbo. But I just wanted to highlight a few things from here in terms of sales volume. They said it a strong combination of yield and growth prospects. And in terms of cap rates, there was a small amount of cap rate compression. Although cap rates increase 16 basis points year over year in major markets and a surge of investment activity in non major markets cause yields to fall 12 basis points. I think those those are just margins just like a rounding error. I don’t take exception to that. Just a small amount. It’s not a blip is something Exactly. Boy pointed out because nomis, investable keen on stuff like that and I’ll just kind of freak them out and it’ll just be another excuse for them not to do anything, which I think is a mistake. Arbor who is a direct Fannie Mae lender and one that we use on our commercial deals because we go direct, we don’t use a broker, we cut out the middleman. Okay, and go direct to Arbor. So if you want to use our same lender, it’s Arbor. So their quarter for 2019 small multifamily investment trends report. These This is a survey so this isn’t like any kind of data. This is just like asking a bunch of dudes what they think. So they want to ask a bunch of dudes like, what do you guys think of the expectations for the next recession? When is it going to be? So if you you asked them we asked them last year, October 2019, like 50%, almost 50% said, Oh yeah, it’s gonna be next year 2020 that’s the year. And no, it’s not gonna happen. Is this too late already? It’s not gonna happen. So this graph is kind of showing, oh, you know, it wasn’t that easy. It’s gonna be the next year, right? I mean, it’s just like kind of pushing both light green to the next one. And I’d put this there because these are just kind of is pointing out, you know, this, I don’t really look at these things. But just kind of interesting to point out. Everyone’s wants to pick the bottom. Everybody wants to say that the the world is coming to an end, I was the guy who call that

30:34

a recession is what that is, is it’s two quarters of successive filing of GDP rate is that net to two or three quarters of negative GDP or just not two successive quarters is what I think is up to six or negative of it. We have the GDP going down. Yeah, yeah. Yeah.

30:56

So same, same new source Arbor. Different chart here, the spread between small multifamily cap rates and the 10 year Treasury yields through quarter for 2019. And this is where this is what all this is all a Marvel’s right here. This is why we do what we do. Because people always ask like, Well, what do you think the interest rates are going to do? What do you think the cap rates are going to do? And I’m like, I don’t care. Because as an investor, you make your the money you make is the difference between the cap rate and the 10 year Treasury yield as what is depicted in this chart? And it’s, it’s like, it’s like a timeless law. There’ll always be a gap between those two. And then since the past, like, decade or even more, it’s been 400 to about 500 points.

31:50

pretty consistent then.

31:51

Yeah, I mean, when when interest rates go down, so the cap rates Yeah, yeah, no, rate ain’t Oh, no, the interest rates are going to go up. Well, the cap rates will let Go off, right? Kind of like, Is this one of those things? That just is always true?

32:07

That’s an interesting blip in Oh, five to eight. That’s that’s

32:12

the change there.

32:14

Yeah. And I think what happened there is just yeah, it was just people just weren’t buying stuff because they were scared they’re flat out

32:21

or alternative investments, maybe the stock market who knows right?

32:27

Well, this is in normally I think, even in a recession. If you look back and compare this thing, chart to other recessions. The gap between the cap rates and the 10 year was pretty consistent. You remember like 2008 that recession? That was more of a real estate issue. Right.

32:47

I just think you know, from a standpoint of moving from certain type of investments, a small multi cap multifamily, you need to take it in go somewhere else, right.

32:58

Oh, yeah. Yeah, yeah, it might be right there. But I think we’ll be

33:04

looking at it wrong because if the spreads going down and actually people more people are getting into it that and that’s what creates the cap rates going down because inflating prices, is that what it means? Right? Right. So

33:15

so once when the graph is going down here that means that invest it’s it’s less advantageous for investors. Yeah,

33:23

yeah. It’s squeezing it. Yeah. squeezing your margins. Right.

