Aloha! Below is this month’s edition of the Da Real Estate Braddahs:

For more insights into investing on the mainland and my personal investing check out my monthly update here in the Greensheet.

- Financial Freedom for Dentists – https://simplepassivecashflow.com/dentist/

- Private Money Lending Top Mistakes – https://simplepassivecashflow.com/lendmistakes/

- When is it time to Retire? Accredited Investor Live Coaching Call – https://simplepassivecashflow.com/when-is-it-time-to-retire-accredited-investor-live-coaching-call/

- Dec 2019 – Borrowing Standards – Rental Income – https://simplepassivecashflow.com/dec2019lending/

- Habits – https://simplepassivecashflow.com/habit/

- Wealth Management Tips from Centimillionaire Family Office Advisor Richard Wilson (184) – https://simplepassivecashflow.com/familyoffice/

- Top Multifamily Markets in 2020: Small Metros, Suburbs – “As a result of slower economic growth, apartment demand is projected at 240,000 units in 2020, approximately 20 percent less than 2019’s estimated 300,000 units,” CBRE’s market outlook for 2020 shows.“

- SECURE Act Summary

- Expands the ability to run multiple employer plans for plan years beginning after December 31, 2020

- Safe Harbor Rules Simplified for plan years beginning after December 31, 2019

- Long Term Part-time Workers permitted to participate in 401(k) plans, which applies generally to plan years beginning after December 31, 2020

- 3 consecutive 12-month periods the employee has at least 500 hours of service

- Repeal Maximum Age for Making IRA Contributions which applies to contributions made for taxable years beginning after December 31, 2019

- Increase Age for Required Minimum Distributions to 72

- Applies to distributions required to be made after December 31, 2019, with respect to individuals who attain age 7012 after such date

RMDs after Death under the Secure Act

- H.R. 1865 – Sec. 401 Modification of Required Minimum Distribution Rules for Designated Beneficiaries

- Basically, requires all IRAs and Qualified Plans to be distributed within 10 years of death

- The Senate version had a 5 year limit

RMDs after Death under the Secure Act

Exception to 10-year rule for certain beneficiaries:

- Surviving Spouse

- Children under the age of majority (but only until reach age of majority, then 10-year rule)

- Disabled

- Chronically ill

- Another individual who is not more than 10-years younger

- Tacked onto last law to keep the government toNo more stretch IRA (including rotes) – only have 10 years. So much money disappear from average Americans.Going after inheritance tax next? Back to Clinton days where it was 600k and over. Maybe do a roth conversion? Or get rid of all retirement funds like how I have been advocating for for a couple years now – SimplePassiveCashflow.com/qrpYou can contribute to qrp for last year until you file for next yearYou can now have annuities in retirement plans – #Lobbistroth conversions –Charitable retainer trust – asset income goes to kids then goes to charity

Naming a charity as a beneficiary

Life insurance

A few others

Note: I personally don’t do retirement accounts because I want to take advantage if bonus depreciation

- U-Haul Migration Trends: Top Growth Cities of 2019

- Raleigh-Durham, N.C.

- Kissimmee, Fla.

- Ocala, Fla.

- Round Rock-Pflugerville, Texas

- West Palm Beach, Fla.

- Port Saint Lucie, Fla.

- Bradenton-Sarasota, Fla.

- Coeur D’Alene, Idaho

- Manhattan, N.Y.

- Harrisburg, Pa.

- New Braunfels, Texas

- Auburn-Opelika, Ala.

13.Huntsville, Ala.

- Spring-The Woodlands, Texas

- Boca Raton, Fla.

- Henderson, Nev.

- McKinney, Texas

- Temecula, Calif.

- Fort Lauderdale, Fla.

- St. George, Utah

- Rent Control Makes a Comeback as Housing Crisis Grows – Three states passed new laws in 2019 limiting rent increases, others are considering their own measures and housing is set to be on the agenda in the 2020 presidential election. – [Why are you buying in Blue states]

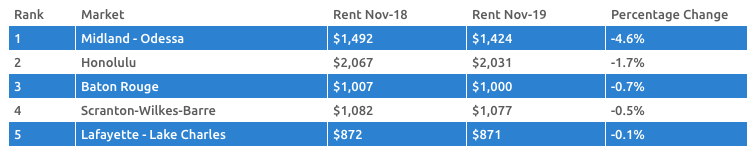

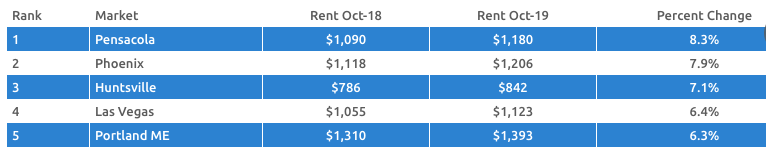

- Markets with largest rent growth 😁Markets with largest rent decrease 🙁

- Amazon’s 1.4 MSF Florida Project – The e-commerce giant tapped Seefried Industrial Properties to construct a new fulfillment center, which marks the first major development at the new Portland Industrial Park in Deltona near Orlando. The company will create more than 500 new full-time positions at its new Deltona fulfillment center.

- Howard Hughes Spends $565M in Houston – The portfolio includes the former headquarters of Anadarko Petroleum and ConocoPhillips, plus a warehouse and developable land.

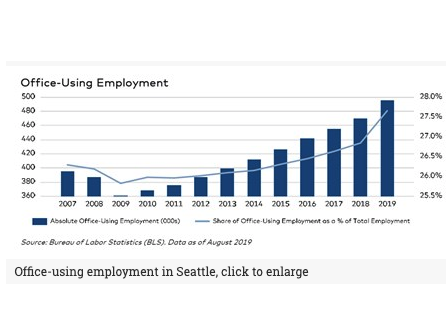

- Seattle Office Report – Fall 2019 – Strong market dynamics continue to support the metro’s rapid expansion, with a saturated tech sector extending and shaping the current real estate landscape.

-

- Largest Employer by State

- Chinese Investment in U.S. Commercial Real Estate Is Plunging – Chinese investors put 76 percent less money into U.S. CRE year-to-date through September than in 2018.

