Aloha! Below is this month’s edition of the Da Real Estate Braddahs:

It was a rather quiet month as we successfully closed two deals. It is a good season for taking it a little slower as we get ready for a busy 2020. Da Braddahs is now a podcast so if you enjoy consuming our content that way subscribe there. If not the YouTube or Live meetings is another way to catch us.

For more insights into investing on the mainland and my personal investing check out my monthly update here in the Greensheet.

- Legal Guide

- Talking with your Spouse

- My Last rental! – https://simplepassivecashflow.com/al4/

- Stop Being a Crazy Rich “Mom/Pop” Asian Investor w/ Elisa Zhang – https://simplepassivecashflow.com/ezmoney/

- Financial Freedom for Doctors – https://simplepassivecashflow.com/doctor/

- Mortgage lending questions for 2020 w/ Graham Parham – https://simplepassivecashflow.com/mortgage-lending-questions-for-2020-w-graham-parham/

- Check out a local lender here talk about the mortgage process and pitfalls

- eCourse is now live – SimplePassiveCashflow.com/ecourse

- New investor portal with 3 free modules and past deal webinars

- Apple Commits $2.5B Toward California Housing Crisis – MHN 19.11.05 – “will commit $2.5 billion towards efforts to solve the severe lack of housing and affordable housing in the Golden State. Apple’s pledge follows similar announcements made recently by fellow big tech firms Facebook and Google.” – Microsoft kicked off the commitments in January, when it announced it would invest $500 million to affordable housing in the Seattle area. Five months later, Google doubled Microsoft’s pledge with a $1 billion investment in Bay Area housing and a plan to build 20,000 units. And just two weeks ago, Facebook announced it was committing $1 billion toward affordable housing efforts in California. – [Failure for markets and public policy to meet housing needs]

- 2019 Rent Growth – MHN 19.11.18 -“multifamily rent growth is back in the black, increasing $1 to an average of $1,476. Year-over-year rent growth remained at 3.2 percent and has been at least 3 percent for more than a year, according to a Yardi Matrix survey of 127 markets”

- Class B & C Investors Circling Secondary, Tertiary Markets – MHN 19.11.04 – “Fueled by strong employment and a growing group of renters by choice, investor exuberance for multifamily properties is spilling over into older properties as well as secondary and tertiary markets. Buyer older properties and renovating them, meanwhile, can offer better returns.”“Groups that would have been looking for the newest, shiniest Class A downtown asset now have modified their strategy to allow for Class B investments,” Pesant said.“I was talking to an investor the other day who bought an asset in Florence, S.C., because it was a 7 cap,” she said. “Everything is a 5 to 5.5 cap in secondary markets. They are going to tertiary markets to get yield and going down the quality curve.” – [Not a new trend for SPC investors but here is another viewpoint of the opposite. Lesson learned is know what you are investing in a specialize and operate well]

- 3Q19 UNITED STATES MULTIFAMILY CAPITAL MARKETS REPORT

- Jersey City Joins Push to Block Airbnb – MHN 19.11.08 – “The new rules in Jersey City bar renters from listing their apartments on the site as well as owners who don’t live on-site.” – [Another reason why I don’t like STRs and prefer blue collar rentals due to this demand]

- Multifamily Rents Rise as Vacancy Tightens – MHN 19.11.08 – ” Effective rents for institutional properties grew by 3.3 percent year-over-year in the second quarter, up 1.6 percent over the previous quarter, as low unemployment rates and ongoing job growth fueled healthy absorption.The vacancy rate declined by 20 basis points year-over-year to 5.8 percent, even as apartment stock continues to expand by 2 percent a year, according to a new report by the commercial real estate finance firm. More than 4,400 buildings providing 797,000 units are currently under construction” – [This is a big of general data on the whole US market which is not really useful but in the big picture the demand is there]

- China Trade deal update 19.11.11 – Home loans started higher but were “saved” midweek when reports came out suggesting a delay of a “phase one” trade deal signing. Bonds and home loan rates like bad news, so a disruption or delay of the trade signing was the reason for rates to improve off the worst levels midweek. Word that both the U.S. and China would roll back tariffs as a deal gets put together was very good news which pushed Stocks to all-time highs at the expense of Bonds and home loan rates. Loan on same level they were at back on July 31st when the Fed cut rates for the first time in 10 years.

- Co-working space

- More than half of the world’s richest investors see a big market drop in 2020, says UBS survey – CNBC 19.11.12 – “UBS surveyed more than 3,400 high net worth investors with at least $1 million in investable assets. Fifty-five percent of respondents expect a significant drop in the markets at some point in 2020. The super rich have increased their cash holding to 25% of their average assets, the survey showed.” – [You are not the rich if your net worth is under 1M… I found it interesting that they still had 75% of their money in the game despite this outlook. This also means not dead equity too.]

