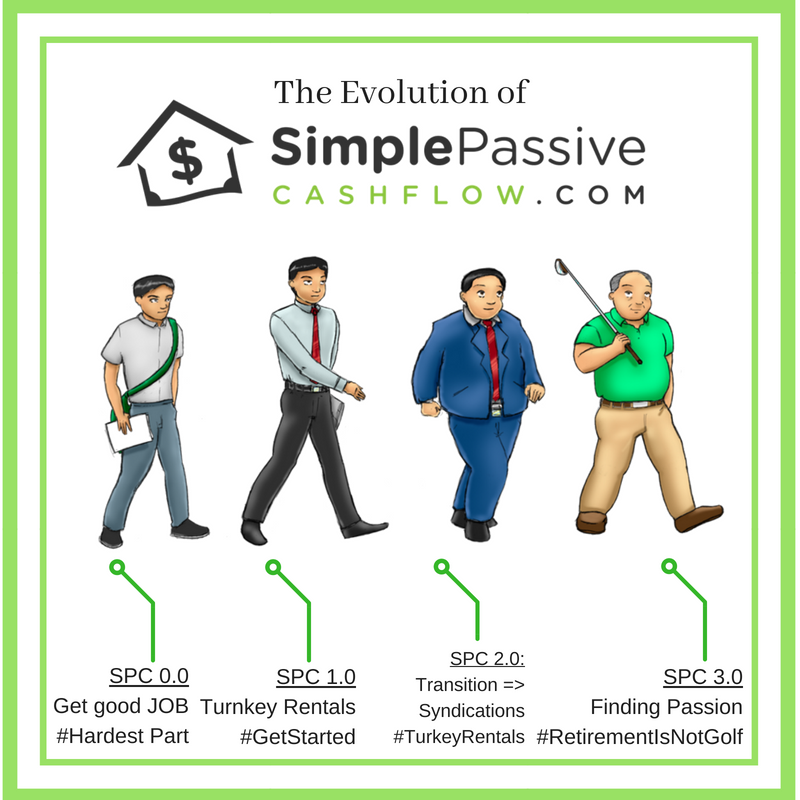

After writing and podcasting since 2016 (investing in my first rental in 2009) I began coaching investors on tactical stuff like buying a turnkey rental or analyzing syndications or MFH. I later began focusing on helping people who had little money or guidance get started.

One of the reasons I moved back to Hawaii was that I realized that there was no one here that did what I did and there was a great need for real holistic financial advice. Not the commission based or hidden fee type. I created a team to build ReiAloha.com – Hawaii’s only passive investor club (Meetup link – Facebook link). It was a lot of fun!

I realized that coaching/mentoring is something that I enjoyed doing however it was not scaleable especially when I gave out free 15-minute calls. (especially when they turn into hour long calls)

My unique position as a real estate syndicator who raised over $15 million dollars to acquire $160 million dollars of cashflowing assets was that I had the connections to turn a theory into reality for others. And I had the insight from taking myself from an Engineer with $0 net worth to quitting my job 12 years later.

Combining my passion with my talent I decided to form a holistic financial planning consulting service to help hard-working family create and preserve a legacy by the following setups.

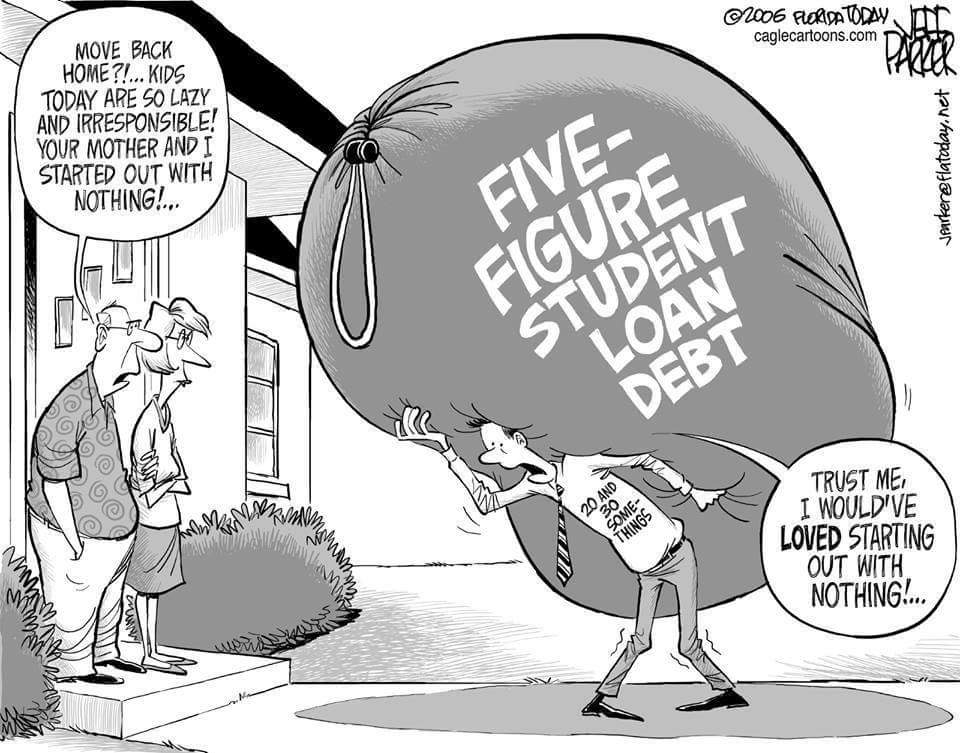

- Removing bad financial myths – like this classic one on debt

- Getting people started in basic personal finances

- Getting people started in investing

- Opening the door to private opportunities

Working with our team will give you 1) tailored financial hacks customized to an individual’s situation and tolerances and 2) access to investments that are real assets that provide cashflow today.