33:27

So you know, if you look at like, we’re there was like a recent sort of a mini dip. That was when things weren’t really that less good for investors. But in this, it’s consistent. It’s pretty dang consistent. And investors make their money on that this delta and then we apply leverage, healthy leverage to this. So we make a four times this is compounding it. Yeah. So I mean, that’s what investing is all about, right? It’s not your Nothing to do about interest rates. It has nothing to do about cap rates. It’s a difference between the two. Yep.

34:07

We’re gonna get a little political here.

34:09

Oh no. So

34:12

so I’m sure all you guys have so much time in the world to look what the Trump camp is going to do with their next budget. But the if you want to you can look it up omb.gov and go through the hundreds of pages of proposals but right now on the table. They are looking to cut 5.6 billion from the department of education funding, which is a 7.8. decrease. The some of the negatives are eliminating Stafford loans which don’t accrue interest for enrolling eliminating supplemental educational opportunity grants. Cutting 630 million of funding to the federal work study program, reducing income driven loan repayment programs to one option Eliminating the public loan, public service loan forgiveness program.

35:06

we’re eliminating that. Oh, yeah.

35:10

Some of the it’s not all bad. You know, we shouldn’t all take pitchforks and knives to Capitol Hill.

35:16

Well, I mean, even like to a point that eliminated that public service loan forgiveness program, I don’t think that’s very, I didn’t think that was a very large program in terms of how many people in fact, I could be wrong. But that’s just a way to forgive their student loans. If they’re working you know,

35:32

I, I think I think my wife has that. But I like tried to look at it and it’s so freakin hard to like, apply for it and get it I’m just like, Oh, it’s not worth it. Like

35:48

I imagine it’s the same for most people. There is all this stuff you have to fill out and there’s all these rules might be

35:55

moved anyway if it’s going away, right.

35:57

Yeah, yeah.

36:00

So some of the positives are here, it’s reinstating the Federal Pell Grant eligibility for short term education programs. For some currently incarcerated students, increasing career and technical education funding by 900 million, and putting caps on graduate and parent loans with annual and lifetime limits. parent, your Parent PLUS loans are, is that in your vocabulary?

36:26

Yeah, that’s basically you’re tying in your, so if you’re the student, you’re tying your parents to the loan. It’s exactly what it says. From what I understand though. Okay.

36:37

Well, I was just, I was just kind of asking. I mean, I have had these. Yeah, I mean, I’m wondering if they’re newer,

36:43

or no, I think it’s been around but it’s, um, it’s some honestly, if you can context benefits, but basically now instead of a student loan where you’re, you’re in for just a student, not basically it’s like them co signing for a loan for you. Yeah. So they’re on it.

37:01

So their Parent PLUS loans for undergrad will be limited to 26,500 graduate students, we kept that 500,000 annually and 100 grand total.

37:12

That’s not much, man. They just did a presentation to a company locally, and we’re talking about the price of tuition these days. And like, I mean, that 26 five is,

37:25

yeah, yeah, yeah. Especially when you’re going for five years. I mean, you went to super cheap, isn’t that?

37:31

Yeah. Yeah, I think I think I like 15 K, I’m not sure but I think I was running this scenario where if your kid is like nine years old, and they have another eight years, and they’re going to auto state, say the mainland and they have auto state tuition. So talking about the the inflation or how much schools have been increasing their prices annually. You might be like, In a nine year old kid today, you might be talking about 267,000.

38:03

Yeah, for the four years, and that’s just grad undergrad. I feel like in the last, what, 10 to 15 years, I feel like universities have gone up three times, whereas the price of like mid pack or punto Hall has only gone up to two times. Am I right there?