- Hillwood to Develop 1 MSF Amazon Fulfillment Center in North Mississippi – REBusiness Online 19.11.19 – “The facility will house picking, packing and shipping operations for larger customer orders and create 500 new full-time jobs. According to The Clarion-Ledger, the new facility will be located within Hillwood’s Legacy Park, a 266-acre business park in DeSoto County. The Class A industrial campus has proximity to U.S. Highway 78 and Tennessee Highway 385; the BNSF and Norfolk Southern intermodal terminals; Memphis International Airport; FedEx Air and Ground hubs; and a UPS sort hub.” – [You need to start getting creating and looking into tertiary markets]

- CRE Industry Preps for New EB-5 Regulations – CPE 19.11.20 – “The new minimums have been adjusted for years of inflation. The minimum investment in assets in a targeted employment area will increase by 80 percent, from $500,000 to 900,000, and the standard minimum investment will rise by the same percentage, going from $1 million to $1.8 million.”

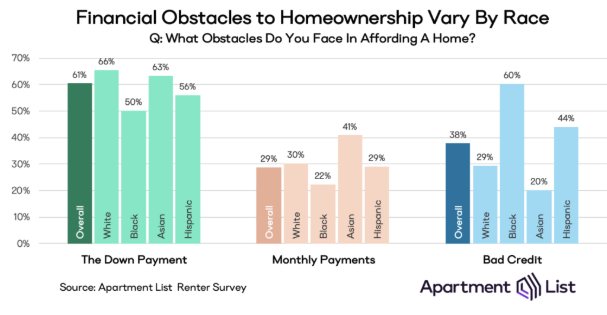

https://www.apartmentlist.com/rentonomics/2019-millennial-homeownership-report/

https://www.apartmentlist.com/rentonomics/2019-millennial-homeownership-report/

Transcript

Unknown Speaker 0:00

This is Episode 21 of the real estate products. December 2019.

Unknown Speaker 0:21

Your monthly blog was statistics just wanted to

Unknown Speaker 0:24

congratulate this month’s winner for the $20 amazon gift card it goes to Carol. Thank you for everyone for listening and for your feedback for your comments and your shares on Facebook. Every time you folks watch us we share and like and make comments. You’re entered into a drawing for the month for the $20 amazon gift card so keep listening and keep commenting keep sharing. We appreciate it very much this month for wahoo statistics for real estate for The month of november 2019, was actually saw, the biggest change that we saw was for single family homes, the active listings for the month compared to prior month went down 2.7% 3% which is the first time it’s gone. We saw a downward movement in active listing. So for, I would say at least eight months, so that was pretty interesting change. Everything else was quite similar from prior year. single family home prices went down. Point 3% at 795,000. Median prices dropped 1.2% of 415,000. Not really not much change. Closed sales, though, actually bumped up for single families bumped up 11% at 320 close sales and, again, not much change on the condo townhouses at 434 days on market, we’re still seeing these market for both singles In condos under the 30 day mark, so again, the the biggest change that I saw compared to prior year was the accurate listings going down for single family by 3%. And a lot of it can be attributed to the fact that this inventory came on market for single families and that coupled with increasing close sales meet active listings drop, but that was in my mind if you’re trying to compare last this this month compared to last year, and you see was the winner the sellers are the buyer. I think the sellers were the winners for the single family and the buyers were kind of the winner for the condo races.

Unknown Speaker 2:43

So is everybody just hiding out till January

Unknown Speaker 2:45

for now, do you think? Um, well see it again, like I said that single family uptake at 11%. You know, we talked about the interest rates being so low again, right? Feds didn’t raise it again. And as Real Estate is, is local. So it just depends on where you’re playing. But in this macro, but all who wide, it’s kind of it actually kind of swung a little bit towards the seller’s market again for the single family. So that’s, that’s kind of interesting. I thought that’s the first time in a while that we see, this is an article that my tech CPA sent over my way, you know, I talked to my tech CPA and Teller of about potential investment types that we want to get into. So I had mentioned just mentioned to her concert conservation easements and haven’t done anything and I haven’t looked into these, but she, after mentioning to her a while back, she ended up sending me this article. It was from Reuters. And it just was saying that IRS is starting to crack down on abuses syndicated conservative easements. And I guess what they’re saying is that there’s only Potentially inflated deductions and as well as hundreds of partnerships and investors involved, so the IRS are looking they’re looking into the promoters, appraisers, tax repairs and others of that could be involved potentially in these abusive syndicator conserve conservation easements. But anyway, the point is, to me is, you know, you should be working hand in hand and get this value add from your, from your, your team, you know, your CPAs, your attorneys or whomever, or whatnot and have these discussions with them if you’re going to do these things, and hopefully, they’ll give you these these tidbits here and there like again, like I said, I was wasn’t planning on doing any of these investments, but she sent it over my way just to let me know, you know, and again, I’m not saying don’t do these kind of things. Just as an example of how you can get value add from your, your, these service providers that you’re paying for you

Unknown Speaker 5:00

Yeah, and for those of you guys who don’t know what conservation easements are, it’s basically a tax deduction. But if you’re smart about it, you when you donate this land and you designate it a conservation easement area so that you can never develop on it, you value at it at a higher clip. So a lot of guys doing this at the optimizing it but not abusing it, or going all the way up to five to one. So if they put 10 grand to a conservation easement, they’re getting a five to one bonus, so $50,000 deduction under taxes. This is exactly what Donald Trump was doing with golf courses. He designates the area around the golf course, as a conservationist offset his taxes.

