I get asked a lot about short term rentals (AirBNB & VRBO).

I don’t do it much like how I don’t flip houses because of the following:

1) Its not passive

2) It’s complicated (make for great social media posts however)

3) You pay a lot of taxes as it is active income (not passive income where you can utilize cost segregations and bonus depreciation)

Either way if you do decide to do STRs I suggest you educate yourself with the basic education or formal training out there. I suggest this program for that.

Here is the deal on STRs in Hawaii:

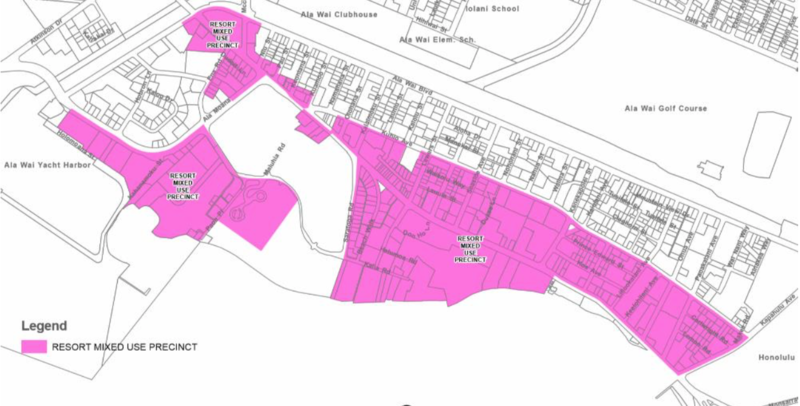

Short term vacation rentals come with an additional tax burden of 10.25% in Hawaii, the Transient Accommodations Tax (TAT). There’s also the 4% General Excise Tax (GET), which you will need to apply and register for a GE License. Additionally, since you’re looking at Waikiki, there will be an additional 0.5% Oahu Surcharge Tax. The taxes are calculated on your gross income from the rents.

STRs Nationally

Short term rentals have become all the rage. However, many investors are on the brink of getting burned. Cities all over Europe have initiated bylaws aimed at regulating and taxing short term rentals. In some cases they’ve been outlawed altogether. The latest city to implement rules is Toronto. There is a shortage of affordable rental housing in Toronto. Recently, they outlawed short term rentals of secondary dwellings. For example, if you have an in-law suite with a separate entrance, you’re not allowed to rent it short term. You can rent your primary residence, or a room in your home. When you do, you’ll pay an annual licensing fee, and a nightly tax. The new rules are too complex to cover in detail in this post. But the point is, you could end up on the wrong side of a new rule.

I’ve spoken with many investors who saw short term rentals as a lucrative market opportunity. They bought property assuming that the same market conditions would persist over the long term. They neglected the possibility of regulation, and they neglected the possibility of an oversupply depressing prices. The barrier to entry for short term rentals has been low historically. Neither of these assumptions are good if you’re making a highly leveraged purchase of an investment property. There are many property owners in Toronto who are staring financial difficulty in the face. The rules don’t take effect for 6 months, but the message is clear.

Cities want their hotel tax revenue.

Cities don’t want those big bad real estate investors to make too much money.

Cities don’t want rental inventory disappearing from the market.

Don’t make a highly leveraged 25 year financial commitment on the assumption that current market conditions will remain the same.

I stay away from things that the general public get into and it seems everyone wants to rent out an extra room or home. It will be a race to the bottom. I think you should stick to bread and butter class C and B rental property and stay away from these niches like student housing or military towns.

Here’s some more intro about the tricky tax situation:

Rented less than 15 days during the year with more than 14 days of personal use

For a vacation home in this category, the tax rules are really simple. You need not report any of the rental income on your Form 1040. However, you cannot deduct expenses directly attributable to the rental period (rental agency fees, cleaning, and so forth). If your vacation home happens to be located near a major event — like a PGA golf tournament or a big multi-day concert — you may be able to rent the place out for a short period even at high rates and pay zero federal income tax.

Tax-smart year-end strategy: The more rental days between now and year-end, the better — as long as they don’t exceed 14 days for the year.

Rented more than 14 days with substantial personal use

Your vacation home falls into this category if you rent it for more than 14 days during the year and your personal use exceeds the greater of:(1) 14 days or (2) 10% of the rental days. For example, a vacation home that’s rented for 180 days during the year and used by you and family member for 60 days falls into this slot.

Personal usage includes use by you, other family members (whether they pay fair market rent or not) or anyone else who pays less than market rent. Personal use also includes time spent at your place by another party under a reciprocal sharing arrangement (“I use your place in exchange for you using my place”) whether the other party pays market rent or not.

Days devoted principally to repairs and maintenance are considered days of vacancy and are disregarded, even if family members are present while you work away.

The tax drill

Vacation homes in this category are treated as personal residences for federal income tax purposes. Follow this six-step procedure to account for the property’s rental income and all the expenses.

Step 1: Report 100% of rental income on Schedule E of Form 1040.

Step 2: Deduct 100% of any direct rental expenses (such as rental agency fees and advertising) on Schedule E.

Step 3: Allocate mortgage interest and property taxes between rental and personal use. See below for how to do that.

Step 4: Deduct as Schedule E rental expenses the allocable mortgage interest and property taxes from Step 3.