38:20

I think to your point, the I mean, the the local schools have been private schools, high schools and have been going up kind of quickly, too, but I think they’re been catching up to the mainland and for high schools, but like you said, I think the colleges have been increasing at a higher rate. Is there a point? Yeah,

38:44

I mean, a good deal. No,

38:46

that’s that’s and that’s the discussion I had with with the participant is they, you know, maybe forecast your ROI, right if, if your child is going to go to Harvard, which is probably not accepted. 20 grand a year including them, room and board, but they’re going to come back in and come back to Hawaii and and take up a profession that starts off at 40 $50,000 a year yet, you know, how long is it going to take for them to pay back their loan? right i mean and that’s the challenge that we see for people getting out of college today is so much debt they can’t buy a police so

39:21

yeah, well discussion for a future beer lab meeting or accredited only meeting. Yeah, join the main and last shoot me in Vienna email. We’ll talk about whether you should go to private school or not get the truth

39:38

of this live recorded stuff from from two guys who have experienced it right.

39:42

Yeah. So next article, the 2020s properties, taxes by state. This was put together by wallet hub. So they rank it’s kind of a cool article, like if you want to go to wallet hub and play around with it, but it’s like an interactive table. But it the reason I put this on here well, Hawaii is like the number one Louis, buy effective tax effective real estate tax rate at 0.27%. Where but the only reason is that we because our our properties are so freakin expensive, right?

40:17

Yeah, you can’t just look at that number alone you get a scroll down to that make that third column about state median home value that gives it a bit better perspective, right? Yeah,

40:26

like I have properties in Alabama. And they are ranked number two, lowest percentage. But if you look on the annual taxes on a 200 to $205,000 home, it’s like almost double, but a $205,000. home. I mean, that’s a minus class property. That would be like $1.5 million here. For sure. Like, at least, maybe, yeah, at least.

40:55

You mentioned latsis to me.

40:57

Yeah. You know, I was looking at some houses. That I want to live in deem like if I would have still lived in the mainland, like some things I was actually would consider living in in 10 years. Okay. If I would have bought that here in Hawaii, it’d be like four to $6 million. Something that would cost me like Emilia, Emilia and half on the mainland. It’s crazy.

41:19

Well, you have your go to realtor, so let me know.

41:28

Anyway, so I think we had some bad news a lot. So I just want to end it with some good news. And CNBC reports that the US experiencing the longest economic expansion on record best in the period from 1991 to 2001. Well, I’m sure the there’s some guy out there drinking a beer and say, well, it’s gonna come down any day. But that you could also be the guy who misses out on though four or five, six best years, right? All right. Your New York Times says the decade long us Expansion has generated 200 million jobs. marketwatch says 3.4% year over year well wage growth is the strongest in more than a decade. Yahoo Finance says January 2020. Ahead record job growth in the private sector sector. And then whitehouse.gov says Of course they’re gonna toot their own horn. lowest unemployment rate in 50 years. Yeah, I mean if you don’t have a job

42:32

I don’t know, man. It’s everyone’s got jobs these days. No, no.

42:41

So the light we let’s talk about this a little bit, Dean. So Deloitte came up with the study of personal savings. A Look at how Americans are saving and so what they did here is we’re showing for for those guys are in the podcast form. You guys can check this out on YouTube. It’s kind of a cool graph. But it’s graphs like the top 20 percentile wage earners. And the rest the 60 to 80 percentiles, the 40 to 60%, the 20 to 40. And then the below. So it’s saying that, that like, five, eight years ago, we hit a little peak. And you can see it in the top 20 percentile people, they were saving a lot of money, and then they dropped a little bit. And I’ve read books on this. It’s called the Great forgetting. They say every eight to 1512 years. They say people forget how things were, they forgot about the recession, and this is just the ebb and flow of life. Okay.

43:45

I get that forgetting thing because, I mean, it seems like our parents don’t forget though, right? Because they see that’s why the older generations are stocking stockpiling the toilet paper in the waters because you know, back in your day, you know, when Things ran out, for whatever reason, or the shipping companies stopped coming, then you know, you’re you’re stuck. So I think some generations Don’t forget.

44:11

Yeah, but you know, from like a who spends the money. I don’t care about them. I care about you, Dean. Right. Right. Like your YouTube stuff. You don’t care. You forgot what happened five years ago?