The Honolulu Magazine ran this article which outlines one of my biggest frustrations that we combat with our clients everyday. We can prevent this decay of wealth and empower your future generations to grow it!

A common mistake

Life coaches often tell you to think of what bothers you most about this world and try to focus your energy to fix it!

If you have followed my journey or read my bio you can see a theme of frustration with the current dogma out there surrounding personal finance.

Going to a private school I was lucky enough to see the financial faults of many wealthy families who’s net worth was decaying generation by generation.

I saw many Grandparents who had money/house for whatever reason and how their baby boomer generation just inherited it and got lucky (never learning to fish on their own).

And my Gen-Y/Millenial generation getting totally screwed because their Baby Boomer parents did not have a clue how to build wealth to begin with.

In estate planning, there is a common default mechanism in trusts to skip every other generation for the very reason.

Side note: Don’t buy a home! Not at least you have so much cashflow from your rentals or passive investments that you frankly don’t know what to do with it.

What I have learned from the Wealthy

1) Investing With No Strategy or Legacy: Families spend decades building a business or real estate portfolio to build capital. Unfortunately, little thought is given to longer sustainability of the wealth to minimize the stench of decaying wealth.

2) Over-Spending & Acquisition of Liabilities after a Liquidity Event (Inheritance): Other than basic over-spending many families not trained in the nuances in of a particular asset class may acquire bad assets even though it may be as basic as a few single family rentals that cashflow from the start.

3) Ignoring Tax Optimization: Families may be adept of managing and growing a portfolio however a team of advisors for the ever-changing tax environment may not be in place to. The best estate planning and structures possible obviously differ from your run of the mill estate attorney who is personally still in the rat race themselves.

4) Lack of Integration: $100+M net worth families need not take chances. At the same time what is not growing is slowly dying. There needs to be clear values, documented mission, rules of engagement for the family members and new family members in order to minimize the chance for families to tear apart from the inside due to feuding amongst the multiple trustees.

To learn more about me and my story click here.

The 4 types of the wealthy?

1) DELAY GRATIFICATION-INVESTOR

Does not require any unique set of skills or special knowledge. It also does not require taking much risk.

Its simple:

a) Save 20% or more of your income by living off of 80% or less of your income (many clients are able to save $20,000-50,000+ a year)

b) Consistently and prudently invest your savings.

It requires enormous financial discipline and a long-term commitment.

2) SELLING YOUR SOUL TO A BIG COMPANY

Working for a big company and rising up the ladder into senior management is another path to riches..You must devote yourself to one company for a long period of time. A common risk is that you could be fired.

Keep in mind that company pays you less than you make for the company. Its a game of arbitrage.

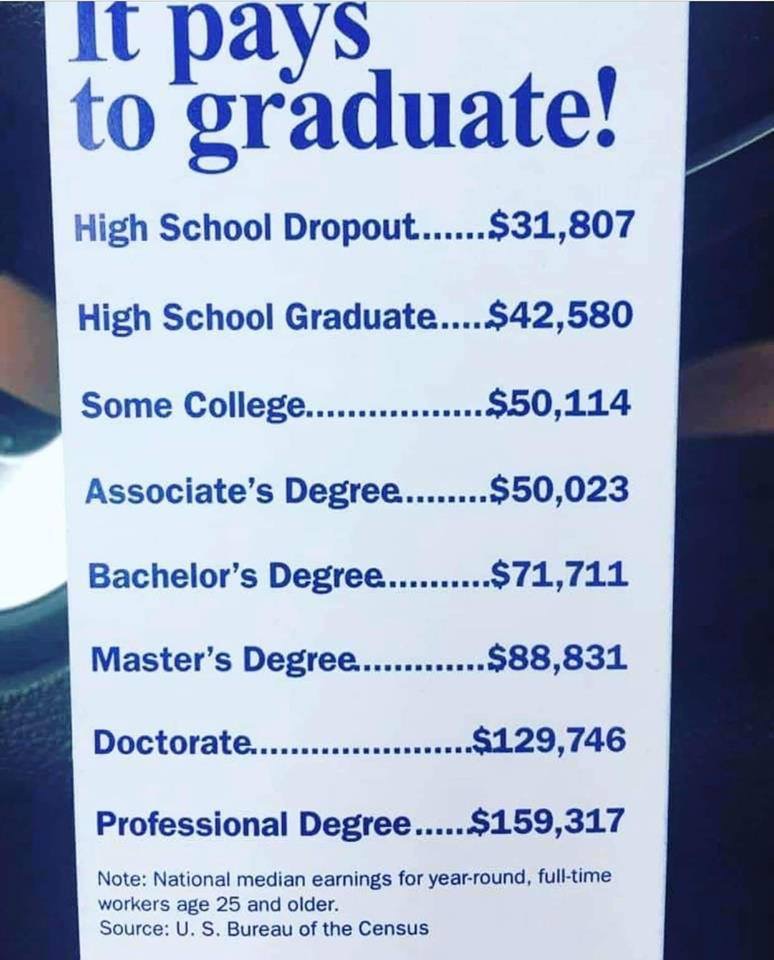

Oftentimes, this requires formal education, such as advanced degrees (PhD, Medical Degrees, Law Degrees, etc.). Not everyone has the ability to devote significant hours every day practicing their skill, or the financial resources to pursue advanced degrees.