Unknown Speaker 5:41

I guess that segues

Unknown Speaker 5:43

right into what I wanted to talk about next, which was you know, we got 19 days till 2020. Very exciting. So, you know, now is a time for a lot of people to sometimes people do it after New Year’s or after Christmas, but you know, why not start are now when you still have time to make these decisions that will affect your 2019. tax year. Right. So, one thing a lot of people will do is set goals for next year I kind of come in to set your health goals, your financial goals or you know, maybe your long term career goals. Also, your family relationships. I think Lynn, you had mentioned I was listening to your other podcast you’re talking about spending time with your significant other and you guys use the gift card or $100 gift card right? Not taking for granted your family and also you know setting your spiritual goals and I think lane and you and I talked about you know, potentially we we can having a goal setting seminar attached to one of one of these things in the maybe in January, maybe after the January seminar might look into that that would be fun. You’re in tax planning right if if you have a CPA contact can now because you can still take deductions or In 2019, right? If you don’t have a CPA find one the worst horror stories is when my CPA is a guy, you know, just before filing time and these people are reaching out and, you know, my tax CPA complains to me about it. Another thing is reach out to your financial advisor if you have if you’re paying for financial visor, I actually have one and I met with her last week, I believe so, you know, meet with them talk about long term goals if they changed. If your own planner you know, take a look at your own portfolio or stock portfolio and see if what changed in the past because, because throughout the year, you know, as if you have dividend reinvestment or or, you know, different stocks and bonds, or your stocks maybe have appreciate or depreciate, it’s time to rebalance it to to what your goals are, right? Same thing with real estate portfolio investor as a time to take a look at that. See if there’s anything maybe a little bit late because it’s a little hard to do real estate transactions if with the timeframe now but why not look at it now right? Also some people are they fail to look at your debt portfolio, you know, now’s a good time. Maybe you can do some debt consolidation, see if you have studying credit, outstanding credit card bills that you can roll into your he lock or, you know, put into a new credit card loan, something like that. But I know I don’t think about those credit card bills because we lay and I think you and I, we like to keep those credit card bills paid off, but I think it’s worth mentioning because there might be listeners out there who are writing that that credit card debt and you know, just paying the minimum payments, which I don’t think is a good idea. And lastly, I guess one thing to look at is are your trust documents you know, good time to see if it’s time to update your trust documents, you know, Put on the bottom kodomo no tammini which means in Japanese it means for the sake of the children. So it surprises me sometimes when I when I talk to fellow investors or just you know, friends and and they have married not have children, but if they do, the first question I always ask is also, you know, do you have

Unknown Speaker 9:19

a trust? For me? As soon as we

Unknown Speaker 9:24

find out we’re having our first Shall we we actually created a trust documents so and actually, next week I’m going to go see our trust attorney to see if we need to make any changes and update them and it’s always a good idea to to revisit those documents to see if anything has changed and you need to make any updates.

Unknown Speaker 9:46

If you have a well, you don’t want to well, because it’s going to go through probate and that’s what everybody’s gonna get. Yeah, it’s your money. You don’t trust truss and I need a referral dinner. I’m going to get that fix

Unknown Speaker 10:03

and then not only that, but when it goes to probate it takes a long time and everything is public and there is a designated fee that comes out of it usually it’s anywhere from like a few percent points all the way up to 10% depending on the size of your trust

Unknown Speaker 10:16

and then talking about your and stuff, this is the time where I figured out if I want to buy something for my business, you know make it the expense now guys haven’t checked out more mainland investing, check out my podcast, simple passive cash flow, calm. I wrote some new articles this month, one of us on lot of my investors are having trouble talking to their significant other who may not be on board with alternative investing, or investing in things other than the 401k or the stock market, which I kind of tend to stay away from due to fees and I can’t control so I wrote this article simple passive cash pumps. spouse, and this is a guy was wearing his heart rate monitor. And he got fired this day. So this is kind of tracking the day I was fired up and

Unknown Speaker 11:14

I probably had to go and tell his spouse

Unknown Speaker 11:20

Let this be you multiple streams of income

Unknown Speaker 11:25

or any correlation with you know how many times your heartbeat goes up that that high if it takes anything,

Unknown Speaker 11:31

take these away from your life in your life span.