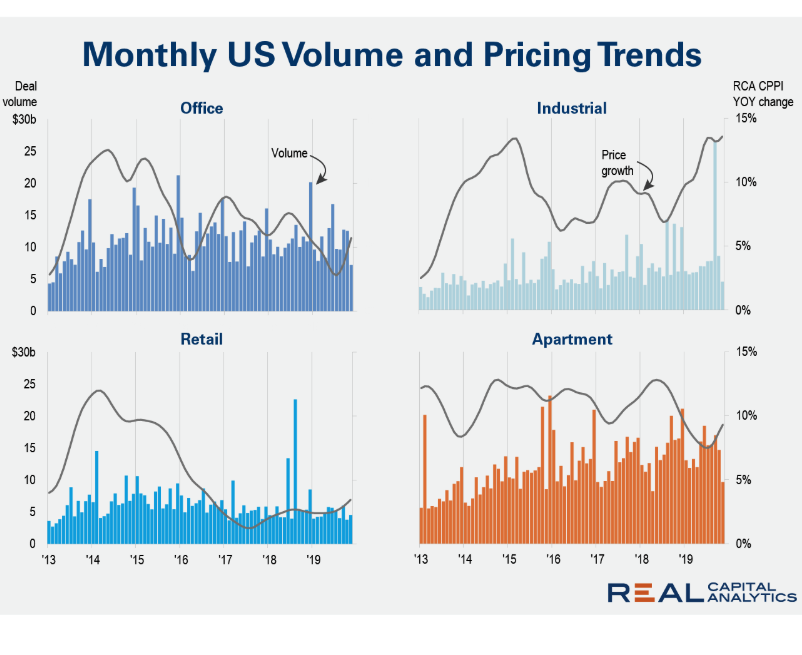

- US Monthly Volume and Pricing Trends by Sector – Ramping up activity in the U.S. apartment and industrial sectors over the last five years while moving away from the retail sector.

- The Impact of the Next Recession on the Multifamily Market

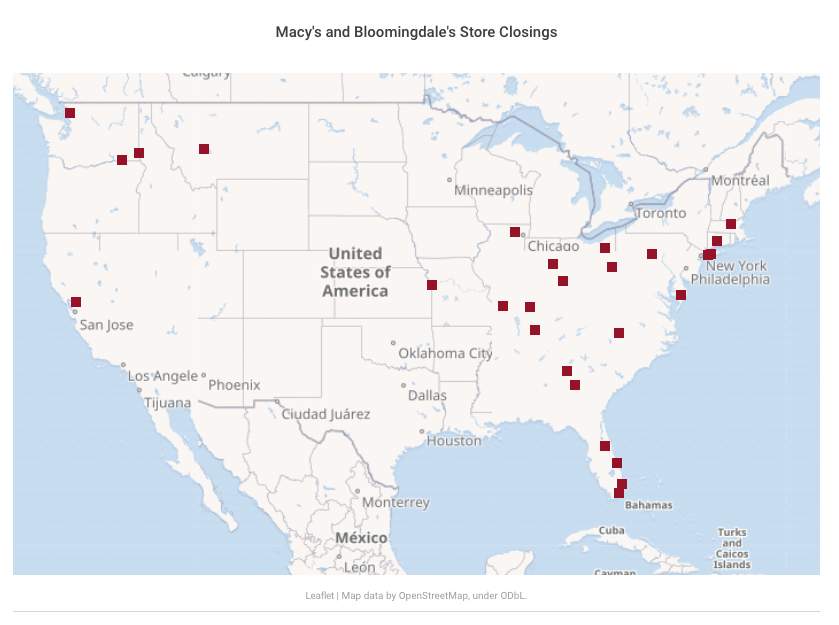

- Macy’s Store Closings – Nearly 30 of the retailer’s 641 locations will shutter following a moderate decline in comparable sales through the holiday season.

- 75 Million Ponzi Scheme – The Income Store

- Retail Property Taxes Likely To Rise – Pier 1 announced it would close up to 450 of its stores.

- Electronics Stores Join Brick-and-Mortar Exodus – Audio equipment giant Bose will close its remaining 119 retail stores in four markets including the U.S.

- Despite Missed Sales Projections, Discount Retailer Five Below Will Open 180 New Stores This Year

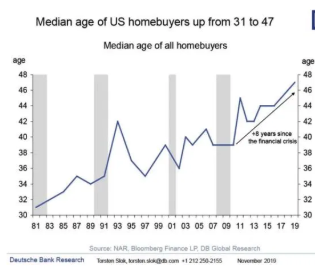

- The median age of homebuyers is now 47

- Co-Showering & Multi-generational Houses?!?

- Hilton Launches New Lifestyle Brand – The hotel firm has already secured 30 commitments for its latest offering, Tempo by Hilton, which is designed to appeal to the ambitious modern traveler.

- Four Strategies for 2020 Success in Class B Multifamily Space – New markets, Tech, Employees, Regulations