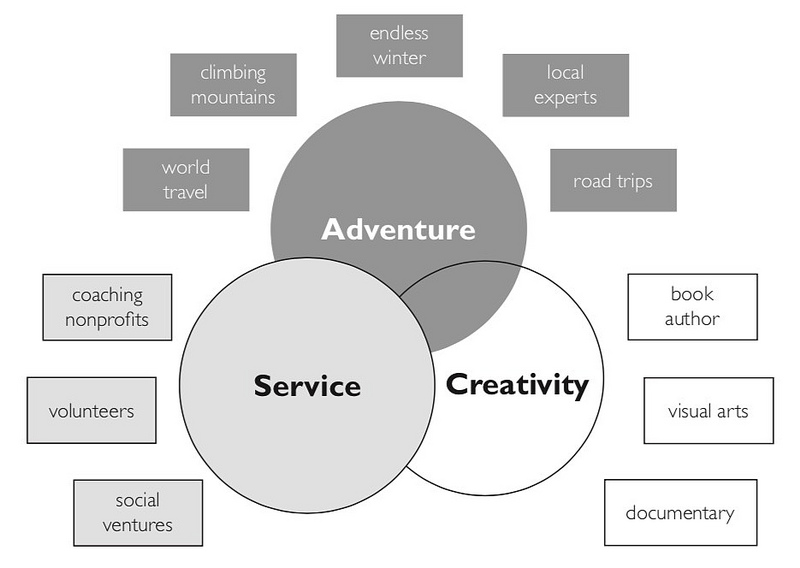

3) IKIGAI

Those who achieve Ikigai (a Japanese term) are individuals who possess knowledge or a skill that they have found a way to monetize and that they also enjoy which compounds success.

This path requires a lot of investment in time (think 10,000 rule of Deliberate Practice and Analytical Practice) and often money.

Essentially the individual is pursuing a dream and driven by the altruistic motivation to provide the world a unique service, which provides added value to a significant number of people.

This path requires a high tolerance for risk, stress and uncertainty.. Not everyone has the fortitude.

4) LUCKY SPERM CLUB

Marrying into money, inheriting money, or winning the lottery.. It requires good luck. Do not confuse the advice of a second generation wealth holder with something you should do to become a first generation wealth hold.

Some of the Financial Hacks we employ

Note: The secret is in the dosage of each of the strategies to optimize the result

- Heloc mortgage paydown

- Rentals

- Syndications

- Tax mitigation: Conservation Easements

- Tax Strategy

- Oil and Gas Investing

Lane Kawaoka has been a contributing author to Forbes since 2016 – See article on Debt

It’s more than money…

People who struggle with poverty growing up develop a scarcity-minded operating system.

In Hawaii, I see this scarcity-minded mentality apply to even the middle-class or upper-middle class households.

We turn off the lights before we leave the room, drive a Camry, drive an extra 10-minutes to sit in the Costco gas line in said Camry, and save disposable grocery bags because it seems like there is not more being made.

Part of it is humbleness and a family-oriented culture (which is why I live here) but the downside is that people develop a mindset of scarcity.

Working with our Team you will you develop into an abundance mindset where you “learn how to fish” and may even like to pay it forward one day.

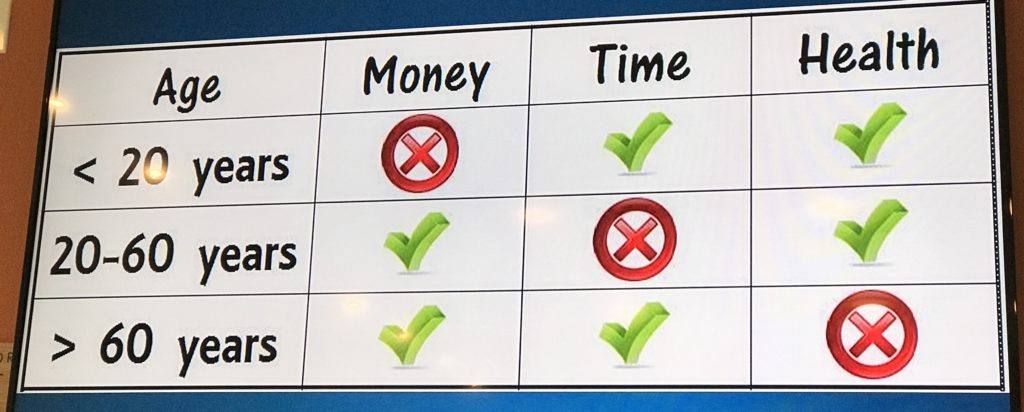

“Majority spend 40+ years building their retirement nest eggs, but have no clue what to do with themselves when they retired. Because 20 retirement books focus on financials and none of them write about enjoyments of retirement. When men reach their sixties and retired, they go to pieces. Woman go right on cooking. Most become depressed and hate retirement if they don’t have growth mindsets.” -Hui Deal Pipeline Club Member

Intangible Value Creation

In this Rich Habits Study, 41% of the 177 self-made millionaires were raised in poor households. Yet, somehow they managed to break out of their poverty as adults. Being poor helps you develop the skills needed to overcome the middle-class and the wealthy. I hear that wealth will typically decay from a family in 1.5-2.5 generations. If you are not getting better you are getting worse!

Here are some of the ingredients that growing up poor (or with the right mentorship) that will help instill that abundance mindset.

Taking Risks

If you are poor and unhappy, then you have to do something about it. Most people will make a piss-poor effort or lack the network/opportunity and develop a victim mindset. Being poor puts you on the ground level and forces you to take risks in the pursuit of the next level up. Working toward something better develops the muscle of taking risks.

Once you have wealth the game switches to capital preservation where it is critical to surround yourself (more importantly you heirs) with the right wealth advisors, insurance agents, CPAs, Estate Planners and other financial advisors. Becoming rich actually makes your risk-taking muscles decrease your tolerance for taking risks.