Unknown Speaker 11:34

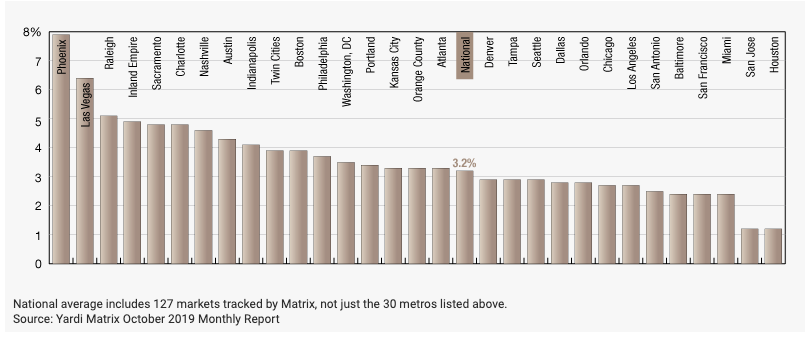

What I noticed like investors, they’ll come to our meeting and they won’t home for like six months because they’ve got a custom to know that you love that new inset. Sometimes they’ll get a scare at work or people will have a new kid and then they’ll want to change something in their lifestyle. But then after a few months, the motivation is gone. Then the status quo So we talked a little bit about legal earlier, I’m creating a legal guide of all the notes I’ve been collecting over the last few years. At simple passive cash flow comm slash legal if you guys like to take a look at that headlines that I’ve been collecting over the last month. So Apple commits 2.5 building towards California housing crisis, what they’re going to do is going to commit 2.5 billion towards the efforts to solve the lack of housing and affordable housing in the Golden State. As we all know, it’s cost an arm and a leg to live out there due to the high tech jobs. It sounds all fine and very charitable. But I used to work for a city and this is sort of the negotiations that happened behind the scenes with municipalities and businesses to get what they want. And for me, as a growth is something I check, I don’t really check housing prices. I look at rent growth because it is a true indicator of what are people paying, who aren’t speculative and who are not like looking to get emotional with their home price. People who rent are doing out of necessity. And here the national average is going up 3.2% a year. You can see some other markets on here that are going up. So the highest ones are Phoenix and Las Vegas, which really no supplies, those are the ones that pop the biggest and they also bomb the biggest exception.

Unknown Speaker 13:32

Because you look at these because these are the numbers that would affect your margins in the long run rather than residential comps going up. Yeah,

Unknown Speaker 13:42

yeah, I mean residential people buying houses. I see it as more of an emotional buy. Where this is really what what is people are paying for value here, right? Yeah, headline here Class B and C investors circling secondary and tertiary markets. So Class B and C properties are properties that are built probably in the 1950s all the way to the 1990s these are not the new luxury cool sexy new builds out there this is the renter by necessity group that

Unknown Speaker 14:17

probably you lived at one time I’d been

Unknown Speaker 14:21

in the college days or you didn’t have money all the money you wanted. So a lot of what they’re saying are a lot of investors are starting to come on over to this type of investing and circling the secondary and tertiary markets which Hawaii is a primary market just like California and New York. So they’re going up their secondary markets, like a lot of the places that Dean and I invest in and also tertiary markets like a Huntsville or a waco texas for example.

Unknown Speaker 14:51

I think gotta start looking to the tertiary soon to like the secondary is kind of getting tapped out.

Unknown Speaker 14:58

Right, right. Yeah. Like some market. It’s like Birmingham, Atlanta, Indianapolis, Kansas City, Memphis. Yeah, it’s all been picked over since 2012. By now.

Unknown Speaker 15:08

Thank you. Yeah, like you said, Casey, the retail this the retail inventory. It’s kind of caught up, kind of like how Vegas was, you know, four years ago, you know, regions kind of, and now you kind of wondering what it’s going to do, because in my mind is coming to get you reached an equilibrium, right? So what’s going to, something’s going to change, you know, because to my, in my mind, if a police one of the secondary markets have reached it can be on then it’s coming out of face to play, because we’re not going to have that that cash in cash return that we’ve so used to getting Oh,

Unknown Speaker 15:43

yeah, but then you know, tertiary markets are scary because you don’t have the abundance of property managers or vendors. Yeah, there’s not every but you know, there’s a lot more tertiary markets and secondary markets and the hit against tertiary markets. That some tertiary markets are just rising with the tide. And it’s sort of hard to tell.

Unknown Speaker 16:07

And it’s a good point to a month like you said finding good vendors are because I’ve heard of, I’ve talked to turnkey providers who made attempts to in you know, startup startup in in tertiary markets and they had mentioned to me that you know, after a year they actually backed out because they couldn’t find quality vendors to to help them through the turnkey process and so they had to actually back up and go move back to those secondary markets.

Unknown Speaker 16:37

Right, kind of like what little rock is that example of a tertiary

Unknown Speaker 16:43

Oh, I’ve heard I heard it down by I haven’t played there or looked into that and he was just like an Iowa Davenport Devonport. Okay,

Unknown Speaker 16:50

yeah, that’s a tertiary market. Up on the screen. Now. I have some summary from the 2019 third quarter, US multicam a cap Markets report it over sales volume cap rates from girls, etc. A lot of its macro data. So it’s kind of taking some data from the National standpoint, I always say, don’t figure out where you’re investing and kind of key in on what’s happening there. But again, you know, they’re kind of quoting the annual effective front growth is increasing 2.2% nationally. Here’s a headline on if you guys are into Airbnb and short term rentals. Another reason why I don’t like this type of investing. Jersey City joins the pushback to block Airbnb. So the new rules and Jersey City bar red bars went to some listing their apartments on the site as well as owners who don’t live on site. Anything you hear about the short term rental and why lately and everybody’s very, like emotional about

Unknown Speaker 17:52

Yeah, I’ve been staying away and like you said, even at our last meetup last in November, we had a bunch of questions. Right, I think mean and

Unknown Speaker 18:01

there was some discussion.