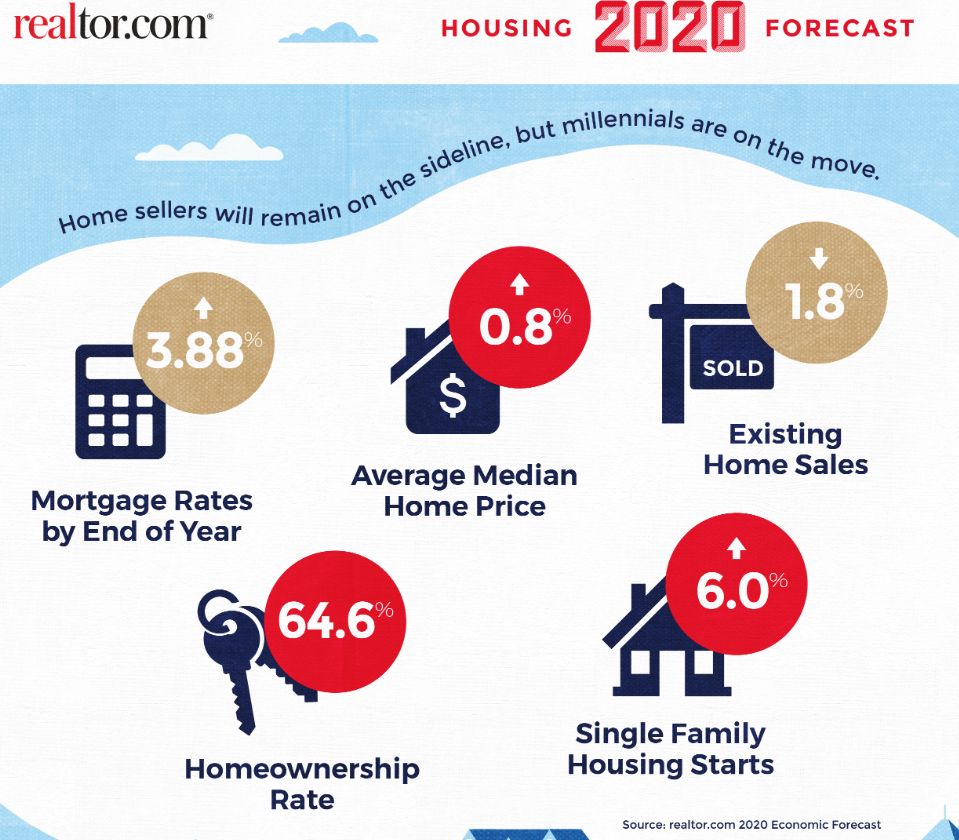

- Housing market falling short by nearly 4 million homes as demand growsThe 5.9 million single family homes built between 2012 and 2019 do not offset the 9.8 million new households formed during that time, according to an analysis by realtor.comEven with an above average pace of construction, it would take builders between four and five years to get back to a balanced market.“Simply put, new home starts are not keeping pace with demand. Homebuilders have a mountain of opportunity, but a big hill to climb,” said Javier Vivas, director of economic research at realtor.com

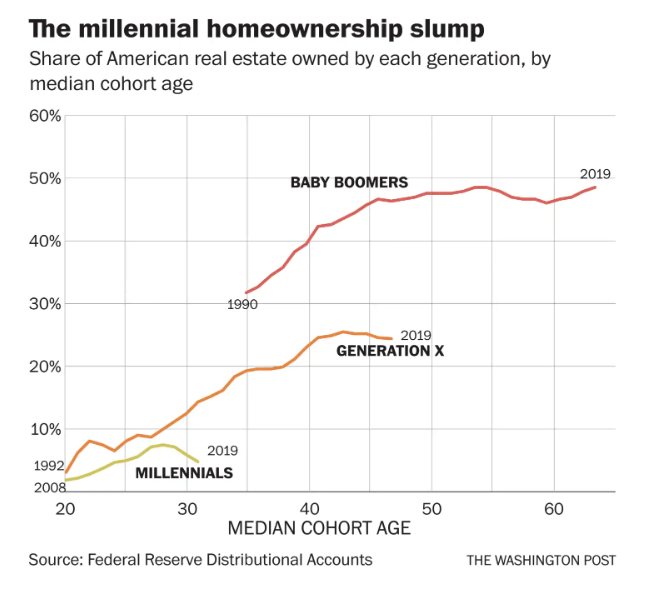

- Millennials’ share of the U.S. housing market: Small and shrinking

Transcript:

0:06

Stay tuned

0:08

we just do local guys with so much to say.

0:20

All right, Hello everybody this is Episode 24 two years into this February 2020 we’re going to talk about some statistics that’s coming soon on MLS status and corage project update is this meeting is you

0:37

ever everyone thank you for tuning in hopefully people know about me as well as you lane you retired CPA doing real estate investing and sales trying to use my bars for good now helping auto investors as well as owner occupants doing the right financial fiscal decisions. But anyway, as usual, we’re going to start off with our first month of 2020 median single family home prices didn’t do much in terms of changing at $770,000. But on the condo prices, we did see an uptick of almost 8% $229,000. That’s like slightly under $400. From prior year, January. So that’s a pretty big jump. That’s for

1:17

the year, right? Not month over month. No,

1:19

this is actually month over month. Huge man. Yeah, that is that is and year every year to there was an uptick also, especially in volume for 2019 versus 20. At night, that would have been a good thing to talk about too. But um, there was a 2019 was actually a very robust year for a wahoo investors or real estate owners. Yeah, so very healthy real estate economy. Really good. You think that seven and a half percent on Oh, that’s kind of a big deal. Yeah.

1:49

Just like who knows, right?

1:51

Yeah, I mean, we could we could chalk it up to the building, you know, Kakaako stuff, but like you said, it could be just like a hit. up, it’s very generalizer because we’re talking all of all. So that’s the challenge in terms of trying to pinpoint it on one single thing. Yeah, but I’m close sales, we see a very big upswing on both sides both went up almost 8%, or single family at 265, close sales for the month and then 16% increase it 379 close sales for condos. The interesting side of this is that the last rule the third rule, where it’s kind of contrary to the first two stats were median days on market for both single family and condos got slower at slower to 35 days for single family and 60 slore to 33 days market for condos. Now we’re going over the one month mark, I guess you could see us that’s kind of big. So I’m very interested to see what’s going to happen next month because I look at the median days on market is more like the leading indicator versus the other stats. Like I did the last few months I’ve been trying to simplify it because he talked about the numbers, yada yada yada so picking a winner for January 20. 20 sellers or buyers and the winner are the few sellers

3:06

dramatics I all right

3:08

so I mean yeah overall with the prices going up like you said lean with that on the condo side jumping up so high overall we gotta go with the price increases the main reason for and the volume for that matter for sellers being the winner for January changing over to some new information so on Oahu for the high central multiple listing service, we started something new and it’s this coming soon status that’s now available instead of you have active we have in escrow showing in escrow not showing and sold. So now we have this new status called coming soon. That started just January this past January 2020. So what it allows listeners and agents to do is to almost like to pre list your place for sale and you can do it up to 30 days before you actually go live within active listening is relatively new. So what we’re seeing is ism. You can use it if you know your network. Ready to go live yet maybe a tenant is checking out or you know, not transitioning out or you’re still trying to do some repairs to get it ready or you haven’t gotten it staged or whatnot. So while you’re in transition high central is now allowing us to pre listed with this coming soon status. And I can see potential benefits in using this status for both my sellers as well as my buyers. And I say potential because I think it’s not really being used because it’s relatively new. So as of last night, I think there are only 24 coming soon listings on all of wahoo. So I think once people start using it the way it was intended to I think there’s potential The way I see it, and again, this new but it would be like pocket listings, where you might be able to be in contract before you even list the property. So it could potentially saving money for sellers. You know, you don’t want to put in the new carpet because this potential buyer reached out and negotiate something with the price. That’s how I see it. And I’ve been trying that with my others now and we’ll see how it goes. So if you guys are in anyone’s interested in how this could help you guys hit me up you guys know how to reach me you know other cool stuff

5:06

try nothing better nothing better to do right then

5:09

we’re trying to you know I’m trying to be progressive right and training for Harvard can’t help my clients save money so I’m not sure 40 hour week day job part time real estate agent on the side anymore.