Embracing Change

Dissect the rise of any self-made millionaire and you will find an interesting story of contrasting phases that lead them there.

Busting Your Butt

Those who are raised in poverty, have no choice but to work hard and make a consistent effort. Growing up in a comfortable environment makes you lazy.

Accepting Failure

When you are rich you are more worried about losing your money. If you look at marketing targeted to rich people it is all about mitigating risk so they don’t lose what they have. We invest in deals with better risk-adjusted returns than your standard institutionalized Wall-street investment however there is still the risk. But in a un-rigged market, you should have higher returns by taking on more risk and ideally a lot more reward in comparison to the incremental unit of risk increase. When you grow up poor, failure does not frighten you as much and, in fact, emboldens you to take risks which strengthens this muscle.

Humbleness

The poor don’t have anything really to show off that makes them look cool. They are humble enough to be mentored and take advice from those who have actually done what they want to do. The rich have egos and don’t want to pay a guy a penny to teach them to do something they want to do (yet they spend over $100,000 on a four-year college?). The movers and shakers put their ego down, down some cash and join masterminds, get in the circles where people are better than them, and get coaches.

Adopting a Positive-Neutral

When you grow up poor you know how hard life can be. Shit happens. You appreciate stuff when stuff goes well and when things go ok or not as bad… you have a positive outlook and keep positive progress forward.

Having neutral outlook allows you to see potential issues proactively which allow you to evolve your strategy.

Rich people get bent out of shape when things don’t go well and derails whatever they are building. They may blame others instead of taking accountability and improve their behavior or business.

Rich people never seem to be fulfilled which is the cause for many suicides of celebrities who seemed to have everything (that and a little drug use). Perhaps they always have the self-doubts in their head telling them that they would have never achieved what they had done if daddy helped along the way.

“There is nothing sweeter than creating you own wealth” -Sting

Building Social Capital

Poor and driven people are more accessible in the lower rungs of success. Being poor allows you to connect with others to help each other on your level. These people later become your friends or running mates in future on bigger ventures. At that point, the pursuit for wealth turns into sport for leisure and greater causes.

Frugality leads to Lean

The poor don’t have money to be wasteful in their pursuit for wealth. This frugality everyday creates a culture of lean business. In this article on quitting your day job one of the reasons I am against leaving you day job too early is that the job creates a time constraint and that requires you to create lean systems.

Rich people have a lot of leash to work with… they ultimately hang themself with that leash.

Don’t send your kid to private school to hang out with the children of the financially declining upper-middle class.

“I was lucky that my parents didn’t try to keep up with the rich Punahou parents. My classmates families are definitely in wealth preservation mode where I am trying to grow it be be something greater. My parents grew up poor so I’m trying not to be the wasteful generation” -Stuggling 1st generation Accredited Investor

“Hawaii has that small town mentality where it really gets disgusting on the extent that people go through just to keep up with social status. Dispite the same exterior appearance of board shorts and slippahs… There is a such a stark socioeconomic divide here that people can lose focus and get lost in the pack. It so important to pass on that work ethic and grit, so that our kids do not become part of a decaying generation.”

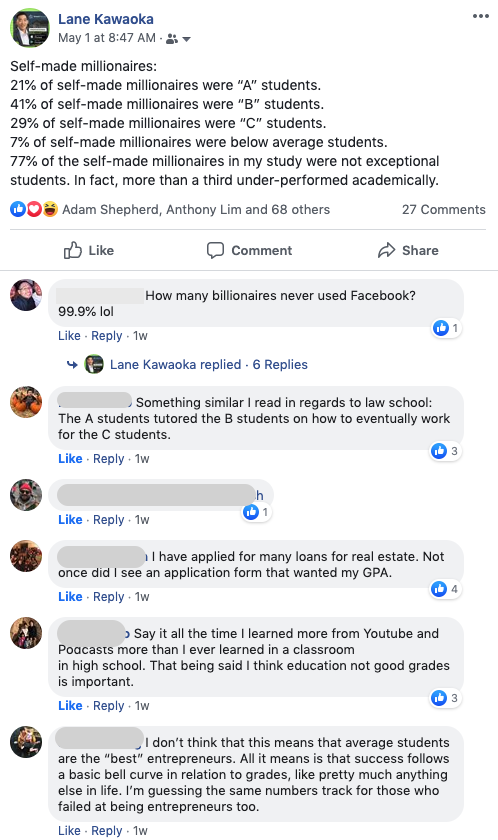

Self-made millionaires:

- 21% of self-made millionaires were “A” students.

- 41% of self-made millionaires were “B” students.

- 29% of self-made millionaires were “C” students.

- 7% of self-made millionaires were below average students.

77% of the self-made millionaires in my study were not exceptional students. In fact, more than a third under-performed academically.

Source: Rich Habits

The Case for private school:

No argument is complete without a fair discussion about the counterpoints. It’s no secret that the majority of future wealth comes from those who come from private schools. One common reasoning behind this is because they have the networks to take them farther and the connections to make things happen.

