Walk through selling our home and why it may be better to not be a homeowner.

Selling Home In Hawaii (Mini-Series Episode 1)

Be a landlord in Hawaii or Investor Out-of-State?

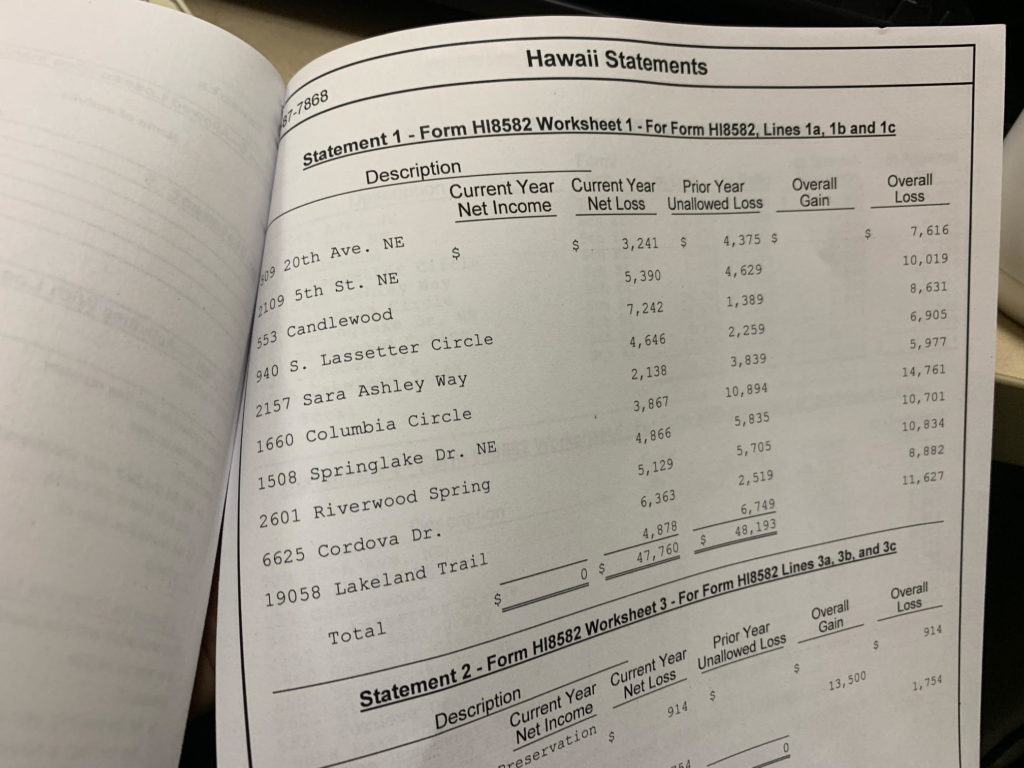

One of the cool things about investing in real estate is that the properties create a paper loss. For single family homes, you can take 1/27 the value of the property (minus land value because that does not devalue over time) per year for 27 years. This is what is shown below. A cost segregation juices this deduction as it puts the asset on a more aggressive depreciation schedule which front-loads as much depreciation as the tax code allows. This is one of the reasons why bigger deals are better because they can support a 5-8K cost segregation study. You don’t get any of this being a house flipper or working at a day job because you get killed with all the taxes since it is all active income (bad). Come to the light side and get Passive Income (good).

Paper losses due to depreciation!