5:21

You know that you know that like the coming soon like you would think like you put it on there you just gonna have a lot of bottom feeders just throwing you junk offers right so you get the free list price. So you’re desperate. Yeah. Are

5:34

they seeing if the sellers does?

5:36

Okay, I could see that as a potential but I also see it as say you have a potential buyer looking in complex that they really want to buy in so they have an auto mailer that will send them any active or coming soon inventory that pops up so they get it now you have this information and the buyer really wants it and you know, the CO we discuss it’s been it’s been a strong seller’s market for so long that buyers in certain areas. I mean in certain price points they’re losing out because some multiple offer situation and so it could potentially have buyers being able to not necessarily sneak in but get a jump on a potential listing and potentially talk to the other side and see if he can strike up a deal and save money on both sides because like I said, maybe the seller is prepping it all we’re going to change the cabinets or we have to redo the flooring because it’s totally messed up but you could have a potential buyer who’s like, Hey, you know what, I’ll take it as is because I know the bones in this building are going to be good and it’ll cost me at most five grand to do the flooring or something and I’m fine with that because I lost our last few times on my offers on this building and I can’t wait any longer so it could not necessarily I mean like you said there’s potential for like low ballers go bother investors or whatever. But then if that’s the case, you just wait till it gets listed right? So it gives sellers more options. If anything,

6:51

I can feel it could hurt you like if you’re listening my condo in here, right? And we’re going to market we’re on market for like a few weeks already. At the Soccer comes on coming through and right. And then he blows our this thing out of the water. It just makes more competition

7:06

for selling right, potentially. Right. I mean, that’s but then again, he’s listing it coming soon for a reason he’s not ready to go live. So yeah, like you said it gives way to more competition from the standpoint of your no sooner before it comes on. And so it’s just more of a transparent market, I guess. Yeah.

7:23

Yeah. I wonder and whenever they have something new like this, there’s all kinds of loopholes, right. And people always trying to gain the system. I wonder if you can put something on coming soon. Take it off, put it back on 45 days, take it off, put it on and find out right. Yeah, right. You’re gonna try that one? Yeah. The

7:42

husband chose getting smart today change certain rules to get around the loopholes to like Nicole, you said if someone didn’t want to show the cumulative diesel market because they temporarily pulled it off and on. So it’s a dynamic process. And I think,

7:55

yeah, you’re not trying to cheat. You’re not playing by the rules, not for your client. Right. Right. Right. Hey baseball, fields zine business

8:03

when you borrow money,

8:04

so that transition to our next topic, which is associations in the news. So I think last month, we talked about how our association dues maintenance fees, it’s not that they’re totally sunk costs, we’re getting value for what paying right in terms of deferred maintenance, saving the funds in reserve to do capital improvements, like roofing, elevators, things like that. So I was trying to talk about the good side of association fees. And so last week, in the news, there was kikki johannah. tower that came out maybe eight months ago, like last year, and this is reserved housing majority of it was reserved housing. But just recently, I think in the last week, they announced that they’re going to increase their maintenance fees as much as 50%. And that’s mainly because the common area operating costs like electricity in the common area and labor to maintain the grounds were under estimated when the first set the fees. So now of course rate, if euro by the body months, I’d be up in arms too. So now they’re trying to figure out how they can try to reduce these costs and therefore not increase the fees. So much. So, and this is on the flip side of the association fees, it can kind of hurt you, right? So, and again, this was reserved housing. So like a two bedroom condo was was going for, like 500,000. So they’re getting very reasonable deal. And of course, you know, they have to qualify for it. And this is in the heart of Kakaako. So it’s prime urban sprawl prime living so lucky for them, I mean, the prices unlucky for them is Association fee hikes and feel for

9:36

them, but what you can do right, so I just wanted to talk about that a little bit in terms of the good bad and the ugly of association fees. And most people like think condos are cheaper, right pricing there is but then you got this implied fixed costs going on and potentially variable costs in the future.

9:52

Yeah. And the thing too, is that one had mixed use,

9:54

you know, down below was on the lobby was

9:58

CVS, right. So you think that would offset some of the coming era costs but friendly not so. Oh anyway next I wanted to give another update on corage development again this is a neighborhood that’s coming up in between is pro city and Mililani and YPO jenji so I spoke to my contacts of our castle and cookin basically, sales were pushed back to q2 of this year. I think initially the last time I had spoken to them it was beginning of this year sales are q1 sales are supposed to start and with the first delivery or people moving in the end of this year, so there’s no change to that and if you live in the area, you’ll see that they are starting a lot of work and it’s evident along the fringes along the the South Side especially as driving by Kamehameha Highway st able to take some pictures. So I just want to show you some of the update if you’re familiar with the Kamehameha Highway and public storage here by the industrial area on the right hand side of the poster just do now in cultural center. So you can see their masquerading they’re opening up this is actually going to be I think One of the south entrance and my understanding is they’re starting construction of the houses on this is south entrance I’m serious might have a few more pictures on it to show how they’re making it nice and pretty with shining gruesome grass along this grading here I used to make all the neighbors happy right? So here this red I was pointing to exactly where I took those pictures. So if you see that’s the southern portion. Here’s a Google Maps picture to give you an idea of what it looks like now again, it’s all farm area. So all those plots of farmland are going to be houses and all along the h2 freeway. So at the top, they’re supposed to be one big on ramp, I think if you So yeah, I just want to give an update on corage. If anybody wants more information or wants me to keep them in the loop on what’s going on, feel free to reach out to me

11:43

no pricing on that stuff.

11:44

They won’t say it’s all going to be market priced. When

11:48

is it like nicer than Makkah, or nicer the couple,

11:52

I have to think it’s going to be above Malka in terms of the rate. That’s it. I mean, it’s Don’t get me wrong. They’re gonna have all different types of gear. They’re gonna have Tom houses they’re going to have their industrial this was to be elementary school there’s gonna be retail but the housing I’m sure it’s going to be like how they develop you know anytime in the middle any market rate or the start building at the bottom and then as they go up especially like the Millennium aka those perimeter lots closer to the top and the edges are all the high end more more custom type homes. So if I had to guess it would be like a similar strategy right

12:23

because when Kapil a and all the other villages came out it was lower than milania stuff. Right?