Not everyone can groom their children and the future generations to devote 30 – 60 minutes a day to reading the following books: Think and Grow Rich, How to Win Friends and Influence People, The Magic of Believing, Millionaire Next Door, The Psychology of Achievement, The Power of Your Subconscious Mind, Psycho Cybernetics, The Power of Positive Thinking, The Millionaire Mind, Rich Dad Poor Dad, The Greatest Salesman in the World, The Richest Man in Babylon, Success Principles, The Compound Effect, The Entrepreneur Rollercoaster, The Power of Focus, Beyond Willpower, Lead Without a Title, Million Dollar Habits, The Power of Habit, Atomic Habits, Release Your Brakes, The Magic of Thinking, 15 Invaluable Laws of Growth, Wisdom of the Robber Barons, Finding Your Element, Outliers, The Wealthy Barber, How to Make Luck, Make Your Contacts Count, The Brain That Changes Itself, or Change Your Habits Change Your Life. Or examine the biographies of Elon Musk, Richard Branson, The Wright Brothers, Andrew Carnegie, Winston Churchill, Henry Ford, Sam Walton, Marriott, Be My Guest, Steve Jobs, Calvin Coolidge, Abraham Lincoln, Warren Buffet, J.K. Rowling, Thomas Edison, Oprah Winfrey, Nicola Tesla, The Magic Kingdom, Titan, Napoleon Hill, Martha Stewart and George Washington. And consumer the right publications like: SUCCESS Magazine, Entrepreneur Magazine, Discovery Magazine, Psychology Today, Scientific American and Self-Magazine.

With parents who 1) want to do (buy) their best, 2) short on time, 3) grew up in a traditional non-entrepreneur family… private school might be the next best thing.

“Private school… its’ the 401K of education”

In addition, private school kids have higher expectations at least in terms of consumerist tendencies. Consumerism is what propels this Nation further with driving to be more, get more, achieve more in search for status and luxury. Of the times “peer pressure” is the best pressure.

“We have all heard of helicopter parents but we need to be aware of being lawnmower parents. It’s when you take away all the uncertainty in a child’s life. When taking forward in a time of uncertainty is the key to success growing up like this is very counterproductive.”

Bill Gates exhibits modesty defying the perception of wealthy people

The rich get richer?

False! It might seem like it in terms of navigating taxes and legal entity structures (which we can help) but according to the Williams Group, a wealth consultancy group, 70% of wealthy families lose their wealth by the second generation, and a stunning 90% by the third.

Interesting study.

And more general study.

But let’s face it being raised in wealthy households have a huge advantage over those raised in poverty. Personally, I was not in a wealthy family but I was given the opportunity to go to private school in Hawaii and a mainland college with some student debt (2003-2007) but the costs are nothing like it is today.

Advantages of the Wealthy

- Better Education – better teachers and more educational resources.

- More Resources – Parents hire tutors for their children where the poor can barely understand the content that their child is learning so how can they help! Think SAT preparation courses and costs of college.

- More Time – Time to study and build a resume with participating in school clubs. Less time worrying if you are going to get beat up or shot.

- Formal Education – Take a look at the basketball player LeBron James (grew up without coaching) with his son Bronny. Senior LeBron might be more athletic but Bronny was given the privilege of formal coaching which is why people say his shooting and dribbling skills are superior. Video.

- Success Peer Pressure (Culture) – When I was going to private school there was this dumb need to have cool cars (that the parents paid for) but there was this expectation or elitism to go to college whereas some public school “crabs-in-a-bucket” culture of anti-education and not over-achieving. This “Herd Doctrine” has a very powerful gravitational pull that directs the behavior of those inside the “rich neighborhood herd” if not only for shallow materialistic or status related motivations (hey… whatever motivates positive behavior). Of course, as you work with us we will get beyond just basic capitalistic and consumerism needs to create a holistic legacy that is Ikigai! Our method is to give you a taste of wealth to escape your scarcity mindset and unlock an abundance mindset that is often more powerful and impactful on the greater good. (Ok enough Star Wars light side dark side talk, read on…)

Disadvantages of being Wealthy

- Less Willing to Take Risks – Those raised in wealthy households have a lot to lose. Those raised in poverty, who have nothing to lose. Hope drives the poor to take changes and obtain greatness but it also drives them to call their credit cards in a whim and sign up for some random $25,000 infomercial get rich quick scheme.

- Lack of Grit – Comfort can lead to complacency. Those raised in a wealthy household do not have to work for their meals, their school supplies, their video games, their iPhones, etc. When you have no choice but to work in order to get the things others are given, you are forced to develop grit. Grit requires practice. More on Grit.

- Fear of Failure – Many of the rich have nothing better to do than to worry how others perceive them. It’s a first world problem. When you grow up poor, you don’t fear to fall because how worse can it get. Some of the most powerful entrepreneurs I have worked with have come from nothing and they understand that they can live on barely anything and they know if they slip back they can climb out once again.

- Uncomfortable With Failure – Consoling parents, tutors, private coaches, etc. when these children begin work in the real world, however, the real world will not coddle them, like their parents. They will eventually be exposed to failure, and when they are, they will be ill-equipped to overcome it on their own. Now perhaps you want your child to be another bucket carrier for a company… they might be ok.

- Unaccustomed to Sacrifice – Those raised in wealthy households are given things they did not have to work or sacrifice for. The pursuit of wealth always requires sacrifice. Sometimes for many years. If you’re unaccustomed to sacrifice, it will be more painful and less tolerable for you.

Distinctions between the wealthy and the middle class

Other than the obvious differences in finances, spending habits and overall mindset here are some of the most significant differences:

1. Multiple Streams of Income

The middle-class only have one income stream which is their job. Many of the people I have interviewed on the podcast have experienced a pivot point where they got fired from said job and were awakened to this reckless financial state. [I suppose you could work your ass off but that would be a poor return of investment on your effort for a bit of job security]

The wealthy know they are never going to become wealthy from just one income stream, their job. Our experience working with working professionals such as doctors, lawyers, accountants, engineers (yay), and pharmacists, is that often times that W2 income stream from their job is the best way to create capital to then acquire assets that create additional income streams.

This process is not a get rich quick scheme but we can help speed this up due to our connections and wisdom.

2. Getting used to being Comfortable with Being Uncomfortable

The wealthy realize that to increase comfort zone and get off the beaten path that most people take.