44:21

Yeah. Last week,

44:24

right. Yeah.

44:27

Yeah, different genders,

44:28

different generations. And another unfortunate takeaway, you know, for the people are 50% or less, they’re barely saving any money. Yeah. Yeah. And that’s, that’s how financial freedom is obtained. You take the the area under this curve, and you invest it so you put it into more investments that build cash flow, right. Not necessarily pay off debt. The big difference? Oh, you’re not pitching Dave Ramsey, then. No, I’m not pitching Dave Ramsey like I believe. I believe that people who are in the top in the below 20 percentile in the 20 to 40 percentile people with consumer debt. Yeah. You need to figure out how to get your finances in order and Dave Ramsey Suze Orman are great resources for that. Right? Yeah.

45:18

But and, yeah, 2.2 is to each their own. Because if you don’t have that large nest egg, then for me, like for me, I don’t come from owed money. So I need to use smart leverage, right. And to your point name, I’m going to see what I can and I’m going to invest it in things that generate income. And the leverage is just a multiplier on top of that. So I have to do smart leverage versus like Dave Ramsey says pay off all your debt. Right. But I think smart leverage is needed for for people in the right situation.

45:49

Yeah. When I hang out into a $4 million house, it’s your strategy will change your return on capital preservation preservation exactly right. As you get past This this point A called critical mass where you have enough money you can just live off the rest.

46:06

Right, right. Right.

46:08

Exactly. Until then we keep doing real estate pratas and did a bunch of articles and podcasts this past month you guys can take a look at it here. And this is the kind of the time of the show where we asked people who are on live if they have any questions. Oh, here’s a deemed helped me out at this. We did a week three. We called it so all my investors from the mainland. I was

46:37

fine. That was awesome, man. I really enjoyed it. It was super cool.

46:41

Yeah, it was fun. Yeah, it’s fun. Yeah, not It’s not often you get a bunch of like highly affluent people who, when they come to Hawaii, they all stay in cheap hotels because they want they’re frugal and they want to save money. You know?

46:57

And just like to your point to just being out a different bunch of people is is always good fun, right? Everyone’s sticking different. You had some great minds in that group right. And great, great activities to get some real fun activities.

47:13

Yeah, you gave it You gave your heartfelt confessional about how you your son’s popping in there. Yeah. screen time. Right.

47:23

So Well yeah, I mean that was that was great. Thank you for the opportunity to participate in. I had fun in the activities that I could join in because to your point, it’s the it’s the full experience right? It’s not just coming to that that seminar on Monday and talking going through all those social activities with everyone. It made it so much better when we actually sat down on for that day of seminar so they come more in touch with the people that I was talking to more willing to share. So I I really enjoyed it.

47:53

I told you man, it was all designed that way. I told you have vision that

48:00

was great and you executed excellently.

48:03

Thank you. Thanks for that hope.

48:04

Yeah, I know. So the listeners man next time Nene has we have one of those things I definitely suggest you come Come on in and have fun with us because have fun and you’re learning. It’s great.

48:15

Yeah. And not too many people came. Yep. And it’s an I think that’s it’s cooler when people like fly out to somewhere and because they’re in there in there like swimwear, they’re drinking the Kool Aid

48:29

and the potential tax benefits of

48:32

Yeah,

48:33

no, no, I mean, you’re, you’re, you’re we had so many people from different walks of life, right? You had the computer programmers, you had the scientists, the engineers it was that I think was very interesting. You had the CPAs. And when we had the the mastermind discussion, everyone’s talking and everyone’s putting in their two cents in their value add and not scaring to share. I think it’s one of the most powerful things about you know, masterminds in general Yeah.

49:01

Yeah. Not many things in life you remember that? That’d be something I’d remember

49:06

for sure for sure.