Step 5: If there’s any net rental income left after Step 4, deduct as rental costs allocable indirect expenses — maintenance, utilities, association fees, insurance, depreciation and so forth on Schedule E — but only to the point where you zero out rental income. In allocating these indirect expenses, consider only actual rental and personal-use days during the year, and ignore days of vacancy. For example, if you rent your vacation home for 90 days during the year and use the property 60 days for personal purposes, allocate 60% of the maintenance, utilities, and so forth to rental usage and 40% to personal usage. The 40% is non-deductible. Even so, the bottom line on Schedule E will often be zero, because the rental income will often be fully offset by deductible expenses.

Step 6: Write off the personal-use percentage of mortgage interest and property taxes as itemized deductions on Schedule A of Form 1040, subject to the new Tax Cuts and Jobs Act of 2017 (TCJA) limits for 2018-2025 (see “TCJA changes affecting vacation-home owners” below).

You are allowed to carry over any disallowed allocable indirect expenses to future years when you can deduct them against rental profits (if you ever have any).

Controversy regarding how to allocate mortgage interest and property taxes

The IRS says you should use only actual days of personal and rental usage to allocate all non-direct vacation-home expenses, including mortgage interest and property taxes. However, two Appeals Court decisions say you can allocate mortgage interest and property taxes differently, by treating actual rental occupancy days as rental days and all other days — including days of vacancy — as personal days.

Before the TCJA, the Appeals Court method was often more beneficial because (1) it allocates more mortgage interest and property taxes to Schedule A (where you could usually fully write off these expenses as allowable itemized deductions under prior law) and (2) it allocates less mortgage interest and property taxes to Schedule E, which usually allowed you to currently deduct more of the other expenses allocable to rental usage (property insurance, utilities, etc.) on Schedule E when applying the rental income limitation.

But after the TCJA changes, some vacation-home owners may benefit from using the IRS-approved method instead of the Appeals Court method. That’s because you will never get any tax benefit from allocating more interest and taxes to Schedule A than you can currently deduct after the TCJA changes. Your tax pro can run the numbers at tax return time and figure out the best allocation method for interest and taxes.

Tax-smart year-end strategy: If your property fits solidly into this category for 2018 and your expenses will comfortably exceed rental income (the usual situation), you will probably come out ahead by renting it out for some additional days between now and year-end. That way, you’ll receive more rental income (good for cash flow), and you can probably still offset all the rental income with direct expenses, allocable mortgage interest and property taxes, and allocable indirect expenses. So you’ll have that much more tax-sheltered rental income, which is always a good thing.

The bottom line

As you can see, the tax rules for vacation homes are complicated.

If you have a vacation home that is rented for more than 14 days during the year and your personal use does not exceed the greater of (1) 14 days or (2) 10% of the rental days, the home is classified as a rental property for tax purposes. (I’ll cover the tax rules for vacation homes that are classified as rental properties in next week’s column. So please stay tuned.)

TCJA changes affecting vacation-home owners

New limit on property-tax deductions:Before the TCJA, you could claim itemized deductions for an unlimited amount of personal state and local property taxes. For 2018-2025, however, the TCJA limits itemized deductions for personal state and local property and income taxes to a combined total of only $10,000 ($5,000 for those who use married filing separate status). This limitation can affect your ability to claim itemized deductions for property taxes on a vacation home.

New limits on home-mortgage interest deductions: The TCJA also places new limits on the amount of home mortgage debt for which you can claim itemized qualified residence interest expense deductions. These limits can affect your ability to claim itemized deductions for mortgage interest on a vacation home.

For 2018-2025, the TCJA generally allows you treat interest on up to $750,000 of home acquisition debt (incurred to buy or improve a first or second personal residence) as deductible qualified residence interest. If you use married filing separate status, the limit is halved to $375,000. Thanks to a grandfather provision for pre-TCJA mortgages (explained below), this change will mainly affect new buyers (those with post 12/15/17 mortgages).

TCJA change for home-equity debt: For 2018-2025, the TCJA generally eliminates the prior-law provision that allowed you to treat interest on up to $100,000 of home-equity debt as deductible qualified residence interest ($50,000 if you used married filing separate status).

TCJA grandfather rules for up to $1 million of home-acquisition debt: Under one grandfather rule, the TCJA changes do not affect qualified residence interest deductions on up to $1 million of home-acquisition debt that you took out: (1) before 12/16/17 or (2) under a binding contract that was in effect before 12/16/17, as long as the home purchase closed before 4/1/18. If you use married filing separate status, the limit is halved to $500,000.

Under a second grandfather rule, the TCJA changes do not affect qualified residence interest deductions on up to $1 million/$500,000 of home-acquisition debt that you took out before 12/16/17 and then refinanced later — to the extent the initial principal balance of the new loan does not exceed the principal balance of the old loan at the time of the refinancing.

Home-equity debt treated as home-acquisition debt: Say you spent or spend the proceeds of a home-equity loan to build, buy, or improve your first or second personal residence. The loan counts as home-acquisition debt for which qualified residence interest deductions are allowed, as long as the applicable home acquisition debt limit ($750,000/$375,000 or $1 million/$500,000) is not exceeded.

Bigger standard deductions: For 2018-2025, the TCJA almost doubled the standard deduction amounts. For 2018, they are:

$24,000 for married joint-filing couples.

$18,000 for heads of households.

$12,000 for singles.

This seemingly benign change can adversely affect vacation-home owners, because their allowable itemized deductions (including those for vacation home mortgage interest and property taxes) may not exceed their standard deduction amount for 2018-2025.