“Whenever you find yourself on the side of the majority, it is time to pause and reflect” -Mark Twain

Good investments are where the reward of an investment outweighs the risk this can be conceptually explained as the risk-reward ratio or sharpe ratio. We like to focus on deals where the reward of an investment outweighs the average risk-reward ratio or sharpe ratio for deals available. In a high-level, we get to know the integrity of people as well as vet the underwriting of the project.

They know that to reap the biggest rewards, they must take the biggest risks. That’s why those with a wealth mindset will be the first to ask for a raise. The middle class is content with the annual inflation adjustment to their pay, but the wealthy will ask for what they’re worth and not working themselves to the bone. The wealthy understand that failure is always a possibility, but lets mitigate our risks and minimize our fall. Whether that means starting their own business, investing in real estate or investing in a new venture, the wealthy will take the risk the middle class is content to avoid.

The middle class is happy being comfortable. It’s comfortable working a “safe” job, working for someone else. It’s comfortable not asking for a pay raise. The wealthy are the opposite. They’re never comfortable. In other words, they’re never satisfied with where they are and will do everything in their power to keep moving the needle.

Sophisticated investors who have an abundance of good dealflow (not sucker deals) know that the more risk they take the more un-proportionate reward they will reap in each individual deal and an overall gain in their portfolio.

3. The Middle Class Accumulates Things and Consumes Content; the Wealthy Creates Them

The middle class spends much of their money on fancy cars and more home than they need. To the middle class, it’s more important to accumulate things because ultimately they want to feel comfortable, significant (show off to others). The rich understand that to become wealthy, you have to want money more than you want things and that’s why they’re creators. They create products, services or in the case of real estate, homes that the middle class want. The wise and wealthy know that relationships is the greatest currency of them and which starts with adding value to other peoples lives.

The wealthy live below their means in order to build their investment capital. The more they have to invest, the bigger their war chest grows, which they will turn around and reinvest. This has the effect of not only accelerating wealth but compounding it as well.

One of the hardest things we struggle when walking with people on this journey is when to take the profits and spend it on pure rewards?

If we buy that reward… the money saved could be used on another alternative income stream. This is where we take a lot of pride in advising our clients and getting down to the root of what drives their happiness. It’s about true lifestyle creation.

4. The Rich Understand the Power of Prudent Leverage

The middle class believes in hard work, and wealthy individuals believe in prudent leverage. There’s nothing wrong with hard work, but hard work alone will not make you wealthy… it will only lead you to a 30-50 year career where you had some lame retirement party.

The middle class like to do things like painting their home, mowing the lawn, cooking, because they believe in the power of hard work. The wealthy understand the power of leverage and that it would be far more cost effective to hire someone to do the work than to do it themselves. Money (once you have it even with a few rental properties) becomes a lower utility and your time is more valuable. You can always trade time for money (job) but you cannot create more time.

The money they saved from foregoing fancy things can be leveraged across three projects instead of just one. The wealthy work just as hard as the middle class, they’re just able to accomplish more through the power of leverage. They aren’t afraid to defer to someone else’s expertise if it makes them more money in the long run or advances their goals. They understand that leverage frees up time for them to work on the things that matter the most in business and in life.

5. The Middle-Class will Focus on Just Saving

Saving is important, but what you do with those savings is even more important. The wealthy aren’t content with a fixed or safe return on their savings like the middle class are when they put their money in a CD or low-risk mutual fund.

The wealthy save so they can invest for earnings. To them, investing in a CD, bond or low-risk fund isn’t earning. They want to put those savings to use, to drive the earnings engine. The wealthy put their savings to use by creating more streams to earn or earning more with the streams they have.

This could mean expanding a business or branching out into another business line. The same concept can be applied to real estate. It could mean buying more of the same types of residential properties in the current investment portfolio or expanding into commercial property.

The “Simple Passive Cashflow” Path to Financial Freedom

One of the favorite things that I enjoy (for contribution) is to take someone through the steps of wealth creation…

- Simple Passive Cashflow (SPC) (negative) -2.0 – Dependance: You depend on others for financial support. Think of the cousin that still lives with your aunty or the acquaintance who does whatever because they have a $4,000 a month trust fund from their deceased parents.

- SPC -1.0 Solvency: You have cannot seem to control your spending and in deep consumer debt. You may or may not have a stable job. Note: Don’t be an idiot and pay $2,000-$50,000 on any kind of a coaching program!

- SPC 0.0 Stability: You have a good job and have your finances in order although you still might be under $100,000 net worth. You are trying to save $20,000 for that first rental property. You might be saving $2,000 to $20,000 a year… good job! You are focusing on paying off high-interest rate consumer debt and paying the minimums on low-interest debt such as student loans or mortgages (PS you should not be owning your home).

- SPC 1.0 Grind: You start adding cashflowing rental units to your name and start seeing the benefits. You stop future contributions to traditional retirement accounts that are heavy in hidden fees and allow you to only invest in garbage investments. You start drinking the SPC Jungle Juice. You have a life-changing phone call with Lane and decide to cash out your 401K to invest in real assets and build pensions that pay out today and start to snowball your unit count. You are by no means financially free but mentally you are seeing the light at the end of the tunnel.

- SPC 2.0 Evolve: As you max out on the available Fannie Mae loans and become an adept investor you realize that rental properties are not scalable and start to invest in private placements. You know you are giving up some control but you realize that you are gaining diversification and your life back which was the reason why you started this in the first place. You now joke with the cool friends you met in the SPC Ecosystem how the turnkey rentals are turkey rentals. Although, in the back of your mind you understand that most people need to go through financial puberty (SPC 1.0).