12:28

Right, right. I mean, you can also think about geographically they’re a lot further out west and hopefully this year is going to be cooler like milania Why Why is

12:38

higher median income demographic wise?

12:41

Yeah. And it’s in theory, you know, it’s it’s closer to town, but further from capoeira, the second city.

12:50

Where do you live out here?

12:54

And that’s partly why I took pictures too is I’m curious to see how this is going to pan out because I live Milani town right? Yeah. And the order set of Mililani

13:03

yeah pumping that medium income up for everybody. taxes so you guys mainland investing check out my podcast simple passive cash flow and the local group Aria Aloha. Join our meetup there and the Facebook page but I’m gonna run through a bunch of headlines this one that people from Hawaii really like this Las Vegas news. You know where that is, if you look at that picture, Dean, I’m no I don’t know if you’ve been to Vegas a dozen times but yeah, so this little sliver that you probably bought by your drive by is getting sold. So that’ll be changing hands here soon, but some real notice here. So in case you guys didn’t realize, but the US government stole a whole bunch of money from you guys this past month, the secure act you probably never heard of it. But it’s pretty big deal with this came about if you recall, like the government shut down and this was governance that was put into act to make sure that that the economy can Going by the government kept working. And it’s a way of they’ve harvested funds from taxpayers, essentially, they got rid of the stretch IRA, here are some other changes that are a little less taxing on people, they increase the age for minimum required minimum distributions, the 72, or we call rmds. But here’s the biggest thing that not a lot of people realize you’re like a stretch IRA Dean, before if your parents died, and they had an IRA, you could inherit it, and you could withdraw it or take it as taxable income pretty much for a long time. But now they said, All right, we got rid of those, you only have 10 years to do it. So essentially, if you your accounting guy or numbers guide, the government just slid a whole bunch of money up in the next 10 years that they can get their hands on,

14:47

because they want their income taxes on it.

14:48

Yeah, and this is why I don’t like retirement accounts because they always do this stuff to us. I mean, not not me anymore. I don’t have any of this stuff. There’s exemptions for this. So like if you pass away and you’re serving You have a surviving spouse, children under the age of 10. disabled or chronically ill this doesn’t apply to you but for 99.99% of people out there, you got to pay up you got to take it as income and pay the government your taxes because they want it. And, you know, this is just an example of what happens when you have certain people in office right? It changes like if you call when Clinton was in presidency, it was pretty nasty. You had to the inheritance tax if you had a state bigger than $600,000 you got a tax and anything more than that now it’s like 4,000,005 million. It’s pretty I know, we never know if the surviving spouse exemption is going to go away stuff changes. So yeah, you know, you guys votes matter leave it at that. I caught multifamily markets in 2020 they’re saying small metros are and suburbs are where to look for rent control makes a comeback as housing crisis grows. Late last year, we saw three states passing new laws in 2019 limiting or rent increases. Yo if you Buying and blue states this is what happens. They’re talking about that over here too. I like to follow the U haul trends it kind of follows the workforce blue collar workers it’s what I personally invest in. So these are where the top growth cities in 2019 a lot of North Carolina a lot in Florida, Texas, Idaho, there’s a Manhattan than there and much Alabama’s and there’s sin there’s Anderson Nevada, I put this on here then I realized maybe the city’s isn’t the best way I’d rather see it marma state level or MSA level director indicator and then you know, I like the U haul because this is where the people like I said blue collar I mean I used to use u haul but Van Lines is a similar report that is more for white collar workers. You know when they get moved their company usually relocates them

16:46

immigration trends of your potential tenants. Right right.

16:49

Man conservation easements we talked about this last time what it is, but if you didn’t catch that one, what this is is for guys making over $350,000 A year when you get above that threshold, you’re going to get killed on taxes. So what a lot of credit investors would like to do is they’ll donate money in the form of land conservation easement to get a taxable deduction. But unlike when you donate $500 to the self initiative harmony when you donate $1 To a land conservation easement, you get $5 around their donation or taxable deduction.

17:25

And this is also one that’s buyer beware too, though, right?

17:28

Yeah. So it’s getting a lot of unpopular attention and Congress as it should, because it’s a head scratcher, right?

17:34

Until you just the one that my CPA had told me that IRS are kind of cracking down on the industry and the shady ones, at least.

17:41

Yeah, yeah. So like what a lot of developers would like to do like golf courses will designate an area as land conservation easement and then sell it to investors and then they’ll donate the land essentially, but the head scratching part is like how they increase the value of the property about five times as they’re donated value. You know, some of these guys are calling it 510 20 times more and that’s when you’re kind of getting a little greedy but we’re in a holding pattern right now. You need to do it talk to your professionals but a lot of my clients are kind of in a holding pattern doing this stuff, at least waiting till the Department of Justice and the Congress battled this out markets with the largest rent growth and largest rent decrease. So on the top there, we showed this last time, but Midland Odessa, Honolulu had the was ranked number two across the nation as a decrease in percent change in rents. That’s not a good thing. Well, I guess depends what side of the table you are right? Right. You know, I’m a renter. That’s true. What do you think like if I came the landlord and I was like, Well, here’s this data. Can I get like a 1% or 2% decrease in my rent? I wonder what happened? I doubt it. Scranton, Lafayette Lake Charles rounds up the top five of the bad boy list. Decreasing rents but where’s it hot? It’s Pensacola Phoenix Huntsville, Las Vegas and Portland, Maine. There you are Victor ideon and Las Vegas

19:09

and used to enhance story

19:10

Yeah, we’ll see what happens in a recession who’s

19:15

got my my

19:17

Amazon created this 1.4 million square foot Florida project around Huntsville. But I put in this here it’s a little bit of fake news because it’s only 500 new full time positions in this fulfillment center usually you’re looking for you know, in especially in a tertiary market of like 100,000 population 500 jobs isn’t that big of a deal I’ll be when you get to a range of one to 2000 that’s a little bit more newsworthy in my opinion

19:44

would also depend on like the current trend in their economy Nick if we talking about like Detroit or something or they’re depressed and in something like this comes about it’s bomb to jack it up a whole bunch radiances and taking it is comes with a grain of salt from that standpoint, too.