Unknown Speaker 18:04

But for me, I’m staying away that

Unknown Speaker 18:08

the jump thing is it’s it wasn’t

Unknown Speaker 18:11

wahoo or the whole as it affected me is actually the funny thing is the Airbnb bnb laws in in Japan is what ended up screwing me up because I used to rent Airbnb units or I used to be a, you know a client and in Tokyo every year I’d stay in an Airbnb and they got stricter, I think a year and a half ago. So I’m in Tokyo where I used to

Unknown Speaker 18:37

rent

Unknown Speaker 18:37

an Airbnb unit a lot, you know, every year we go to the same spot it it’s dropped off in that actually the numbers the number of Airbnb units in Tokyo has drastically reduced have been reduced because of their restrictions. kind of similar to what happened to us here on in Hawaii.

Unknown Speaker 18:57

Yeah, I’m actually going to Japan soon Mmm. Staying in Airbnb. But when I was looking at it, it looks like certain parts of Tokyo they allow it other parts they don’t. You know, it is weird. I’m not too sure how they and honestly, I’m not

Unknown Speaker 19:11

Yeah, I wasn’t tracking why but I think, you know, the other residents are getting mad because people from all around the country weren’t followed, you know, Japan is very strict and, and set in their ways and you need to follow the rules, right. They’re very regimented. And when the foreigners come there and they, they don’t sort their trash properly because it’s hard to sort your trash there properly according to what their laws are. So they can recycle

Unknown Speaker 19:39

because I was trying to find like a place near one of the smaller train stations that said the deal with like, leaving Shinjuku and taking 15 minutes every time Yeah, you can’t, you can’t find anything around those areas. So stick with the basics. So here, I put I put these Everybody likes these maps where it’s like a 10 Top 10 happiest cities, which is Miami, Oakland, Austin, San Jose, Philadelphia, Los Angeles, Boston, Honolulu, Hawaii, Portland, San Diego. Those are the again the top 10 happiest cities how they came up with it with that I have no idea. But people tend to like these. So I put this in here also have America’s top 10 most dynamic cities, which is San Francisco, Seattle, Denver, Aurora, Colorado, Grand Prairie, Texas, Oakland Fort Worth, Texas, San Jose, California, Atlanta and Miami, Florida. Don’t know what that means, but congratulations. But getting back to more real news. Multi housing news says multifamily rents rise as vacancy Titans so they can see and rents are sort of correlated University So if you have, let me see that more clearly, you have more vacancy, that means you have less than your occupancy, it gets higher than your rents should rise to here they’re quoting them 2.3% year over year, which is exact pretty much the same in saying in the last other couple articles. So it’s consistent. Be present is usually what is said to be inflation, even though there’s this website out there shadow shadow statistics shadow stats, but they basically say that the all the government statistics on inflation, inflation are bogus. Check it out for yourself. Say for The Real News on the big China trade deal. Just did about this thing. I don’t care. It comes

Unknown Speaker 21:49

up every once in a while.

Unknown Speaker 21:51

Yeah, it’s been a while. But this kind of affects the home loans. So earlier in November, The home loans were starting higher, but it went. It was kind of saved earlier in the month because of a suggesting of a phase one trade deal signing. So the bond and the home loan rates like this bad news. So it just kind of like a disruption or delay to the trade signing was the reason for the rates to improve off the worst levels need to be worried that both the US and China would roll back terrorists as a deal gets put together with very good news, which pushed the stocks to all time highs at the expense of the bonds and the home loan rates. So loans on the same level as you as they were back in July 31. When the Fed cut the rate first time in 10 years, we don’t have too much coworking space in Hawaii Dewey, funny like with that we we don’t have we weren’t but we have

Unknown Speaker 23:01

Kakaako there’s a couple. Yeah,

Unknown Speaker 23:02

I think, to me, it seems like they just like have a business and they go out of business. That’s just my observation. That faddish

Unknown Speaker 23:09

thing,

Unknown Speaker 23:10

here’s a graph of showing the market vacancy rate of this coworking space and is inversely correlated with the percent co working. So, on here you have Manhattan and Brooklyn, the New York type of markets who have a very good demand for this type of properties. I was recently in Seattle at a working we work is this big company that had a vision of pushing forward all this coworking space backed by a lot of venture capital. Venture Capital can push you forward and propel your business even though your business doesn’t make any money probably about a month ago where they realized they weren’t making any money, and then another bank SoftBank, kind of build them out. Again, sounds like you’re just kind of putting gas into a broken car. CNBC says that more than half of the world’s richest investors see a big market drop in 2020.

Unknown Speaker 24:13

Interesting.

Unknown Speaker 24:14

So they surveyed the unfathomable number of 3400 high net worth investors, which is not that many people. So I would throw the survey out immediately. But they they interviewed at least with at least a million dollars in investable assets, you know, again, take it for what it’s worth, but they found that 55% of the respondents expect a significant job in the market. And the super rich have invested their cash holdings up to 25% of their average assets. So I found that interesting, pull the higher net worth people that they’re still 75% invested in the game. I mean, I don’t know what your theory is on how much cash you hold, but I see a lot of people who don’t have as much money hoarding a lot more cash and not doing anything, which might be partly reason why they’re not over a million dollars network. So that was just an observation.

Unknown Speaker 25:14

Because it’s the ones that that are not there that actually we need our money working for us.

Unknown Speaker 25:20

Right? I mean, I’ve I’ve talked to a lot of guys who run blind cool funds, and I always asked like, Hey, what’s your philosophy on like, how much cash you want to have on hand? And they’re usually in you know, under 15% range? You gotta you gotta be in the game. That’s why you invest in cash flow stuff.