49:08

So I my lessons learned this month I read that book willpower doesn’t work I would suggest that one being

49:17

Yeah, I took a look it down to

49:20

it’s good. Especially I think we talked about it the other episode, right? Or it’s like

49:27

you you can’t do your part is not strong. So you have to physically take out the the diversions right

49:35

right yeah, yeah a great system systems because you just have to understand that willpower you’re not gonna whether they call it white knuckle you can’t white knuckle your way through everything.

49:45

Right? Right.

49:46

So this The book has a whole bunch of strategies and I’m I actually, when I listen to that book like that, I don’t listen to it at two or three x feed I actually listened to it one x feed so I can like, think of other action items to do based on what they’re talking about

50:03

the library has gone to, I bought them for the library.

50:07

And the next book I’m going to read is this go giver. And I am opening up a book club, because I got nothing better to do these days. But we’re only gonna read like a book every two months. It’s a slow book club. Okay, that’s doable. Yeah. So you can go to simple passive cash flow calm slash lane hack. And every couple months, we’ll get on a call like this, but everybody will see each other and be able to have a nice discussion online. No pants required. And we’ll talk about this book. I think I got it scheduled for April 25. So if you want to get in now and start reading it, you’ve got a quite a while. that’s doable. Yeah, it’s free. 99 and I’m just gonna read the book.

50:53

No Cliff Notes.

50:54

No Christmas cheating. No, no Cliff Notes I’m putting on from now on.

50:59

Let me See if we got some questions here. Oh, we got we got a few.

51:05

I got one popping up. But can you see that one from? Mr. Chang over there?

51:12

Um, are you on the Facebook part?

51:14

Yeah. So he’s, he said, um, and while it’s unfortunate that the Cova 19 made the market crash, we’re looking forward to homeownership in 2021. Can you predict what the interest rate will be?

51:28

Wow.

51:30

Yeah, well, I had a slide. Right, right. Yeah.

51:34

Well, this is what the NBA forecasts

51:38

that’s better than what I would have. So

51:41

can you see this theme and you get bigger.

51:44

It’s still in them. It’s not in presentation mode. There is.

51:49

So you can read that. So

51:52

the way I would read this is I would just look at it. Like take the 2019 baseline at 1.8. And then It’s going to go up a little bit, and then it will just climb very slightly, maybe 10% higher, which, if the interest rate is 3% man, it’s like 3.3. Who cares? Right, right. I mean, like I said, if you’re buying an asset that actually produces you know, income which is a cat what a cap rate essentially is, who cares what the interest rates are because the cap rates will go up. Yeah, I see it you know, if you’re buying a house to live in debt, you’re gonna just camp out and for 30 Yes, then you’re just reducing buying

52:31

power. Yeah,

52:32

yeah. So I but I wouldn’t freak out in terms of like, what’s what’s what the interest rate is doing? I mean, it’s all time lows right now.

52:43

So many factors to say, you know, and I two years from now, all right, got the political factors got the race coming up and the year, son, so many different factors.

52:58

But we got three marks. questions here and I got a I got a head to the CrossFit gym at seven. Okay, Okay, got it we got a run through this does the interest rates going down affect the HELOC rates? You don’t take that one.

53:13

So, in what I’ve typically seen it at I’m not the banker guy but what I’ve typically seen is I think it will yes but he lock rates seem to adjust a little slower and the reason why that is is a lot of times the the banks are offering these promotional rates right so you see these big signs and and to me over these past I don’t know how many years now it’s it’s always been kind of around the local financial institutions you know, say 1% if you’re when you’re locked 2% for two year lock 2% for three year lock around there and then now they’re they’re changing their products now they’re offering you know, like close to a little under 5% for the five year lock. So and then it’s What changes is the, after that promotional rate? What the what the the, it’ll reset to so that that rate changes, but the the promotional rates don’t seem to change as quickly as on the 30 year mortgage. And I think that they’re promoting these, um, these products that way. But what does change? The underlying, the way that these locks are written up is when it does reset after your promotional rate, it’s going to be tied into either prime or, or something with the current rate is at the time of reset. So, yeah, that’s what I’ve seen. And that’s my experience.