19:59

Yeah. just seemed like the these newspapers just need to make headlines right and yeah, Amazon is a big name. Oh yeah, of course realtor.com and they came out with this 2020 housing forecasts, they said that the mortgage rates will go up by the end of the year to 3.88%. I would argue itself pretty steady anyway. Yeah, average median home price will go up by 2%. existing home sales or volume will go down 1.8% and single family housing starts will go up 6% but I’m, as we’ll talk later, it will be much less than the growth rate. There’s still a housing shortage, Millennials will make up 46% of the mortgage origination up from 43% last year you working with any millennials? I am Are they the old kind? Or is it like no, no kind of young? Yeah, sometimes you can have a 40 year old millennial to Oh yeah, I got Jason some of this data they, they love, they love like weird ages sometimes. And so They

21:00

said You mean mindset? Oh, yeah that too.

21:05

We can talk a little bit more about that. We got a slide on that later. Okay. Us monthly volume and pricing trends by sector it for years. You guys listening on the podcast and by the way we have a podcast now Hey, watch this while doing chores for your spouse, and you give massages while you’re listening to podcasts. You can listen in 2.0 speed touring. Yeah, a lot faster. Or you can just watch this on the YouTube and just watch the words that we’re going to read. But we have some graphs on here on the office, industrial retail and apartment trends. Howard Hughes spends half a billion dollars in Houston on the are narco petroleum and conical Philips old headquarters down there in Seattle, their office employment is going way up. And it makes sense because that workforce space is very tech

21:54

oriented. Your old stomping grounds.

21:57

Yeah, they don’t work out there in the field. Like their offices, largest employer by state, so I have a picture of all the states out there and their biggest employer, Hawaii is alterus Industrial you ever heard what is that?

22:11

That’s, um, that’s outsourcing work. That’s labor outsourcing. So that’s super interesting. I think,

22:17

what is that? Like? What do they do

22:19

they outsource work, like, if you need, like a secretary or temp secretary or you need admin clerics like that, then you hire them. I think if that’s all just that I thinking of my old employer, we went through them to hire a admin assistant

22:32

temporarily. Do they pick from the local workforce? Are they like hiring people out in the mainland?

22:37

It was local. Yeah.

22:39

I don’t know if that’s a good thing or not.

22:43

No, that’s interesting. Yeah. I mean, maybe it’s cheaper to go through a third party and you’re just paying them an hourly set fee and you have to worry about HR and HR and retirement and medical benefits and stuff. Yeah. So I mean, that’s just it’s not like outsourcing to India or anything, but if that’s True. That’s convention that’s super interesting

23:02

little Nevada where Las Vegas is their highest employer is MGM resorts and everywhere in the south Texas, Oklahoma, Kansas, Iowa, Indiana, Illinois, Indiana, Ohio, I think that’s Virginia and everything we’re in the middle is Walmart.

23:22

It’s even more interesting. I didn’t

23:23

know that Montana and Wyoming are Walmart to say oh, I work for Walmart you’re part of the union or tribe. So I buy mostly BNC class apartments but I kind of look over the fence that the a class stuff from time to time and some of the new amenities you’re seeing in a class apartments luxury stuff or like the Hilton bikes peloton. Yeah, you own I love I did not I did not have one in this next year.

23:49

It seems really cool. I like it’s funny because I was talking to my wife about you know, I really want to I like the rubric just sizes because I like the energy and then he sometimes any Somebody to push me so this is I guess the next best thing right? Because you’re at home you have screen either you’re watching a pre recorded video or you’re live with people yeah, suddenly it’s the next best thing then then being at 24 Fitness or

24:12

you should check out the the the mirror is in that thing. No, it’s like a mirror. That’s a mirror but it’s also a screen so you can see yourself and watch the person to imitate them. And you can you

24:24

Oh, that’s actually kind of powerful for like, yeah, dancing so I can see a very applicable

24:30

Yeah, but maybe it’s just motivating or unwilling to see yourself.

24:35

Well, unless it’s like makes you look thinner or something then maybe you can bend the outs, words, insights that makes you look thinner.

24:41

Yeah, I said I’m thinking or, you know, on the smartphones, yeah, makes your complexion look

24:47

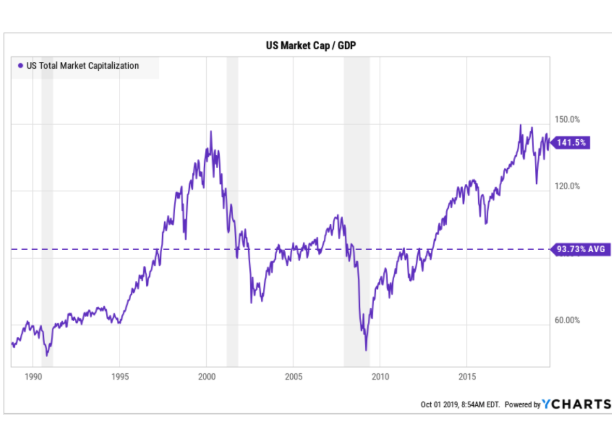

nicer, make you work harder. You got a larger gap to fill. I have a graph of this isn’t the stock market. This is the US market divided by GDP. So we are right at the 2000 Level year 2000 Oh Macy’s my wife loves Macy’s Don’t worry guys they’re not closing they’re closing 30 stores across the nation by our beloved one in forage and all the water is here to stay

25:17

but the question is for how long range yeah

25:19

and across the nation other stores here one are closing down and bows that makes our Bose headphones that allow us to drown out the rest of humanity is going out of business and crying babies on the plane. Yeah. Do you know what Five Below is there to know? What’s that? Well, if you go out to the middle of nowhere America, there’s these five below. They’re like discount retailers. It’s like 99 cent store but $5 and below Okay, okay. Yeah, I didn’t know either. I walked into one because I thought it was a frozen yogurt place when I was like visiting some properties. Okay, like, Oh, this isn’t for you here. Maybe

25:55

stuck. You want to watch in a downward economy?