Unknown Speaker 25:39

Yeah 25% seems really high especially if you’re in even though like accredited or just barely accredited. Yeah, 25%

Unknown Speaker 25:48

out of the game sounds pretty, pretty

Unknown Speaker 25:52

high. Well, I mean, you know, but but when you include the equity in your house, you know that I can, I don’t know what their metrics were, but I consider that as cash. Yeah, that’s true. deadlies equity, right? So if you have a million dollar net worth, and 600 of it is stuck in your house,

Unknown Speaker 26:14

then I would consider you 60% cash. Okay,

Unknown Speaker 26:18

so in a case in the place where, like, Honolulu, in Hawaii, you know, places where the really serious are expensive and that person is actually going to be really high, you know, with, you know, with a lot of people’s wealth in their, in their homes.

Unknown Speaker 26:33

Right, which is the exact opposite of what the pros are doing. All right. The pros are still in the game. We had a question going back to the last slide. Question is, are he locks considered as cash? I guess in my opinion, I do. I mean, if you have a key lock and it’s not being used, then

Unknown Speaker 26:57

it’s sort of liquid

Unknown Speaker 27:01

Interesting on

Unknown Speaker 27:05

me, he like it’s just like equity in your house. Yeah, liquidity.

Unknown Speaker 27:11

liquidity is cash

Unknown Speaker 27:15

it’s something you can tap into.

Unknown Speaker 27:17

Yeah. Within five to 10 days you can get at that liquidity. Yeah.

Unknown Speaker 27:23

I mean by Connie sentence, I don’t think it’s considered cash. It’s just some available debt to tap into, you know, available funds and like you said it’s the equity it’s a way to access the equity in your home that you wouldn’t be able to with it in with other means, right. That’s that’s it a tool to be able to access the equity in your house?

Unknown Speaker 27:45

Yeah, yeah. I mean, I You’re right, like an accountant would call it not not equity or not liquidity or cash. But accountants also credit go to work tomorrow night. But in No investor who knows how to affect effectively flex their cash to them they see liquidity as cash is the same. I mean is caching is the cash value in my life insurance policy they can get at tomorrow. Cash No, but it sure

Unknown Speaker 28:22

thing, both.

Unknown Speaker 28:25

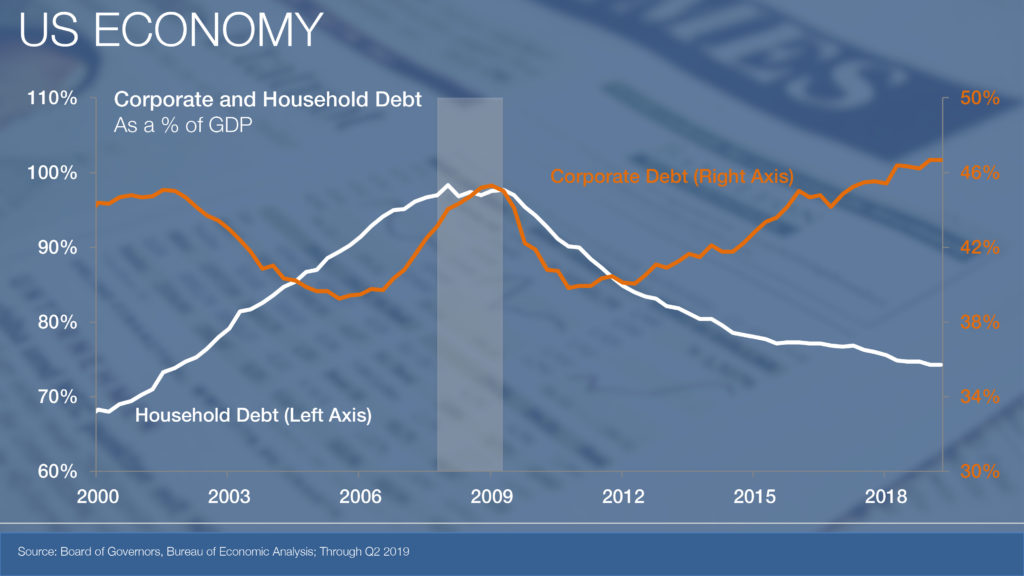

And that’s Hawaii, right? I mean very fiscally conservative, which may or not, may or may not be the best thing for financial well being. Here is a chart for showing the household debt is peaked in 2009. But it has recently gone down to lower levels in the recent years, which was kind of surprising to me. It’s it’s saying that the average household is there about 75 percent now, when the peak they’re almost 100%.

Unknown Speaker 29:04

That’s, that’s, that’s sort of comforting for me because I felt that,

Unknown Speaker 29:08

like you said in the past, but everyone was

Unknown Speaker 29:10

so over levered and people were just, you know, banking on their on debt, you know, whatever it may be credit card debt or whatever, and like, you know, living the life and buying things that be probably couldn’t afford. So it sounds to be a little bit more balanced now.

Unknown Speaker 29:26

More Hell yeah. Yeah. And that makes sense, right? Because in the P faith, they were saying that household that was almost 100%.