54:40

Yeah, and exactly what Dean says they’re teasers because here in Hawaii, there’s not as many like banking products because the banks are really conservative here. So instead of like five, six different random, like lending products, all we got to hear on Hawaii is like the healer, that’s all we got. So it’s they’re trying to teach you to get into their banking system, and They’re willing to cut their their profit margin to get you in the door because they know with you know banking clients once you get them in the door they typically stay so it’s kind of like you know like Uber giving $50 off a first ride kind of a thing

55:15

where they’re like to your point to they’re hoping to get other business right like the your your banking, checking maybe your your business or maybe a kids the owner or their peripheral products like there I go there but like, you know, five to nine or or personal banking or financial advising or you know, they try to get all of your business not just the he locks or getting a HELOC. A lot of people will try to use it to do their own using that money, you know, to sweep money back and forth. So then you need another account, right, your regular checking or savings so then they’ll get you with these other products not get you from A negative standpoint, what gets you from the standpoint of your business?

55:58

Yeah, and if you’re like me Who’s a cold heartless numbers guy who has no allegiance to one bank or another and just goes after the lowest rate. We have the cheat sheet at Rei aloha comm slash Sherlock, with all the teaser rates for all the banks and a little cheat sheet on how what’s the most effective way to hop from them and not pay any fees? So

56:24

very common, very common.

56:26

Yeah, everybody’s trying to be a selector guy with a little plug outlet thing. Everyone’s a little like do it yourselfer, right? This is how I do it. I don’t I don’t paint my house. I do this type of stuff.

56:39

Hey, wherever you provide value, right?

56:43

Yeah. Next question. What do you think of investors on the mainland who are investing in Hawaii? Do you see any of those guys competing with you?

56:52

investors? Um, yes. What do I think about them? I mean, this just are they

56:58

Are hundred no bid or

57:02

no? No.

57:04

I mean, the markets a market wherever you go, if you go in the main then there’s local guys there that I’m, I’m the auto state guy competing against them. So um, I mean, I don’t view them as anything specific. I mean, you know, back in the 80s, we had the the Japanese investors driving up prices right and and now you don’t see that as much we had, you know, theoretically they’re like Chinese investors not only here but all over the world and then then I think I don’t know if it’s true but the Chinese government was trying to stop the monies from going out of China. So they started to put like caps and regulation. But I mean, the market is the market, right? And so if you’re investing in Hawaii, on Oahu, I mean, you always talk about the full spectrum of investing right one side you have cash flow, and on the far other side, you can have appreciation. So depending on what your long term goal is, it’s going to determine where you invest in what you’re investing in, whether it be cash flow, or appreciation for wealth preservation, but if so, typically if you’re investing in Hawaii, you know, San Fran New York, you’re probably not going to look very good on the cash flow side compared to other places right lane like, like Alabama, Texas, KC Indy or not. So I mean, I don’t look at them in any way. Besides, you know, I’m putting in my offer. I don’t know what the other competition is that’s putting in they’re submitting their offer. So at the end of day, it’s just are the numbers working for me? And I mean, like you said, you can look at at the macro level to see like, is a lot of money coming in from foreign places and is that driving up our markets? And try to do that macro analysis they call we talked about on on, on your side, your half of the podcasts and stuff. But I mean, at the end of the day is do the numbers work, right? Because you know, you’ve talked about your real property taxes and percentage of the value of your home but at the end of the day, it’s the bottom line what’s what’s the net cash on cash return, forecasted appreciation, we can see all those numbers play in what is your, your bottom line? So I don’t hope that answers their question. But I, I we look at information but take it with a grain of salt.