- SPC 3.0 Zero-Gravity: You have the financial means to quit your job and experience to do whatever you focus on. Financially you have blown past the $1M net worth mark and focusing on that critical $3.5M milestone where you can pass it along to your kids and they will have a hard time screwing it up. Now that quote from Lane is making sense… “The Passive Cashflow is the Simple part, its what you do after is the hard part.” Retire is not about not having to wake up or golfing. It was about finding your passion, helping others, and finding happiness. It is in our experience that it takes a few generations to get to SPC 3.0. Here is a local example. We specialize in taking regular people to $1.0M net worth and then to $3.5M net worth.

These ideals refined from “Work Optional” by Tanja Hester

Shouldn’t I have a Financial Planner?

The truth is no one built substantial wealth with the aid of a traditional financial planner. As we say here in our PIG tribe… never take financial advice who is not on the path or made it to financial freedom. Financial Planners get rich off the fees they tack on to what investments they sell you. Read the rest of the story here.

The following are some legal and made up terms in the money management world:

Financial advisor is one of the most common titles used by licensed financial professions. This title was commonly given to Paine Webber representatives on their business cards and marketing materials when I was at the firm in the early 2000s. This title has no legal or regulatory meaning. It is strictly used for marketing purposes. While it is commonly used by most Brokers and Advisors, anyone could legally use this to describe themselves, including attorneys, insurance agents, brokers, investment advisors, financial planners, accountants, even dentists. This is one of the most confusing terms as it does little to determine a person’s qualifications.

Financial Consultant was commonly given to Smith Barney representatives on their business cards and marketing materials. Again this has no legal or regulatory meaning and is strictly used for marketing purposes. Anyone could legally use this to describe themselves and does not help you determine a person’s qualifications.

Financial planner is one of the more commonly used and misused titles in the financial advisory industry. Many professionals use this title to describe their holistic services of providing individuals and families with a financial plan. Constructing a financial plan is the first step in any financial advisory relationship. Unfortunately, there is no legal or regulatory standard for calling oneself a financial planner. This has allowed people to use the title in order to project a professional image that the person is providing unbiased financial planning services, when in fact, they may not be. Some insurance agents who use this title to brand themselves as a financial planner in order to sell more insurance products to unsuspecting clients – not the Infinite Banking type.

What’s infinite banking or as we setup for our clients… Ohana Banking?

Benefits:

- Tax – Free growth on my earnings.

- Steady, consistent, year after year “upside only” accumulation, somewhere between 5% and 7%. No home runs, just single after single, each and every year.

- To make certain that any gains I earned will be locked away and not subject to market downturns.

- To allow me to borrow money personally without interest, without a payment schedule (I would want repayment optional), and without affecting my credit score.

- To allow me to lend money to my family members at the preferred rates I designate.

- To transfer to my spouse, children, grandchildren or my favourite charity without taxation on the gains and without the expense of probate.

- To be creditor – proof, protected from frivolous lawsuits.

- To not have required distributions, like an IRA. If a withdrawal is taken I want it to be my decision and not the government’s. I don’t want them to ever tell me when, how much or how often.

- To be backed by the strongest financial companies in the world. Stable companies that are over 100 years old.

- To carry my personal family name, like the Phillips Family bank.

If someone calls themselves a financial planner, be sure to check their licenses and certifications to make sure you know what you are getting from that person as a professional. Do not confuse a Financial Planner with a Certified Financial Planner®.

“Stockbroker”, is used to describe someone who buys and sell securities on behalf of their clients in exchange for commissions. This person works at a broker-dealer or “wirehouse” and most likely would have a license such as a series 7, series 66, series 63 or others. Many brokers don’t like the term “broker” and consider it a pejorative term.

Investment Advisor Representative (IAR) has legal and regulatory meaning. This title is conferred to someone who has passed the series 65. This person would be required to use a fiduciary standard of care with their clients. A fiduciary standard of care is one of the highest standards of care from a legal and regulatory sense. This is one of the highest standards of care. Clients should seek to work with professionals who are bound to high standards of care. An IAR is either regulated by the SEC or the state’s securities agency. This license and title do not allow the professional to buy or sell securities for commissions. This is a fee-only license, where the professional can only get compensated directly by the client directly and cannot obtain commissions from product providers, or other related sources without disclosure to the client. This is the most transparent forms of compensation. Clients should consider an advisor who has this distinction if they want transparency. This title is not commonly used by advisors in marketing materials due to its length and better substitutes such as financial advisor, or even investment advisor which is a shorter version of this title. This license can be combined with the next one, Registered Representative, if the person has passed both certification tests.

Registered Representative has legal and regulatory meaning. This title is conferred to someone who has been licensed by passing the series 7 test. The Registered Representative or “Rep” would be able to use the license at a broker-dealer to buy and sell securities for clients in exchange for commissions and would be regulated by FINRA. The standard of care for RRs in recommending securities is that they are “suitable” at the time of the transaction. The rep is not responsible for any of the securities sold to the client after the purchase or sale of them. There is no “fiduciary standard” of care requirement with this designation. This title is almost never used in any public or marketing manner. Trends in the financial service industry have shifted away from using this title in favor of titles such as financial advisor.

Wealth manager does not have any legal or regulatory meaning. It is not a commonly used title. It is used to confer a holistic approach to working with clients inclusive of financial planning, investment management, and specialized services such as legal, tax or estate planning advice. It is frequently used in single or multi-family offices, Registered Investment Advisory (RIA) firms, or private client groups at large firms. This is the title I choose to use to describe my services over the other alternatives.