Unknown Speaker 29:34

Right. So like, the, you know, US citizens are kind of, at one point, you know, spending on all these kind of frivolous things and just, you know, living the gluttonous life and, you know, we looked upon by other countries name or what are these Americans doing? You know,

Unknown Speaker 29:53

I read this book, and they call this the great forgetting, but every like 12 to 20 years. You completely forget how it was in 2000. Right? I mean, look, like you said 19 days, it’s going to be 2020. Lucky I forgotten how life was in 2009 or 2000. Yeah.

Unknown Speaker 30:16

I mean, Millennials like to drink beer, because it’s cheap.

Unknown Speaker 30:22

And it’s it’s change, change cultures. The orange line here is the corporate debt. And that is at new highs. It’s even higher than it is in 2009. And I think we’ve been talking about what quarter for 21 closing? Yeah, I think there was another store that was similar. And they cited corporate debt as the

Unknown Speaker 30:46

other debt restructuring. Yeah.

Unknown Speaker 30:51

I don’t really understand that all but I might get what corporate debt is but I don’t understand why. Because you don’t need you need to know how to be thing but We’re talking about the tertiary market. So here Hill would develop a 1 million square foot Amazon fulfillment center in North Mississippi. I just threw this article in here because you know, these are the things you have to look for. When you’re investing I would call this more of like, I don’t know what a smaller than official market is. But contrary or tertiary Some people say but these are the set of the markets you need to kind of look in turn blocks that hadn’t been turned before you run into this Eb five thing. I know a lot of people in gateway towns like Seattle or Hawaii, you get a lot of international people it’s a system to you want to come join the country.

Unknown Speaker 31:50

You’re paying for your to become a citizen. Is that the one?

Unknown Speaker 31:53

Yeah, you

Unknown Speaker 31:56

put money into some kind of like economic The good thing. For the United States I don’t know how I feel about that. I don’t really care but it is what it is. And you so you can be a US citizen if you invest 900,000 and then that’s that was

Unknown Speaker 32:13

it that much? Okay. I thought it was a mess, but yeah, okay. Okay. Oh,

Unknown Speaker 32:17

it’s a lot of money. Yeah. I think we’re already here.

Unknown Speaker 32:21

So it’s like, I’m trying to get fasttrack to get your black belt in karate. Yeah, yeah. No way more expensive though.

Unknown Speaker 32:31

It’s like clear going through TSA. Oh, there’s another one here. mazing things at money.

Unknown Speaker 32:37

Make nastic on that.

Unknown Speaker 32:39

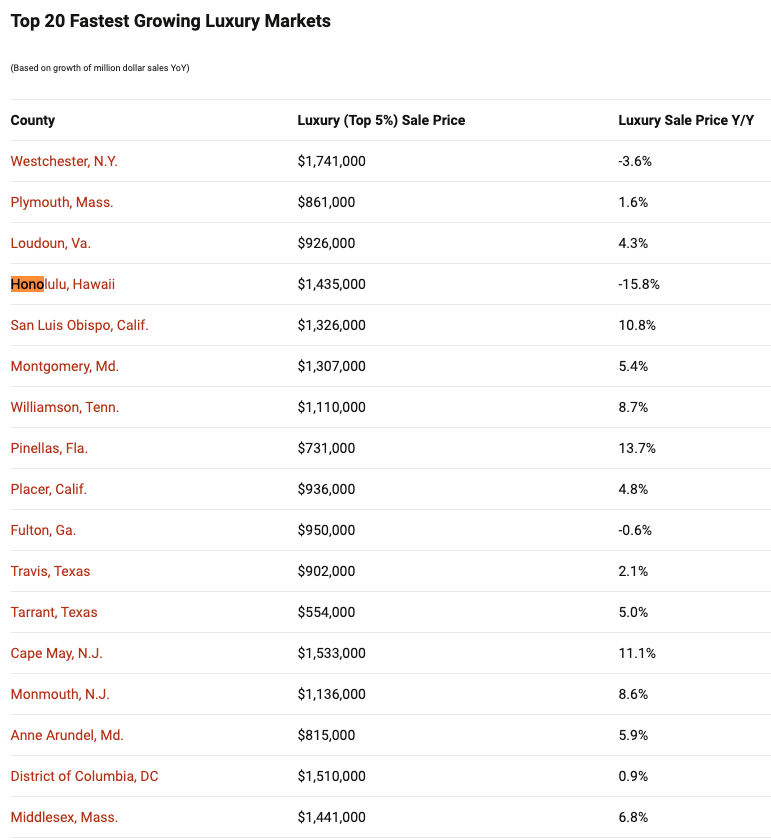

Top 20 fastest growing luxury markets. Honolulu. Hawaii is number four on the list on the high end, right. That’s that’s a trouble Hawaii, a lot of locals on the bottom. And I’m not a high end international money coming in. Not too many people in the middle. I put this in for Hawaii. People. Louie Bhutan, they acquired Tiffany, the jewelry company that Tiffany was owned by Warren Buffett. But anyway, Louis Vuitton now owns them and how this ties into Hawaii. If you go in Waikiki on Colorado Avenue there’s at that corner you get the Quicksilver and the first hole a bang louisv Aton shortly after actually is the same day they acquired Tiffany. They made some more moves they acquired the to occupy real time retail assets that Quicksilver is and the first one bank that means they have their their forecasts their long term forecast is is pretty bright for our tourist industry in Waikiki. Hmm.

