I am constantly pitched for random development deals and some times these phishing requests get annoying because I have little interest due to the poor risk adjusted returns and the fact that I would be a debt investor and not equity investor (upside).

More on private money lending deals which is offered in our investment club.

[CENSORED SCREENSHOT]

And no I am not going to pass you to someone in the Hui Deal Pipeline Club

This madness has to stop because I don’t do deals with people I don’t know, like, or trust. I lost $40k straying from this logic in my first passive deal in 2014. Although in my defense, that’s what you do when you are a newbie investor with no network of other passive investors. To learn more about that deal and what I try to help new investors avoid. In other words, if we have not met, it ain’t going to happen and please do not try to offer 12-20% rates… that is just embarrassing yo.

Why do I not like these types of deals?

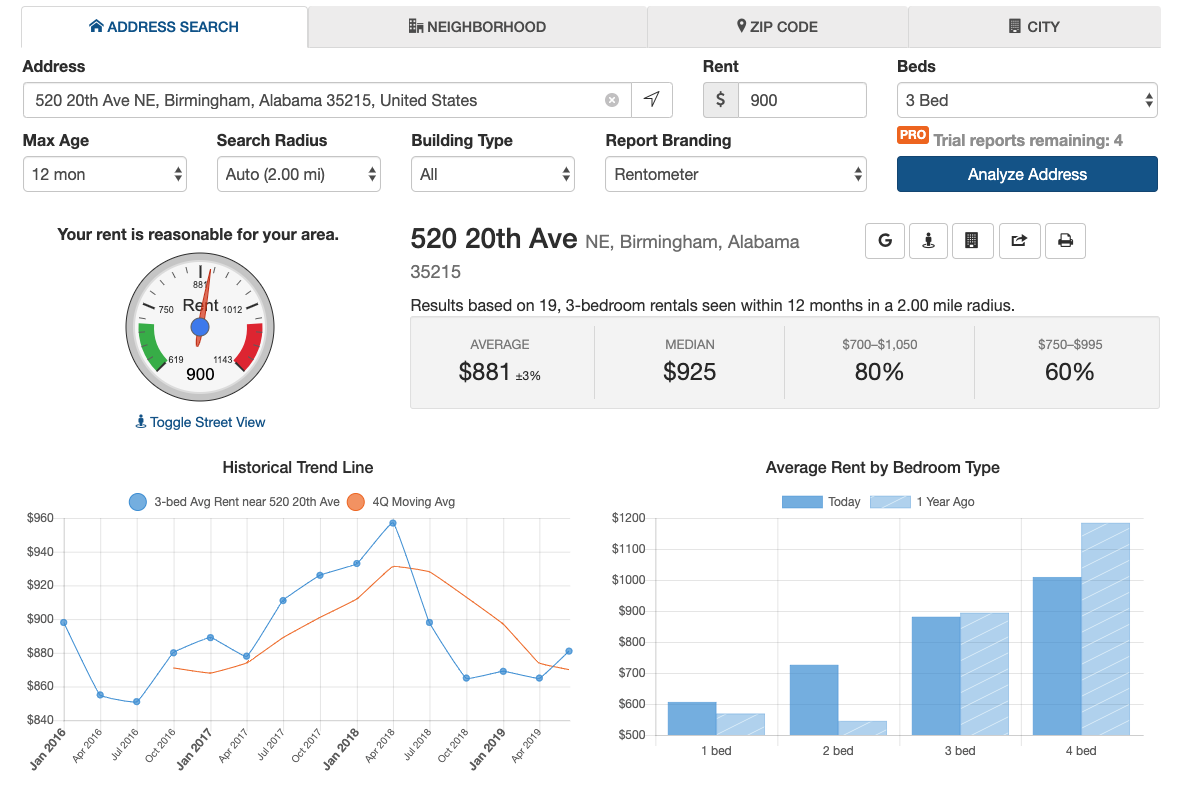

1) No exit strategy – If I am going to do private money lending I am going to do it in and area (secondary or tertiary) and non-luxury class (Class B or C) where I can achieve a 1% Rent-to-Value Ratio or more so if the economy corrects during construction I can rent the property out and not bleed holding costs. (More info – http://simplepassivecashflow.

2) Commercial > Residential – Residential properties are so subjective and requires an emotional buyer on the end to pay a crazy price. Think House-hunters on HGTV where a couple set out to buy those dream home and you watch as one of the spouses manipulates the other to buy the one they want regardless of price. It great when it works as the developer (as a debt investor you don’t partake on the extra profits anyway). But the sale price it’s really outside your control as it is dictated by what other houses are selling for. I prefer math to dictate when our sales price goes as a multiple of the income minus expenses that the property cashflowand. This is something we have control over and can have multiple exit stratergies.

3) Alright the development plan goes perfectly and gets a great sales price. Unfortunately as mentioned before you as the debt investor don’t see any of the upside. Here are the problems a) your yield stops as you have to scramble for the next deal to go into and b) all this gains is active income taxes at the highest tax amounts. You don’t get any of the sweet benefits of depreciation or bonus depreciation from doing a cost segregation on a bigger deal as a LP. SPC Guide to Syndications.

4) Better options – when you get one or two syndicated deals from a plethora of asset classes outside the most competitive realm of single family home flipping that offer existing cashflow and value add opportunities where total returns range from 80-120% in 5 years then it blows 8-12% first lien deals out of the water in terms of risk adjusted returns. If you are looking for even lower risk investments in the same 8-12% range I would suggest triple net leases with stable multi-million dollar companies like Starbucks, doctor/dentists offices, or Walgreens. In addition, for even more non-correlated assets consider life settlements where you are getting on the sure thing… Death. Read more on this morbid non-correlated asset here.