Join our July 21-24 Investor Education Tour – https://simplepassivecashflow.com/tour2019/

- Additions to the Analyser –

- Washington Post – China’s yuan falls below sensitive level of 7 to US dollar – 19.08.7 – “weak currency makes China’s exports too inexpensive” – [China’s response to the US trade tariffs is to de-value their currency]

- CPExecutive – Federal Reserve Cuts Rates for 1st Time Since Recession – 19.08.1 – [I see this as the FED being pro-active in some softness. Like taking some Vitamin C after a long dirty airline flight]

- Additions to the Happy post -Ben-Shahar shares four archetypes in his book called Happier outlines how we fall into these four “the happiness archetypes”:

- Rat Racer – enjoy the idea of a future destination, but neglect the present

- Hedonist – enjoy the journey (right now), but neglect the future

- Nihilist – enjoy reliving the past, but neglect the present & future (because it’s hopeless)

- Happiness – enjoy the experience of climbing toward the peak

The happiness archetype is the ideal.

- Lessons from the Wealthy w/ Frazer Rice – https://simplepassivecashflow.com/153rice/

- Commercial Shopping Center Investing w/ Michael Flight (EP156)

- Hacking your Fico Credit Score – reialoha.com/ffico

- Live Coaching Call w/ Non-Accredited Investor – SimplePassiveCashflow.com/155jason

- Census data for population data – [although I think this information is not too useful because it does not capture inter-state migration]

- If you would like a rent-o-meter report go here. I am also on the search for paid groups or subscriptions to join to share the data or services I get with you!

- Land Conservation Easement info page

- Life Settlement Info Page – https://simplepassivecashflow.com/life-settlement-investing/

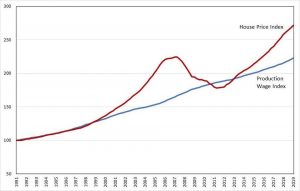

- Housing price index all time highs

- REITS buying into Primary Markets like Seattle

- MHN Multi-Housing News – 19.06.12 – Don’t Wait to ‘Buy the Dip’ in Seniors Housing

A number of this segment’s investors have sidelined themselves waiting for deeply distressed assets to come to market. Those opportunities may not present themselves. - The Cons of Private Money Lending

- CPExecutive – Industry Watches as Fed says no rate cut for now – 19.06.20 – [Some say its the beginning of a downward slide but I think its just a good example of how the Fed controls the extreme ups and downs.

- CPE – Saturated Markets Push Down Self Storage Rents – 19.07.8 – [This is why I like MHP much more than Self Storage]

- MHN – Portland Multifamily Report – Summer 2019 – year-over-year rent growth decelerated to 1.2% as of May – [1-3% annual rent increases is typical]

- Walker & Dunlop Arranges $40.6M in Financing for Keahumoa Place Apartments in Hawaii – 19.06.20 – http://rebusinessonline.com/walker-dunlop-arranges-40-6m-i…/

What are these expenses?

Taxes: In the beginning of the acquisition process you have to ASSume part the taxes as a certain percentage of the market price. However keep in mind that every county calculates this differently and re-assesses the tax basis for properties especially when the property transfers ownership. Best tip is to get around other passive investors in that area to ask them what the change as been or to assume that taxes will go up 10-80%.

Insurance: You can take a certain percentage outlined in the spreadsheet, ask the current owner (if you believe them), or what we suggest is to get one of our insurance referrals within the mastermind to give you an actual value.

Management: This is typically 8-10% of the rental revenue plus 50-100% of the first months rent. The property management can also collect additional fees by splitting late fees or charge for renewing previous tenant leases. This is where it is important to have peers or a mentor to save you hidden dollars here. Also make sure you pick a good one with this guide.

Vacancy/Turn-over Expenses: Typically it takes 2-6 weeks to do some touch ups around the property after a tenant moves out to when the new tenant moves in. 4 week vacancy is 1/12th loss rents and needs to be accounted for as a “Vacancy” expense line item. This is where most novice investors fail to account for.

Maintenance: I have always been told to put aside 10% of the rents or 1 months rents as money set aside to fix random things in the property. Also remember that when you old tenant moves out you might have to fix a thing or two (or $20,000).

Also don’t forget about contract services such as lawn/yard service, snow removal, pest control, or pool maintenance.

Cap Ex: This is not in your net operating income for all you geeks (engineers) crunching numbers but this is another 10% or so going to a cash reserve account to pay for broken stuff down the 2-15 year road. This money is to pay for large ticket items. More info here. I say geeks because experienced landlords know that its very hard to predict this stuff and it is a waste of time to track and build models to predict this stuff. In reality the best thing you can do is spend your time not in Spreadsheet Land but find more deals to decrease your risk but making more cashflow! Easier said than done when you are limited with fund and getting started which is why you get a mentor to mitigate your risk and understand that these scary things is exactly why you should push forward because most people will back out and thin your competition.

Utilities – In most single family homes the tenant is in charge of the utilities (electric, gas, trash, sewer, water) which makes you life easier. However in 2-4+ unit arrangements the responsibility is all over the place.

HOA Fees – It worth mentioning but check if your property has this. Condo or townhouses typically have a HOA monthly fee and is why we don’t recommend them as investments in addition the face that it is a nightmare dealing with their governance system.

[Resource MFH info page] Physical Occupancy vs. Economic Occupancy in Apartment Investing – Note this is mostly used as an example of what LP’s should be aware of. In most cases LP’s either know too little for example they just look at the Pro-Forma returns and don’t look at the assumptions that the operator used to get there. Or they spend so much time evaluating things that have little impact to the numbers for example running away when they hear of minor foundation issues or rodents that can be remediated with a few thousand dollars of seller concessions. In the Passive Investor Accelerator & Mastermind we try to focus on what is really important but obviously that is not free (but going into a bad deal is costly too). Vacancy in apartments decreases top line income and getting occupancy as high as possible is the goal. There are two different types in apartment investing 1)

Physical Occupancy and 2) Economic Occupancy. Physical occupancy (number of units that have a tenant with a signed lease, occupying a unit) is what most people are familiar with in apartment investing and what is often overlooked when a passive investor reviews the underwriting assumptions of a syndicator. This is shown on the rent roll with the tenants name next to the unit number which also needs to by physically audited with boots on the ground verification. Physical occupancy is a percentage calculated by dividing the number of occupied units by the total number of units for example a 100 unit apartment with 8 units vacant has a physical occupancy is 92% (92 ÷ 100).

Pay attention here… if a rent roll shows a unit is occupied, doesn’t necessary mean it’s also generating income. A tenant might be a deadbeat or the nice way of putting it there might be “loss to lease.”

Economic occupancy is the amount of money of actual rents received as related to the occupancy. This also takes into account tenants who don’t pay the full rent and also things like concessions ($200 move in specials, discounts to motivate tenant prospects). This is the net rents received (not including other income). The net income will deduct for bad debts/loss to lease. The economic occupancy is calculated by dividing net rent received by the gross rents possible.

On the same 100 unit apartment, assume each unit rents for $1000/mo. There’s a gross potential of $1,200,000/year (100 units x $1000 = $100,000/mo x 12 = $1,200,000/year). Using the same physical example say there are an additional 10 deadbeats (that the previous seller stuffed in there right before the sale) and 10 people only able to pay half the rent… then you are looking at an economic occupancy of 75%.

This might be a little too much info for a LP but Economic occupancy can be a sign of the following:

Bad Management and bad collection practices

Bad tenant qualification practices

PM stealing money

Bad rent collection practices

Lack of maintenance, causing tenants to leave

Or a clear sign of opportunity!