59:37

Yeah. Yeah, I think it’s the same anywhere. I mean, when we, when we get outbid, like investing in an Alabama and we looking at some random group from California, we just kind of like, you know, hit her head against the wall. I mean, it’s kind of like when a you know, like the opposing pitcher hits a home run off. I’ll throw you on the National League. I just highlight all right. What Ever. Now that’s just they happen. Yeah, it just happens. And more than likely, you know, some mainland person, they don’t know the sub markets and they think they’re just a sucker buyer. I mean, just that’s what you have to deal with. And you just got to remain consistent. Yeah,

1:00:16

yeah, exactly.

1:00:18

So the last question here, will we get killed in the near term when tourism drops off? And how long does it take for the islands to recover? Its term going going down? I don’t know. I don’t pay attention.

1:00:31

I just spoke to someone that worked in the hotel industry last week, and they’re telling me that occupancy rates were, again, this is anecdotal information. This is not from the bed or anything, but he’s telling me their hotel that he was working at occupancies rates were in the low 80s. And I think around this time of year, they’re typically more in the 90s. So I think we’re feeling starting to feel it. I mean, the airlines are doing Definitely feeling it right i mean they’re already the Asia and Europe they’re stopping

1:01:07

flying for indifferent

1:01:10

yeah I got a sad email from Alaska Airlines CEO saying not Don’t worry about the coronal I

1:01:18

think didn’t was it Amazon in Seattle? Didn’t the the safe you don’t have to fly on. postpone any are not necessarily Facebook. Yeah. Facebook Yeah. Because after Washington State right they’re having the fatalities are going up so I think it’s in the Seattle area to Seoul. I mean I think we’re already seeing it in terms of it hurting. That’s hard to say when will we recover? I mean, tourism industry. I mean

1:01:51

yeah, that’s tough. I I like to think that our, with our

1:01:57

medical technology being so Advanced that

1:02:03

and and our government governments internationally being so proactive and no one wants to see a recession that everyone’s working hand in hand to make sure that you know this is going to be I think like it’ll just total guesstimate is like, you know, in maybe a month we’ll have a handle and and contain it and maybe it’ll peak. But total guesstimate I I don’t have a

1:02:28

crystal ball. I don’t claim to be Nostradamus. I don’t know glean What is your take the you don’t think that the Chinese made this virus five years ago and now they’re trying to cash in on the vaccine that they already have.

1:02:43

I shoot I don’t know but I don’t know if you maybe you gotta go look at the day traders and see who’s who’s making the big shorting the market big time from from China and then maybe then we’ll get our answer.

1:02:57

I don’t know I invest in stable Blue Collar markets right are steady growth and population growth all right I got nothing in Hawaii I just live here.

1:03:06

So to your point in you don’t care what I don’t have a short term real

1:03:10

No, I don’t care. Yeah.

1:03:16

You don’t think they made that virus? No.

1:03:20

All these conspiracy theories I tell you guys a lot of things all the time I think about from

1:03:24

well I’m curious about that North Korea when and if they’re actually doing that to that one is hot off for fish that is right. Just kill off the people with with the disease

1:03:34

and that’s a total propaganda thing to say, right. We don’t have any coronavirus here. Or too healthy.

1:03:40

Right? But hey, maybe he’s seeing the truth. Because if you just get rid of the the bug, the people with it, I mean, that’s sad not to laugh at it, but in you know, not putting it past in, in what could be happening, right?

1:03:55

Yeah, I don’t know. Maybe he’s a nice guy. I don’t know. Yeah, that’s true. You know, we don’t know.

1:03:58

Dennis Rodman hangs out with me. Yeah,

1:04:02

yeah. Alright guys, well, we’ve gone five minutes too long. So we will see you guys next month. And um, before you guys go make sure and check, go to our events section, RL hood comm slash meetings or events and check out our seminar that we’re going to try and put together on May 2, so it’ll be a half day event. And you guys can learn all about getting to financial freedom and how do you buy a rental property and we’ll walk you through that.

1:04:34

All right, well, talk to you guys later. Bye. Bye.

1:04:40

Three real estate investing, check out our ei aloha.com

1:04:55

just do local guys with so much to say. So listen to them.

Transcribed by https://otter.ai