Unknown Speaker 33:46

I guess I haven’t thought about it. Yeah. You know,

Unknown Speaker 33:52

they’re not obviously not keeping money in cash right.

Unknown Speaker 33:58

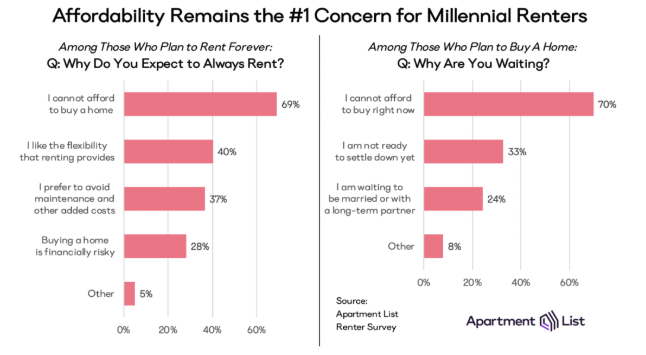

Making Moves here. dollars so affordable remains the number one concern of millennial renters. So we have some of the top excuses why do they plan to always rent number one with 69% is obviously they can’t afford to buy a house 40% said they like the flexibility of renting 37% they prefer to avoid the maintenance and other added costs. Which I am a big proponent to not purchasing your home in Hawaii. Instead rent invest your money and buy real estate. Not everybody has you know the ability to balance their budget and save so they asked a different question what why are you waiting to buy and again this is asking of a millennial said I cannot afford it. I am not ready to settle down yet. And 24% the minority waiting to be married or with a long term partner, maybe to split the bill. I read this book this past month, the richest man in Babylon. How was

Unknown Speaker 35:09

it? It was super boring. super boring. I’m sure you’ve heard this book. Yes, I have. Yes. made many attempts. Yeah. You read it. Was that the guy that ran into the different vendors?

Unknown Speaker 35:22

Yeah, and maybe it’s written in like old English, like the Bible. So it’s incredibly boring. And like, sometimes I just spaced out, I can’t. I only read the first like, quarter of it or third of it. Basically, here’s the gist of it. You don’t need to read it like this guy. He, he goes to the richest man in Babylon is sort of his mentor. And he’s like, Hey, man, like how do you get rich? Right? How do I keep like get out of the rat race. And the rich guy is like, just take 10% and just put it aside. They don’t be like everybody else and spend all your money Take the 10% and buy stuff that makes you money. Yeah, obviously, it’s the whole talk about buy assets, right that produce money, whether that be real estates or businesses. So what he does is he’s like, Okay, I’m going to go talk to the blacksmith who’s doing everybody’s doing some deals in spices, you know, and he’s gonna make some money. And then like, the old man is like, yeah, I mean, that’s a good idea, you know, at least you’re not blowing it on some monkeys or something like that. But what the heck are you betting on the blacksmith? What the heck does he know about spices? I think he lost the money in that thing but he wanted he wanted a good lesson there. You know just gotta buy go into deals right that’s the lesson learned are the richest man in Babylon says like, it’s amazing. Like that’s why all the wealth gets collected by

Unknown Speaker 36:55

the few

Unknown Speaker 36:57

never gonna have the perfect information. So you Get it take the leap.

Unknown Speaker 37:01

Yeah and they also said something about like kids like there’s some commentary about like passing your your money off to your heirs. I don’t know if you’re interested in that you should read it but I, I lost interest in this book. I give it two stars. So here’s some articles. You guys can read it. Again, you do this in video form too. So we have all the graphics if you guys check out later, but anything else you’re working on Dean,

Unknown Speaker 37:29

pretty busy and the real estate side for for this time of year. Usually, you know, ready to getting ready to go on shows but kind of busy newsted said also still actively looking for investments on now is you know, great time. Especially with you know, secretly a lot of that attends people that are going on trips and not thinking about either moving buying or selling. So the investment side locally, I’m actually semi actively looking and you know, viewing Some properties just to see if it makes sense from your my investors. What like local stuff? Yeah, local stuff more on the west side to try to attempt to get more of a cash flow play.

Unknown Speaker 38:10

Here’s the legal disclaimer guys. You guys can read it. And we’ll catch you guys next time. Do what did I say?

Unknown Speaker 38:19

January earIy. Journey night on Thursday, Thursday. Yep. The Keller Williams office will be in person. Sorry if anyone showed up and we weren’t there. But we think about a week ago we made it. We said that we would not be in person right for today’s meeting.

Unknown Speaker 38:37

Yeah, you gotta you guys gotta join the email list. That’s the only way you’re going to get the best information. What do that goals seminar to the wounded on January 9.

Unknown Speaker 38:48

Yeah, after this one. Okay. Yeah, that sounds fun. I’m looking forward to that too. Okay.

Unknown Speaker 38:53

All right, everybody. We’ll talk to you guys next time. Yep. Thank you.

Unknown Speaker 38:58

Right. Free real estate investing. Check out our E i

Unknown Speaker 39:03

thought calm

Transcribed by https://otter.ai