Insurance agent is a state-licensed professional who is licensed to sell insurance products in different lines of insurance. These products typically consist of life insurance, long-term care insurance, health insurance, property and casualty insurance, and annuities. This profession is closely related to financial advisors. Unfortunately, there is a lot of overlap from both financial advisors selling insurance products and insurance agents promoting themselves as financial advisors. This has obfuscated the line between the two professions. Some financial advisors are licensed to sell insurance, and some insurance agents have become licensed to sell financial service products through a broker-dealer. What is important to note is that while both professions are important in the financial planning process, it is more important to understand what value each can provide to you. I am planning on writing a future post to help differentiate the two and give you a better understanding of each profession when you work through the financial planning process.

What is a Family (Ohana) Office?

Work with us!

Financial planners primarily assist with lifestyle planning, including budgeting, college, and retirement. Most of their clients are the middle class who get destroyed by taxes and don’t know who to use the system in their benefit.

Wealth Planners (which is what we are), on the flip side, provide services to mostly high-net-worth individuals (over $500,000 net-worth) and ultra-high-net-worth individuals (over $3.5M net-worth). Our services include tax planning, capital gains planning, estate planning, asset protection and risk management. And we also advise from a holistic approach too.

For those looking to become wealthy, neither the financial planner nor the wealth manager will be of any help. And you need someone who has done it themselves as opposed to another employee who works as a glorified salesperson. As outlined here, commissions tied to securities trading and insurance sales, financial planners are less concerned about helping you get ahead and more concerned about helping themselves get ahead by charging fees on trades and earning commissions and residuals on life insurance policies. I don’t know anyone who got wealthy using a traditional financial planner or wealth manager since they’re more about maintaining wealth and less about growing it as I have done ever since graduating engineering school in 2007 and quitting my job in 2019.

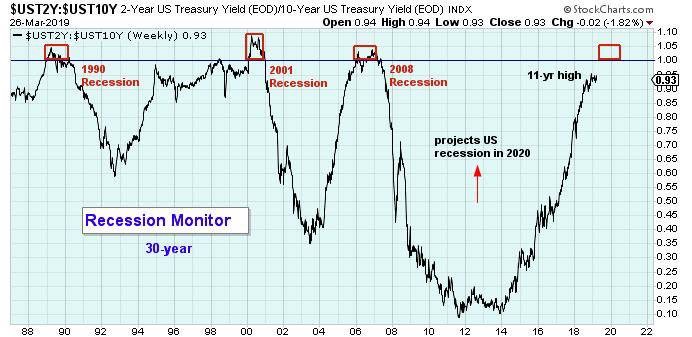

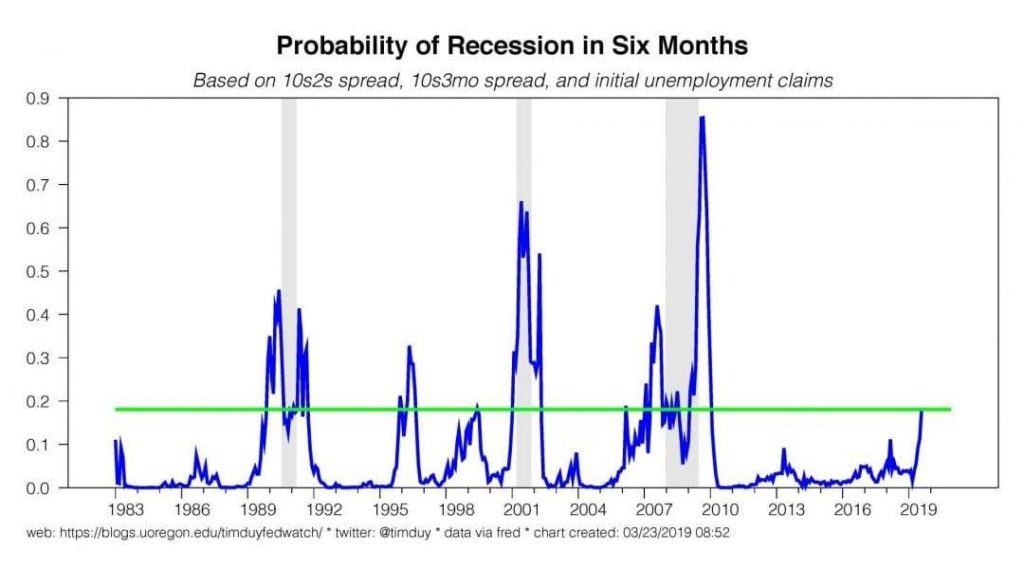

Get out of the traditional investment that only make you financial planner rich.

Find refuge in real assets that produce income throughout a recession.

Maybe you need some best practices working with the estate of your aging parents?

After growing my knowledge base from 2009 to 2013 buying rental properties and getting my portfolio to 11 cash-flowing turnkey rentals. I started to put my money into my own education and spend over $50,000 in my own personal development via masterminds, conferences, and personal coaching to study and engineer this process of wealth building. I discover that there is a distinct difference between the actions of the wealthy vs. the middle class.

A financial planner won’t help you get there, and a wealth advisor won’t talk to you until you’ve reached that pinnacle so they can mooch off fees and you leave all the risk to you.

There’s no such thing as a Wealth Planner, the next best thing is to study the habits of the wealthy and mimic their tendencies and priorities to reach the heights they have achieved.

When I broke it down it was Simple. And I am sort of kicking myself today because it took me so long and so many mistakes to get just to 11 rentals from 2009 to 2013. In 2018, I replaced my 100% of my living expenses with passive income and got my portfolio up to 2,100 units but in all honestly, the first few properties were the hardest…

We can get you on the path to financial freedom, faster, cheaper (fewer mistakes), and a lot of fun (and new friends) along the way. At the very least take in the free podcasts and the free financial newbie guide at here.

If you don’t want us to hold your hand… yes there is a program for you too.

Pingback: The "Talk" with your parents - Simple Passive Cashflow