25:58

Yeah, in the other session. Yeah, the dollar to Family Dollar went did real good. I remember that

26:04

$750 million Ponzi scheme from the income store. So I did a podcast with another gentleman who buys websites. And what they do is they fix it up virtually right? they’ll create content, they’ll increase SEO, and they’ll increase the net operating income essentially and then sell it but I guess what the income the income store I don’t really know if I know what it did. You guys can look it up on your own. But it was a place where you can buy and sell these websites, but they turned out to be a scam. Was he telling me about

26:35

the income start? No, no.

26:38

No, yeah. This is why he did like this, right. They

26:42

can work from wherever. Yeah, no, I said you mean you help these guys out and he’s accomplished.

26:48

But this was a big I think a lot of people went to this website. All right, let’s beat up on the millennials now or this case, medium age of homebuyers is now 47 years old. Can you believe that used to be in the 1980 era, medium age of homebuyers in the United States was 31 years old. And in the last 40 years, it’s gone up to 47 millennial share of the US housing market is small and shrinking. So the little graph of where the baby boomers were at and then the Generation X people, yeah, Gen X or Yeah,

27:26

Mm hmm. Well, what I was curious about is the last stat is like, I’m assuming that that’s all owner occupied. So like, what about guys like you are renting but using your money to invest you fall on as a non buyer, Daniel?

27:38

Yeah. Or it’s like other statistics on unemployment, where they like phone people, but how do you measure all the people who are pissed off and they don’t want to answer that too, because they’re out of work?

27:49

Yeah. Well, yeah. And the dare say that the unemployment rate is is very skewed to because it’s excludes the unemployed who have totally stopped for a long time now.

27:58

Yeah. People get up, right? Yeah, right.

28:01

It’s good also that the statistics are skewed in that sense, and including the ones that are continuing to try to apply for jobs legitimately or illegitimate. Right?

28:11

collect unemployment rate. So there’s ways to not be in that number. So that’s deceiving, I think when you guys are looking for houses to sell, but there’s a recent trend in CO showering and multi generational houses, and I read this one article, and it kind of showed all these things and that’s what I picked out. I don’t know if it’s literally people are coming together to save money, but I do know like a property that was built in the 1980 or 1990s. So not too old. Well, what we’re going to do on that is we’re going to get rid of the tubs and put in a new column luxury shower, but you know, it’s not that expensive. People would rather have a shower than a tub will get a $50 rent increase for that.

28:52

I know of people who get a single family and chop it up two rooms or even like little cubicles, and it’s almost Like not a youth hostel per se but they’re renting out the room and then they have shared kitchen and bath and they’re all individual usually singles in a maid military or doctor or residence or something and then they don’t mind this need a place to sleep and they don’t mind sharing kitchens and the bathroom with other people they don’t know and then they end up getting to know them so it’s almost like a long term Airbnb, I guess. I don’t know how else to explain it. But in that sense, yeah, the landlords happy because you’re you’re collecting way more than you would if you’re just renting to one single family long term and we can see he totally handle your vacancies very because if one person leaves and it’s like one out of five or one out of seven, so

29:35

I went through I said it on a pitch for this guy. He was doing an app and it’s like crowd surfer but he was like exactly what you said the long term renters but they just want a room. He was telling me all these nightmares that would have initially right when they first started out they had to make it was the same sex or because obviously you know the issues with that with it and I think they gave the people free Netflix. subscription because they found out if they’re just on their phones all the time or watching Netflix that there’s little interaction and that’s where the problems of the company is when tenants interact. So if you keep them at their problem,

30:15

that’s their reality, right? They’re watching the Netflix and that’s where their world is at. So, right the outside world is there in their matrix.

30:23

Another trend Hilton is launching a new lifestyle brand called Temple by Hilton. It is designed to appeal to ambitious modern traveler I needed glasses I thought that said women travelers for strategy strategies for 2020 success in the classroom multi speaks to the first one was new markets so getting out of places that everybody has been talking about for the last half a decade Dallas, Texas since everybody’s looking there and everybody knows it’s a good market tech so they said like old tri news be I’m not gonna say her name a LEX a because things will start to happened if I say that word here or other forms of technology in the apartments, treat your employees? Well, a lot of these places, the employees, the office staff and the handyman workers are on salary as opposed to paying your tenants or you’re paying your property manager certain percentage primarily. And then different regulations. As we said, you know, the rent control Diem, did you know that in 2025, there will be more people turning 65 than babies being born.

31:27

I did not know that. They are doing the assisted living. But yeah.

31:32

That’s like everybody talks about that thing. And it’s man, are you looking for something super hard and difficult where you haven’t owned a property

31:40

for high liability? Yeah, well, I mean, if you talk about trend, I mean, that makes it spot on right, that hits that heartstring right there in terms of telling me where to look. So maybe it’s not that maybe it’s things that he’s 65 year olds are going to be using

31:55

that type of market my buddy he does venture m&a is like the cool way of saying it but merger acquisitions. But you have all these older people who have built businesses and obviously haven’t really employed the best technology and systems and practices but just created with hard work, right? Good old fashioned business sense, but they’re unable to sell the business. So mergers and acquisitions is a good way to play that I think is you take a business like a restaurant or an insurance practice, or like a dentist franchise, and you buy it. I think that’s a better way to play it.

32:28

That makes sense. I’ve seen that too. Like in the accounting world on the CPA world, a lot of CPAC start off the work for the big four are being backed into the big six and then you know, they find out they want to be entrepreneurial, or do you want you don’t want to be partner here. They want to work on their own. So they open up their own practice. And then by nature, it grows because they get more and more clients and then they call you said they’re hiring employees who are good at doing the work. But when it comes time to succession planning to hand it on, even their children don’t want to take it over. So what do you do now? Right, so I’ve heard great stories of operatives. Ladies like that, I guess you could say for the small practices that don’t have a plan, it is great. I mean seems to be like a win win. Because usually, if the agreement works out, the employees are retained and the management company gets company to take over with more volume and more actually adds a different niche to the larger companies that might have had larger clients.

33:21

Yeah, it’s definitely interesting, right? The phrase that’s always said is who is the person that has the keys here, right, if that CPA leaves or retires business is going to fall apart? Yeah, that’s why you don’t want to buy that business. But there’s always a way to keeping that person on retainer and making their buyout contingent on X amount of clients thing.

33:40

And a lot of times you know, it’s not to say that the partners are irreplaceable and they are facing the challenges like you said, you need a smooth transition because of course you’re gonna have attrition rate. So the plan is you just make sure in your that m&a deal when you’re pricing it out, which is usually based on digicash rules is that you’re you’re taking to account if you’re on the buying side that the attrition you follow

34:00

You want to do is retire and play pickleball three four times a week then why get into all that stuff?

34:06

Yeah. Where do you play pickup on case people want to hang out with you?

34:11

I started off playing in Mililani town there’s a we have a recreation rec center three and so there’s eight dedicated courts so if you’re not come by hit me up. I’ll go all over the island though you guys want to play? I love Ilene honestly, it’s a great sport. It’s one of the fastest growing and young guys are getting into too. I think a 21 year old professional came down from the mainland he stopped by and we got to experience some pro to corporate flying artists Honestly, I do enjoy it. I laugh about it initially. This is an old fox game and it’s kind of dorky and stuff but I’m enjoying it a lot.

34:45

I well, while you’re doing that, I would say hundreds of thousands or millions of employees are trying to race for the spiky thing in corporate America. Somebody right now is working his 14th or 16th hour needs to go home and sleep for four hours. Before coming back

35:01

Super Bowl commercials on it right to rice and anything

35:04

yeah another statistic I was at this family office meeting and they’re talking about how in that slide to the right is how energy storage is has changed and will change before it was a power plants to the houses and then now we got all the solar panels and maybe the solar panels might feed outwards eventually but the other statistic was in 2026 the cars will they’ll be more electric cars than gas cars

35:31

I thought by then don’t be hundred percent. I mean, a lot of manufacturers are saying bye. I thought it was a 10 years they’re gonna be out of production for Dynamo fields are gonna be easy. I thought there are shifting you have people already off the grid with some battery storage.

35:46

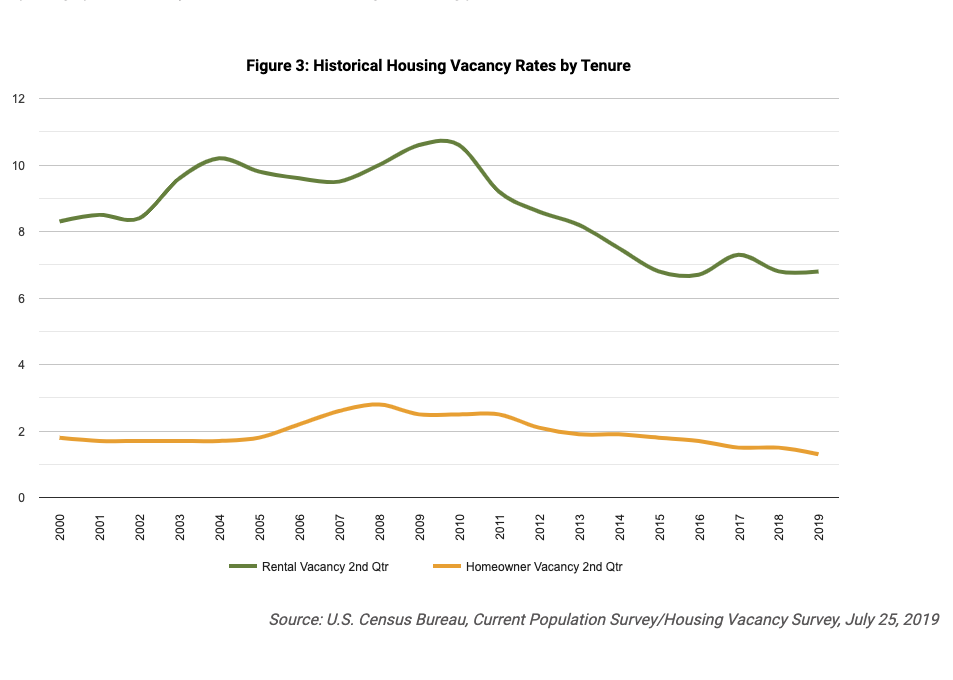

I think I’m going to buy that Tesla truck. Really? Yeah, that’s gonna be a couple years I still gotta drive my car. So next headline here housing market following short by nearly 4 million houses as demand grows. So as much as you see housing prices going up, the demand is going up much faster vacancy rates have been going down over the past decade and home ownership vacancy has gone down slightly also. And I think that’s at the end here. I do my little book report to you, Dean. I’ve been reading this book willpower doesn’t work by Ben Hardy. Did you

36:21

tell me about that? I bought it from the library. You read it? I think I skimmed it, but I had to return it by the time go talk about it. I need to hear what you get to

36:29

see. Well, that’s exactly why willpower doesn’t work. You don’t need the damn book.

36:33

Oh, it’s because I didn’t take the distractions out right? Because isn’t that what it is in the whole premises because we’ll Park doesn’t work you need to take all the distractions out of your life so that you can focus in on the things you gotta do. You know, these

36:44

books are just kind of space fillers, right? Half of it is you’re a human being you’re not a machine, right? And I already kind of know that. But then the other half of the book are things like you said, and then creating systems to set yourself up for success which you

36:59

are The master of lean and let’s say you can’t make any

37:02

systematic changes this past month I can steal

37:07

no nothing earth shattering I still gotta keep on looking back at my vision board and for me it’s the passion is still the real estate sales but one thing that I’ve had to refocus on his power talking about like he said to be able to play pickleball as they still want to increase my investment portfolio my real estate my buy and hold real estate portfolio so that means I need to increase my deal flow from that standpoint so that I haven’t been I’ve been working more on the real estate sales side and helping others out so you got to step back and help yourself on to me the real estate sales part is the fun part and I enjoy that and passionate about that but I need to also step back and own a build my deal flow because I also have my own personal investing goals set for the year on my vision board. So I got to relook at that I guess yeah,

37:53

buy another cup of health if you can play four times a week. That’s a part of it right rewards setting rewards for yourself. Yeah, I think that’s what they talked on this book too.

38:03

Okay, yeah, we’re gonna travel the world with you to link one of these days.

38:07

Have some fun. This is the part where we talk about the legal disclaimer and you’re not giving any legal tax or investment advice relationship advice, advice that’s it and hope you guys liked it check out the YouTube channel and join ariella Hall comm check us out there and anything else for the folks there, Dean. Oh, just keep on keepin on. All right. Take it easy, everybody. Bye. Bye.

38:37

Three real estate investing you check out our e i aloha.com.